Morgan Stanley Investment Banking Pitch Book

Project Roosevelt

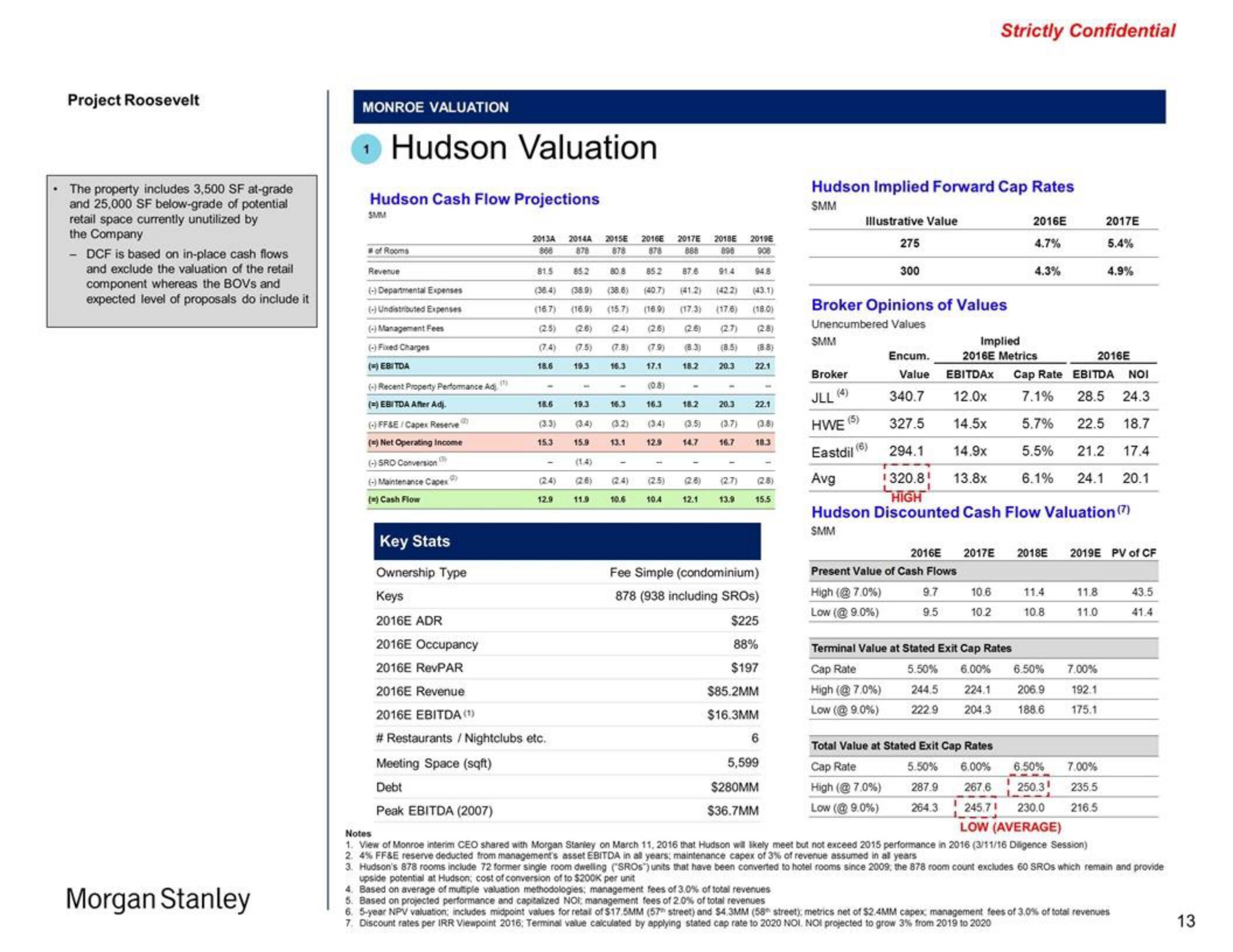

The property includes 3,500 SF at-grade

and 25,000 SF below-grade of potential

retail space currently unutilized by

the Company

- DCF is based on in-place cash flows

and exclude the valuation of the retail

component whereas the BOVS and

expected level of proposals do include it

Morgan Stanley

MONROE VALUATION

Hudson Valuation

Hudson Cash Flow Projections

SMM

of Rooms

Revenue

(-) Departmental Expenses

(-) Undistributed Expenses

(-)Management Fees

(-) Fixed Charges

(-) EBITDA

(1)

(-) Recent Property Performance Adj

(=) EBITDA After Adj.

