Trian Partners Activist Presentation Deck

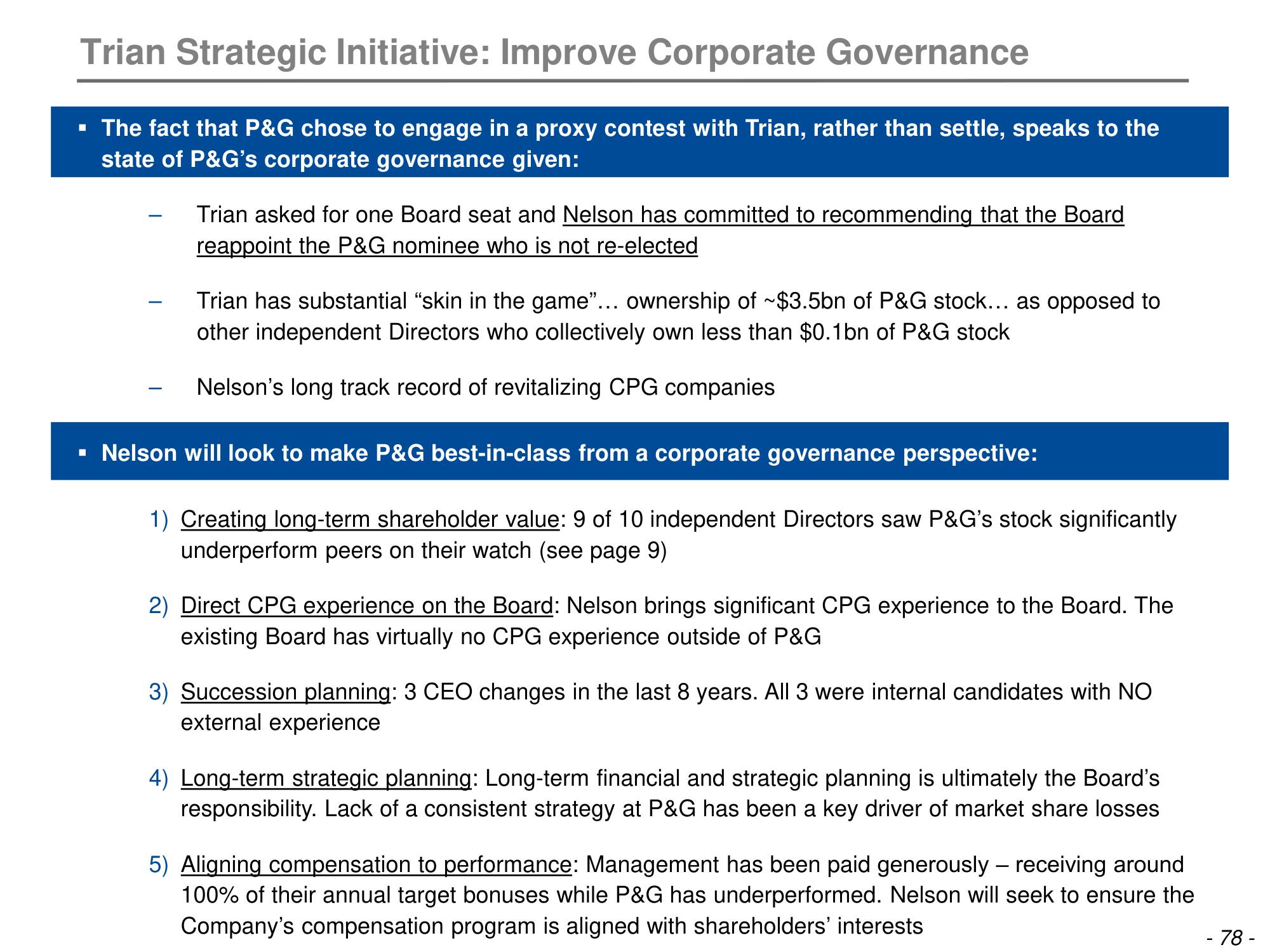

Trian Strategic Initiative: Improve Corporate Governance

▪ The fact that P&G chose to engage in a proxy contest with Trian, rather than settle, speaks to the

state of P&G's corporate governance given:

Trian asked for one Board seat and Nelson has committed to recommending that the Board

reappoint the P&G nominee who is not re-elected

Trian has substantial "skin in the game"... ownership of ~$3.5bn of P&G stock... as opposed to

other independent Directors who collectively own less than $0.1bn of P&G stock

Nelson's long track record of revitalizing CPG companies

▪ Nelson will look to make P&G best-in-class from a corporate governance perspective:

1) Creating long-term shareholder value: 9 of 10 independent Directors saw P&G's stock significantly

underperform peers on their watch (see page 9)

2) Direct CPG experience on the Board: Nelson brings significant CPG experience to the Board. The

existing Board has virtually no CPG experience outside of P&G

3) Succession planning: 3 CEO changes in the last 8 years. All 3 were internal candidates with NO

external experience

4) Long-term strategic planning: Long-term financial and strategic planning is ultimately the Board's

responsibility. Lack of a consistent strategy at P&G has been a key driver of market share losses

5) Aligning compensation to performance: Management has been paid generously receiving around

100% of their annual target bonuses while P&G has underperformed. Nelson will seek to ensure the

Company's compensation program is aligned with shareholders' interests

- 78 -View entire presentation