Advent SPAC Presentation Deck

Summary Financials

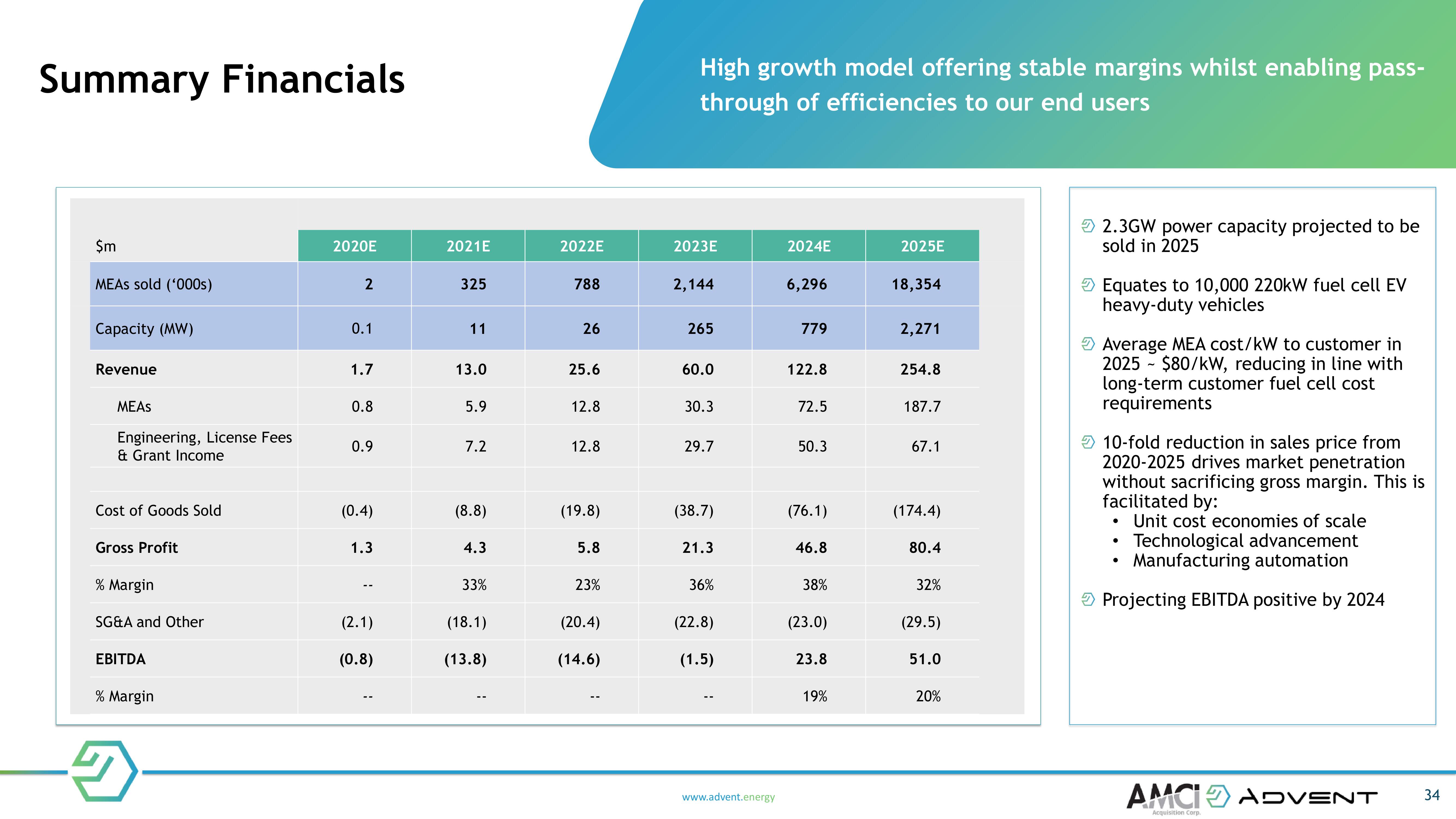

$m

MEAS sold ('000s)

Capacity (MW)

Revenue

MEAS

Engineering, License Fees

& Grant Income

Cost of Goods Sold

Gross Profit

% Margin

SG&A and Other

EBITDA

% Margin

2020E

2

0.1

1.7

0.8

0.9

(0.4)

1.3

(2.1)

(0.8)

2021E

325

11

13.0

5.9

7.2

(8.8)

4.3

33%

(18.1)

(13.8)

2022E

788

26

25.6

12.8

12.8

(19.8)

5.8

23%

(20.4)

(14.6)

High growth model offering stable margins whilst enabling pass-

through of efficiencies to our end users

2023E

2,144

265

60.0

30.3

29.7

(38.7)

21.3

36%

(22.8)

(1.5)

www.advent.energy

2024E

6,296

779

122.8

72.5

50.3

(76.1)

46.8

38%

(23.0)

23.8

19%

2025E

18,354

2,271

254.8

187.7

67.1

(174.4)

80.4

32%

(29.5)

51.0

20%

2.3GW power capacity projected to be

sold in 2025

Equates to 10,000 220kW fuel cell EV

heavy-duty vehicles

Average MEA cost/kW to customer in

2025 $80/kW, reducing in line with

long-term customer fuel cell cost

requirements

10-fold reduction in sales price from

2020-2025 drives market penetration

without sacrificing gross margin. This is

facilitated by:

• Unit cost economies of scale

Technological advancement

Manufacturing automation

Projecting EBITDA positive by 2024

●

AMCI ADVENT

Acquisition Corp.

34View entire presentation