Experian Investor Presentation Deck

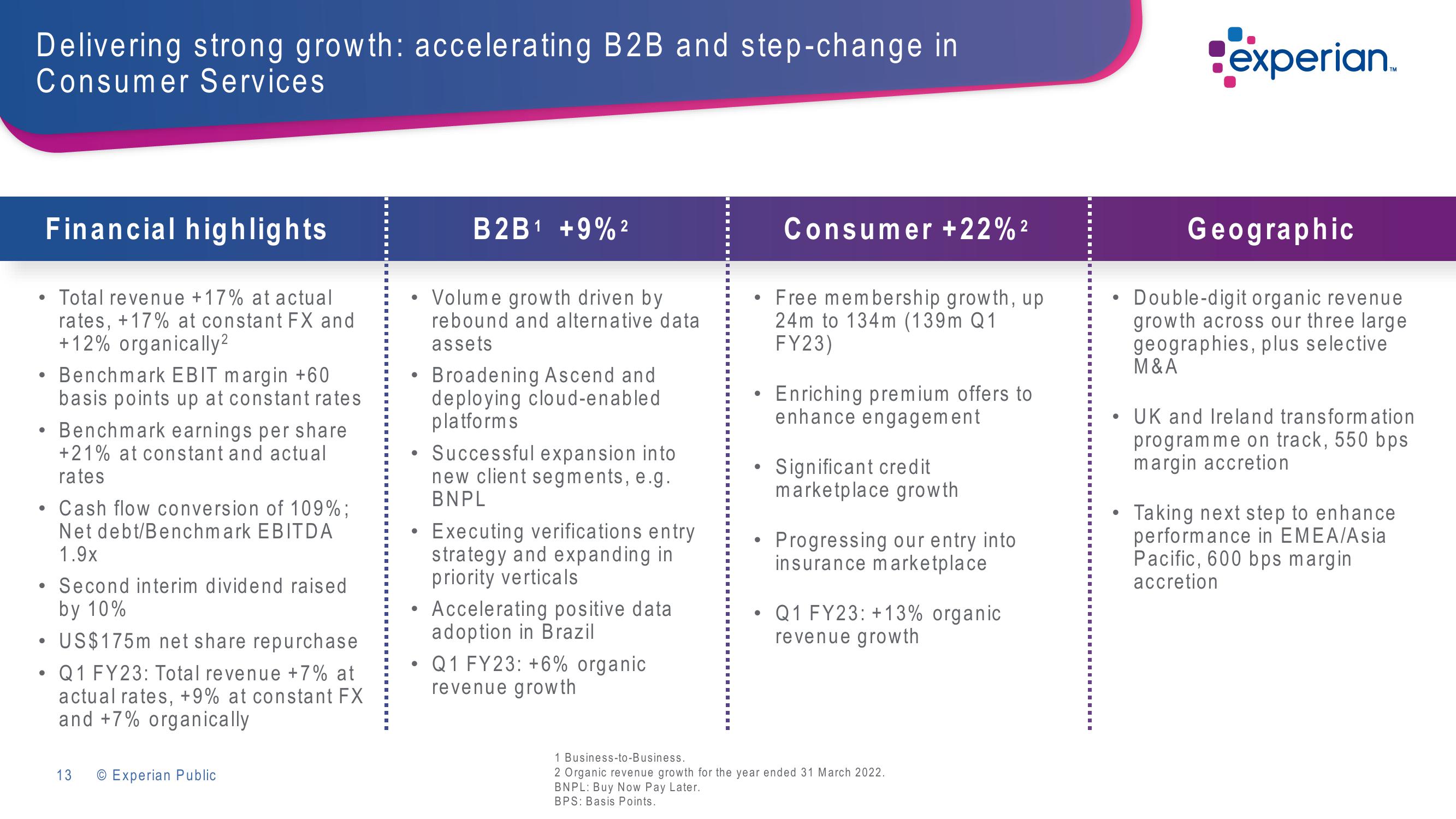

Delivering strong growth: accelerating B2B and step-change in

Consumer Services

●

• Benchmark EBIT margin +60

basis points up at constant rates

●

●

Financial highlights

Total revenue +17% at actual

rates, +17% at constant FX and

+12% organically²

●

Benchmark earnings per share

+21% at constant and actual

rates

Cash flow conversion of 109%;

Net debt/Benchmark EBITDA

1.9x

Second interim dividend raised

by 10%

• US$175m net share repurchase

Q1 FY23: Total revenue +7% at

actual rates, +9% at constant FX

and +7% organically

13

O Experian Public

• Volume growth driven by

rebound and alternative data

assets

●

B2B¹ +9%²

●

Broadening Ascend and

deploying cloud-enabled

platforms

Successful expansion into

new client segments, e.g.

BNPL

Executing verifications entry

strategy and expanding in

priority verticals

Accelerating positive data

adoption in Brazil

• Q1 FY23: +6% organic.

revenue growth

Consumer +22%²

• Free membership growth, up

24m to 134m (139m Q1

FY23)

• Enriching premium offers to

enhance engagement

• Significant credit

marketplace growth

●

Progressing our entry into

insurance marketplace

• Q1 FY23: +13% organic

revenue growth

1 Business-to-Business.

2 Organic revenue growth for the year ended 31 March 2022.

BNPL: Buy Now Pay Later.

BPS: Basis Points.

experian.

Geographic

• Double-digit organic revenue

growth across our three large

geographies, plus selective

M&A

●

UK and Ireland transformation

programme on track, 550 bps

margin accretion

Taking next step to enhance

performance in EMEA/Asia

Pacific, 600 bps margin.

accretionView entire presentation