(-) FF&E/Capex Reserve

(=) Net Operating Income

(-) SRO Conversion

(-) Maintenance Capex

(=) Cash Flow

2013A 2014A 2015E 2016E

888 878 878 878

Meeting Space (sqft)

Debt

Peak EBITDA (2007)

81.5

(16.7)

(2.5)

18.6

18.6

(3.3)

15.3

(24)

12.9

Key Stats

Ownership Type

Keys

2016E ADR

2016E Occupancy

2016E RevPAR

2016E Revenue

2016E EBITDA (¹)

# Restaurants / Nightclubs etc.

19.3

85.2 80.8

85.2

91.4 94.8

(38.9) (38.6) (40.7) (41.2) (42.2) (43.1)

(16.9) (15.7) (16.9) (17.3) (17.6) (18.0)

(26)

(26) (2.6) (2.7) (28)

(7.5) (7.8) (79) (8.3) (8.5) (8.8)

16.3 17.1 18.2 20.3 22.1

19.3

(0.8)

16.3 16.3

(3.2)

15.9

(1.4)

(26)

11.9

(24)

13.1

(24)

10.6

12.9

(25)

2017E

888

10.4

87.6

-

18.2

20.3

22.1

(3.5) (3.7) (3.8)

16.7

14.7

18.3

2018E 2019E

898 908

(2.6)

12.1

(2.7)

13.9

15.5

Fee Simple (condominium)

878 (938 including SROS)

$225

88%

$197

$85.2MM

$16.3MM

6

5,599

$280MM

$36.7MM

Hudson Implied Forward Cap Rates

SMM

Illustrative Value

SMM

275

300

Broker Opinions of Values

Unencumbered Values

(6)

Strictly Confidential

EBITDAX

12.0x

14.5x

14.9x

13.8x

Implied

2016E Metrics

Present Value of Cash Flows

10.6

High (@7.0%) 9.7

9.5 10.2

Low (@ 9.0%)

Cap Rate

High (@7.0%) 244.5

222.9

Low (@9.0%)

2016E

4.7%

Broker

(5)

Encum.

Value

JLL (4)

340.7

HWE

327.5

Eastdil 294.1

Avg

1320.8!

HIGH

Hudson Discounted Cash Flow Valuation (7)

SMM

Terminal Value at Stated Exit Cap Rates

4.3%

2016E 2017E 2018E

Total Value at Stated Exit Cap Rates

Cap Rate

High (@ 7.0%)

Low (@ 9.0%)

5.50% 6.00%

287.9

264.3

11.4

10.8

5.50% 6.00% 6.50%

224.1 206.9

204.3 188.6

Cap Rate EBITDA NOI

28.5 24.3

7.1%

5.7% 22.5 18.7

5.5% 21.2 17.4

6.1% 24.1 20.1

2017E

5.4%

2016E

4.9%

11.8

11.0

7.00%

2019E PV of CF

192.1

175.1

43.5

41.4

6.50% 7.00%

267.6 250.31 235.5

245.71 230.0

LOW (AVERAGE)

216.5

Notes

1. View of Monroe interim CEO shared with Morgan Stanley on March 11, 2016 that Hudson will likely meet but not exceed 2015 performance in 2016 (3/11/16 Diligence Session)

2. 4% FF&E reserve deducted from management's asset EBITDA in all years; maintenance capex of 3% of revenue assumed in all years

3. Hudson's 878 rooms include 72 former single room dwelling ("SROS") units that have been converted to hotel rooms since 2009, the 878 room count excludes 60 SROS which remain and provide

upside potential at Hudson; cost of conversion of to $200K per unit

4. Based on average of multiple valuation methodologies; management fees of 3.0% of total revenues

5. Based on projected performance and capitalized NOI, management fees of 2.0% of total revenues

6. 5-year NPV valuation, includes midpoint values for retail of $17.5MM (57 street) and $4.3MM (58 street); metrics net of $2,4MM capex management fees of 3.0% of total revenues

7. Discount rates per IRR Viewpoint 2016: Terminal value calculated by applying stated cap rate to 2020 NOI, NOI projected to grow 3% from 2019 to 2020

13View entire presentation