Allego Investor Presentation Deck

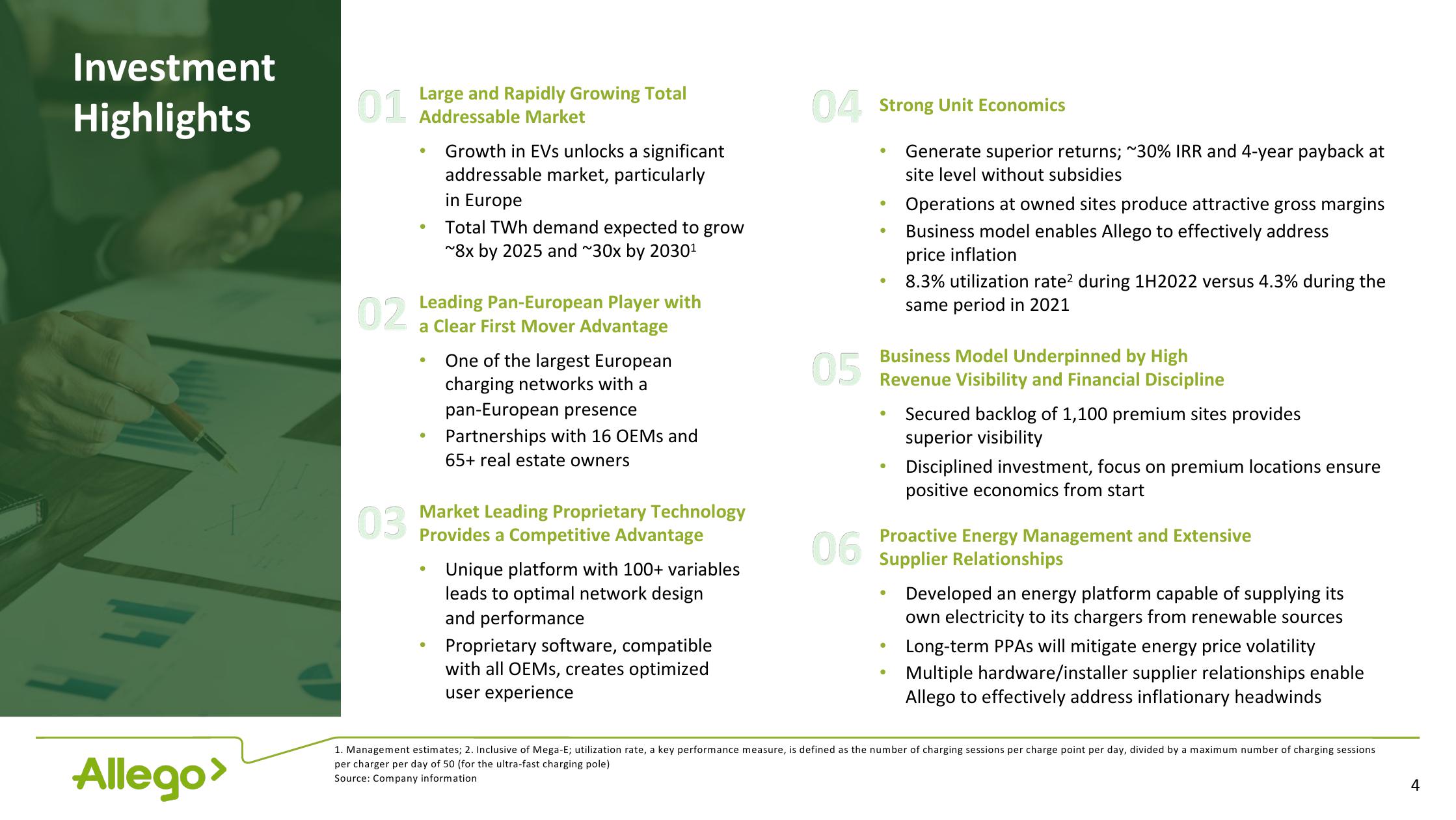

Investment

Highlights

Allego>

01

Large and Rapidly Growing Total

Addressable Market

03

●

Growth in EVs unlocks a significant

addressable market, particularly

in Europe

02 Leading Pan-European Player with

a Clear First Mover

●

Total TWh demand expected to grow

~8x by 2025 and ~30x by 2030¹

One of the largest European

charging networks with a

pan-European presence

Partnerships with 16 OEMs and

65+ real estate owners

Market Leading Proprietary Technology

Provides a Competitive Advantage

Unique platform with 100+ variables

leads to optimal network design

and performance

Proprietary software, compatible

with all OEMs, creates optimized

user experience

04

05

06

Strong Unit Economics

Generate superior returns; ~30% IRR and 4-year payback at

site level without subsidies

Operations at owned sites produce attractive gross margins

Business model enables Allego to effectively address

price inflation

8.3% utilization rate² during 1H2022 versus 4.3% during the

same period in 2021

Business Model Underpinned by High

Revenue Visibility and Financial Discipline

Secured backlog of 1,100 premium sites provides

superior visibility

Disciplined investment, focus on premium locations ensure

positive economics from start

Proactive Energy Management and Extensive

Supplier Relationships

Developed an energy platform capable of supplying its

own electricity to its chargers from renewable sources

Long-term PPAs will mitigate energy price volatility

Multiple hardware/installer supplier relationships enable

Allego to effectively address inflationary headwinds

1. Management estimates; 2. Inclusive of Mega-E; utilization rate, a key performance measure, is defined as the number of charging sessions per charge point per day, divided by a maximum number of charging sessions

per charger per day of 50 (for the ultra-fast charging pole)

Source: Company information

4View entire presentation