Melrose Results Presentation Deck

Other Industrial

Melrose

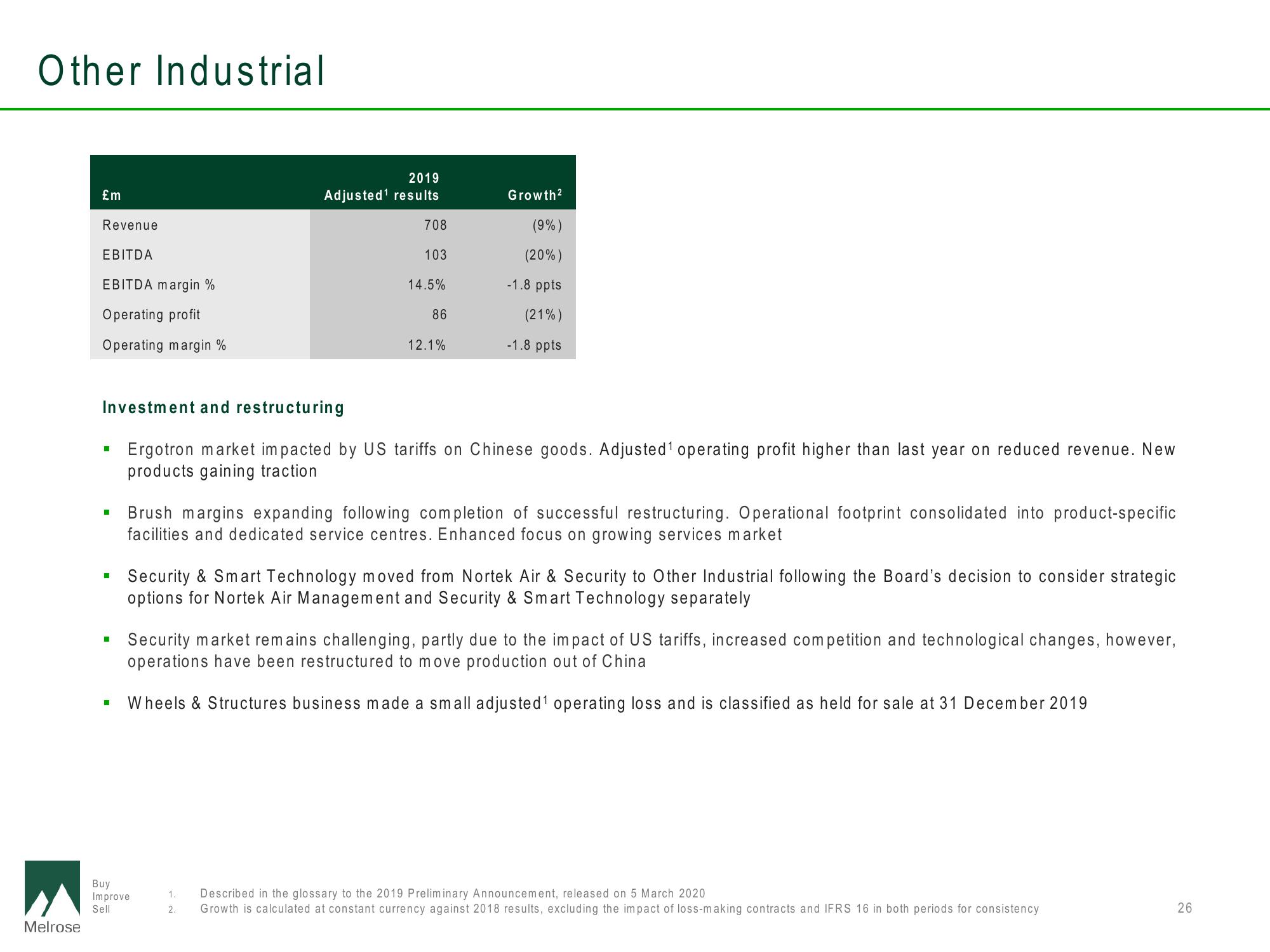

£m

Revenue

EBITDA

EBITDA margin %

Operating profit

Operating margin %

I

■

■

I

2019

Adjusted¹ results

708

103

14.5%

Investment and restructuring

Ergotron market impacted by US tariffs on Chinese goods. Adjusted ¹ operating profit higher than last year on reduced revenue. New

products gaining traction

86

12.1%

Buy

Improve

Sell

Growth²

(9%)

(20%)

-1.8 ppts

(21%)

-1.8 ppts

Brush margins expanding following completion of successful restructuring. Operational footprint consolidated into product-specific

facilities and dedicated service centres. Enhanced focus on growing services market

Security & Smart Technology moved from Nortek Air & Security to Other Industrial following the Board's decision to consider strategic

options for Nortek Air Management and Security & Smart Technology separately

Security market remains challenging, partly due to the impact of US tariffs, increased competition and technological changes, however,

operations have been restructured to move production out of China

Wheels & Structures business made a small adjusted¹ operating loss and is classified as held for sale at 31 December 2019

1. Described in the glossary to the 2019 Preliminary Announcement, released on 5 March 2020

2. Growth is calculated at constant currency against 2018 results, excluding the impact of loss-making contracts and IFRS 16 in both periods for consistency

26View entire presentation