Zegna Results Presentation Deck

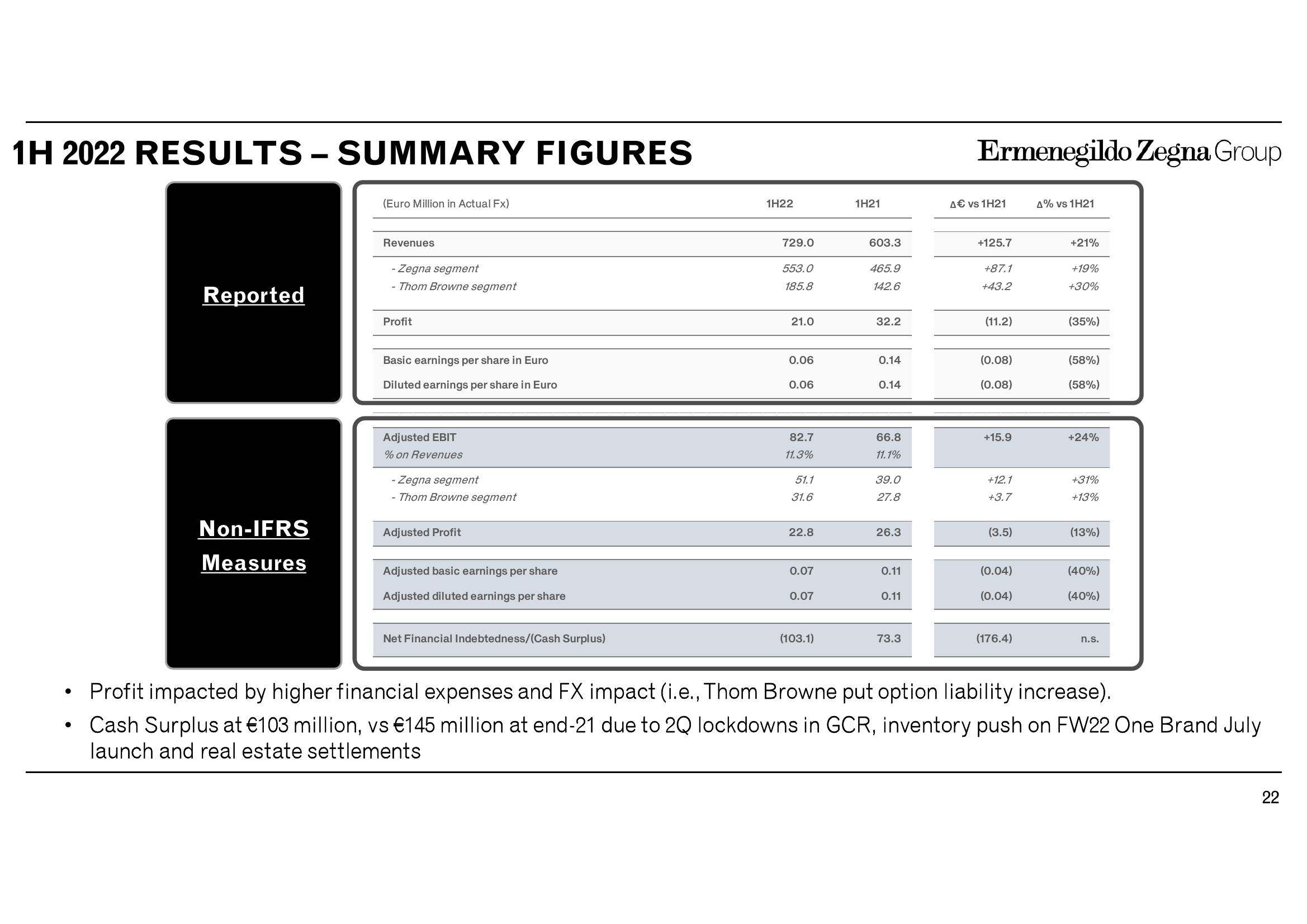

1H 2022 RESULTS - SUMMARY FIGURES

●

●

Reported

Non-IFRS

Measures

(Euro Million in Actual Fx)

Revenues

- Zegna segment

- Thom Browne segment

Profit

Basic earnings per share in Euro

Diluted earnings per share in Euro

Adjusted EBIT

% on Revenues

- Zegna segment

- Thom Browne segment

Adjusted Profit

Adjusted basic earnings per share

Adjusted diluted earnings per share

Net Financial Indebtedness/(Cash Surplus)

1H22

729.0

553.0

185.8

21.0

0.06

0.06

82.7

11.3%

51.1

31.6

22.8

0.07

0.07

(103.1)

1H21

603.3

465.9

142.6

32.2

0.14

0.14

66.8

11.1%

39.0

27.8

26.3

0.11

0.11

73.3

Ermenegildo Zegna Group

A€ vs 1H21

+125.7

+87.1

+43.2

(11.2)

(0.08)

(0.08)

+15.9

+12.1

+3.7

(3.5)

(0.04)

(0.04)

(176.4)

A% vs 1H21

+21%

+19%

+30%

(35%)

(58%)

(58%)

+24%

+31%

+13%

(13%)

(40%)

(40%)

n.s.

Profit impacted by higher financial expenses and FX impact (i.e., Thom Browne put option liability increase).

Cash Surplus at €103 million, vs €145 million at end-21 due to 2Q lockdowns in GCR, inventory push on FW22 One Brand July

launch and real estate settlements

22View entire presentation