Kinnevik Results Presentation Deck

Intro

Net Asset Value

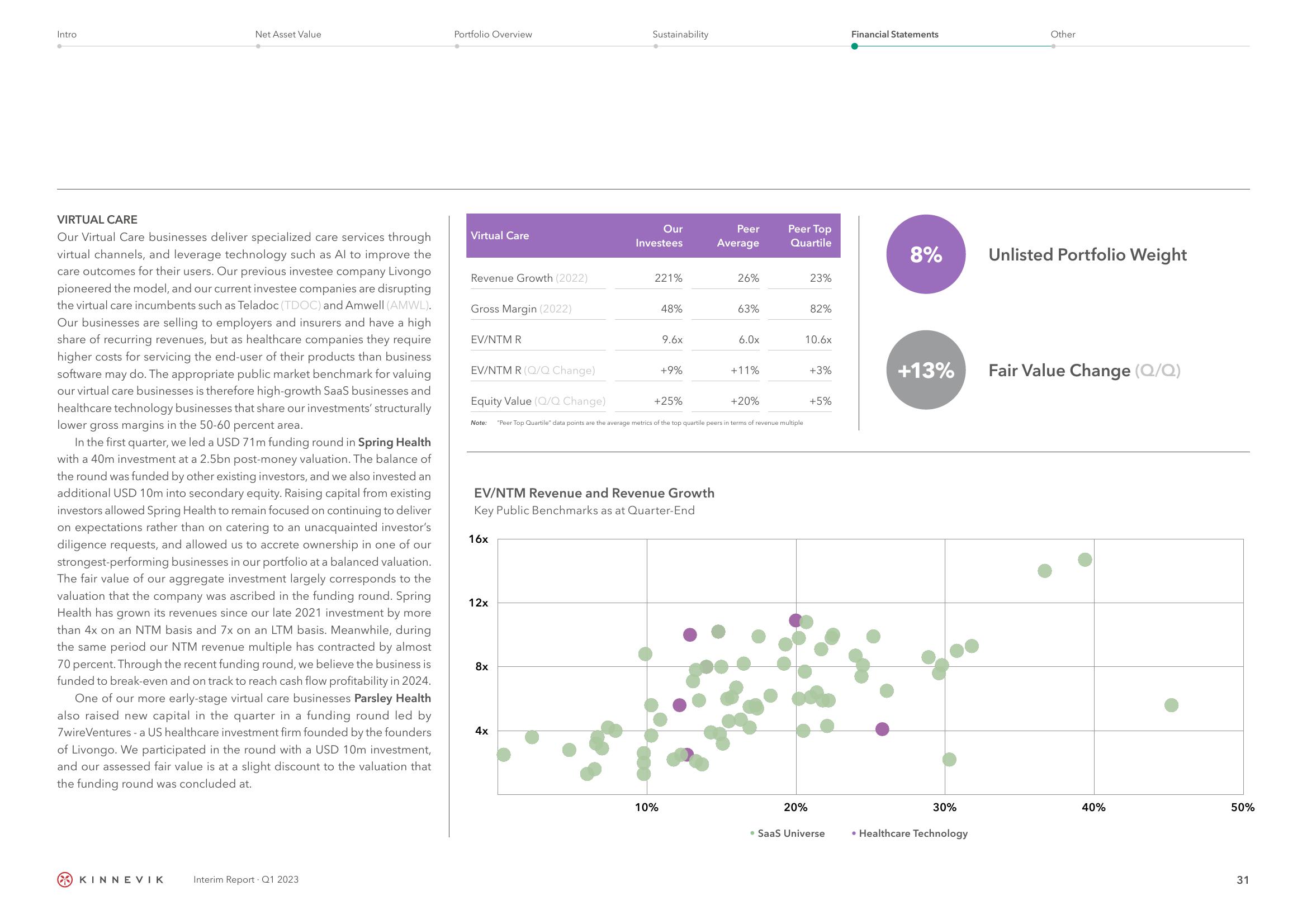

VIRTUAL CARE

Our Virtual Care businesses deliver specialized care services through

virtual channels, and leverage technology such as Al to improve the

care outcomes for their users. Our previous investee company Livongo

pioneered the model, and our current investee companies are disrupting

the virtual care incumbents such as Teladoc (TDOC) and Amwell (AMWL).

Our businesses are selling to employers and insurers and have a high

share of recurring revenues, but as healthcare companies they require

higher costs for servicing the end-user of their products than business

software may do. The appropriate public market benchmark for valuing

our virtual care businesses is therefore high-growth SaaS businesses and

healthcare technology businesses that share our investments' structurally

lower gross margins in the 50-60 percent area.

In the first quarter, we led a USD 71m funding round in Spring Health

with a 40m investment at a 2.5bn post-money valuation. The balance of

the round was funded by other existing investors, and we also invested an

additional USD 10m into secondary equity. Raising capital from existing

investors allowed Spring Health to remain focused on continuing to deliver

on expectations rather than on catering to an unacquainted investor's

diligence requests, and allowed us to accrete ownership in one of our

strongest-performing businesses in our portfolio at a balanced valuation.

The fair value of our aggregate investment largely corresponds to the

valuation that the company was ascribed in the funding round. Spring

Health has grown its revenues since our late 2021 investment by more

than 4x on an NTM basis and 7x on an LTM basis. Meanwhile, during

the same period our NTM revenue multiple has contracted by almost

70 percent. Through the recent funding round, we believe the business is

funded to break-even and on track to reach cash flow profitability in 2024.

One of our more early-stage virtual care businesses Parsley Health

also raised new capital in the quarter in a funding round led by

7wire Ventures - a US healthcare investment firm founded by the founders

of Livongo. We participated in the round with a USD 10m investment,

and our assessed fair value is at a slight discount to the valuation that

the funding round was concluded at.

KINNEVIK

Interim Report Q1 2023

Portfolio Overview

Virtual Care

Revenue Growth (2022)

Gross Margin (2022)

EV/NTM R

EV/NTM R (Q/Q Change)

Equity Value (Q/Q Change)

Note:

16x

12x

8x

Sustainability

4x

Our

Investees

221%

48%

EV/NTM Revenue and Revenue Growth

Key Public Benchmarks as at Quarter-End

9.6x

+9%

+25%

10%

Peer

Average

26%

63%

6.0x

+11%

+20%

"Peer Top Quartile" data points are the average metrics of the top quartile peers in terms of revenue multiple

Peer Top

Quartile

23%

20%

82%

10.6x

+3%

+5%

• SaaS Universe

Financial Statements

8%

+13%

30%

• Healthcare Technology

Other

Unlisted Portfolio Weight

Fair Value Change (Q/Q)

A

40%

50%

31View entire presentation