KKR Real Estate Finance Trust Results Presentation Deck

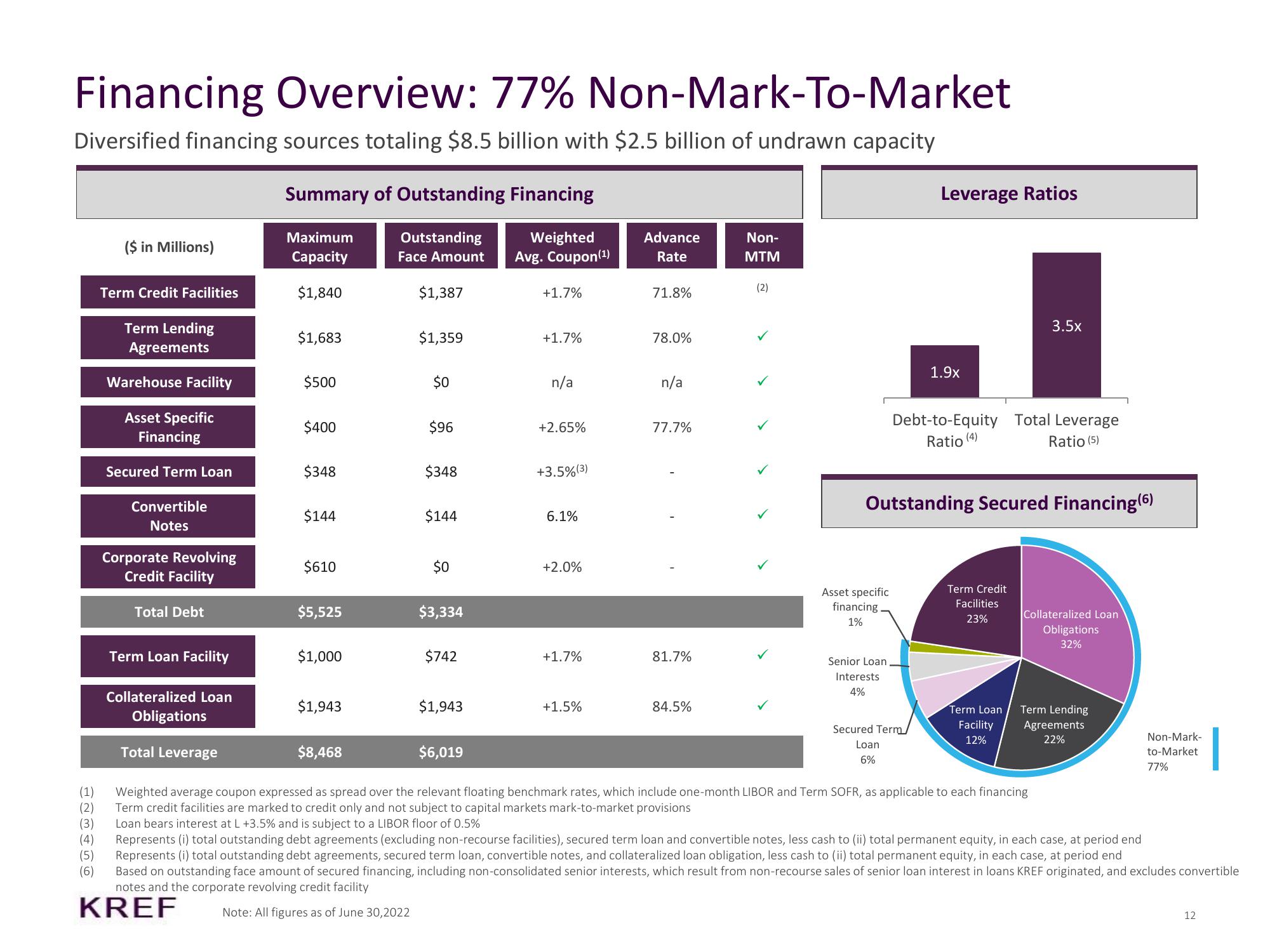

Financing Overview: 77% Non-Mark-To-Market

Diversified financing sources totaling $8.5 billion with $2.5 billion of undrawn capacity

($ in Millions)

Term Credit Facilities

Term Lending

Agreements

Warehouse Facility

Asset Specific

Financing

Secured Term Loan

Convertible

Notes

Corporate Revolving

Credit Facility

Total Debt

Term Loan Facility

Collateralized Loan

Obligations

Total Leverage

Summary of Outstanding Financing

Outstanding

Maximum

Capacity

Weighted

Avg. Coupon (¹)

Face Amount

$1,840

$1,683

$500

$400

$348

$144

$610

$5,525

$1,000

$1,943

$8,468

$1,387

$1,359

$0

$96

$348

$144

$0

$3,334

$742

$1,943

$6,019

+1.7%

+1.7%

n/a

+2.65%

+3.5% (3)

6.1%

+2.0%

+1.7%

+1.5%

Advance

Rate

71.8%

78.0%

n/a

77.7%

81.7%

84.5%

Non-

MTM

(2)

Asset specific

financing.

1%

Senior Loan

Interests

4%

Leverage Ratios

1.9x

Outstanding Secured Financing(6)

Secured Term

Loan

6%

Debt-to-Equity Total Leverage

Ratio (4)

Ratio (5)

3.5x

Term Credit

Facilities

23%

Term Loan

Facility

12%

Collateralized Loan

Obligations

32%

Term Lending

Agreements

22%

Non-Mark-

to-Market

77%

(1) Weighted average coupon expressed as spread over the relevant floating benchmark rates, which include one-month LIBOR and Term SOFR, as applicable to each financing

(2) Term credit facilities are marked to credit only and not subject to capital markets mark-to-market provisions

(3)

Loan bears interest at L +3.5% and is subject to a LIBOR floor of 0.5%

(4) Represents (i) total outstanding debt agreements (excluding non-recourse facilities), secured term loan and convertible notes, less cash to (ii) total permanent equity, in each case, at period end

(5) Represents (i) total outstanding debt agreements, secured term loan, convertible notes, and collateralized loan obligation, less cash to (ii) total permanent equity, in each case, at period end

(6) Based on outstanding face amount of secured financing, including non-consolidated senior interests, which result from non-recourse sales of senior loan interest in loans KREF originated, and excludes convertible

notes and the corporate revolving credit facility

KREF

Note: All figures as of June 30,2022

12View entire presentation