Eutelsat Mergers and Acquisitions Presentation Deck

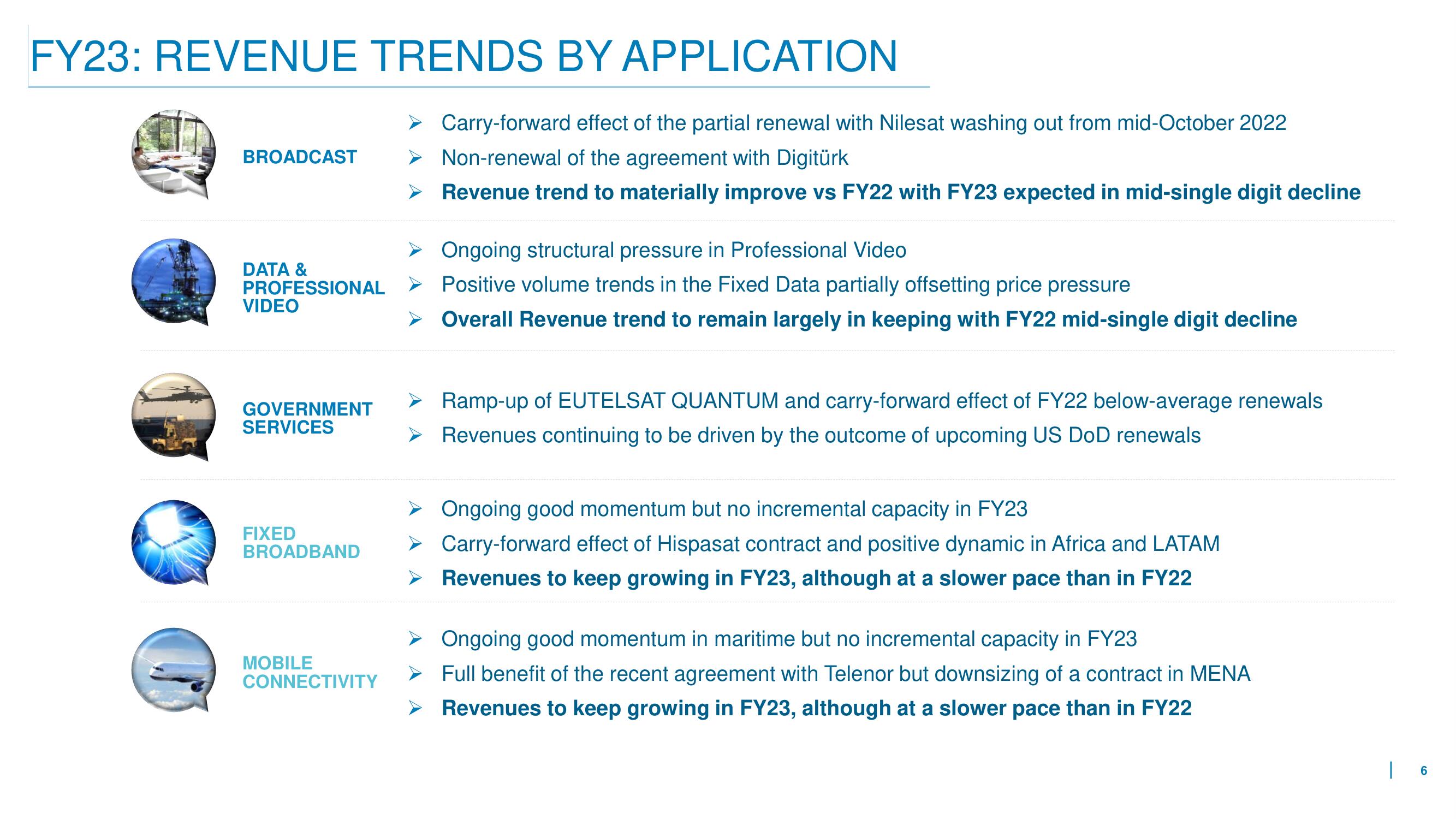

FY23: REVENUE TRENDS BY APPLICATION

BROADCAST

DATA &

PROFESSIONAL

VIDEO

GOVERNMENT

SERVICES

FIXED

BROADBAND

MOBILE

CONNECTIVITY

Carry-forward effect of the partial renewal with Nilesat washing out from mid-October 2022

Non-renewal of the agreement with Digitürk

Revenue trend to materially improve vs FY22 with FY23 expected in mid-single digit decline

➤ Ongoing structural pressure in Professional Video

Positive volume trends in the Fixed Data partially offsetting price pressure

Overall Revenue trend to remain largely in keeping with FY22 mid-single digit decline

➤ Ramp-up of EUTELSAT QUANTUM and carry-forward effect of FY22 below-average renewals

Revenues continuing to be driven by the outcome of upcoming US DoD renewals

➤ Ongoing good momentum but no incremental capacity in FY23

Carry-forward effect of Hispasat contract and positive dynamic in Africa and LATAM

Revenues to keep growing in FY23, although at a slower pace than in FY22

➤ Ongoing good momentum in maritime but no incremental capacity in FY23

➤ Full benefit of the recent agreement with Telenor but downsizing of a contract in MENA

> Revenues to keep growing in FY23, although at a slower pace than in FY22

| 6View entire presentation