PJT Partners Investment Banking Pitch Book

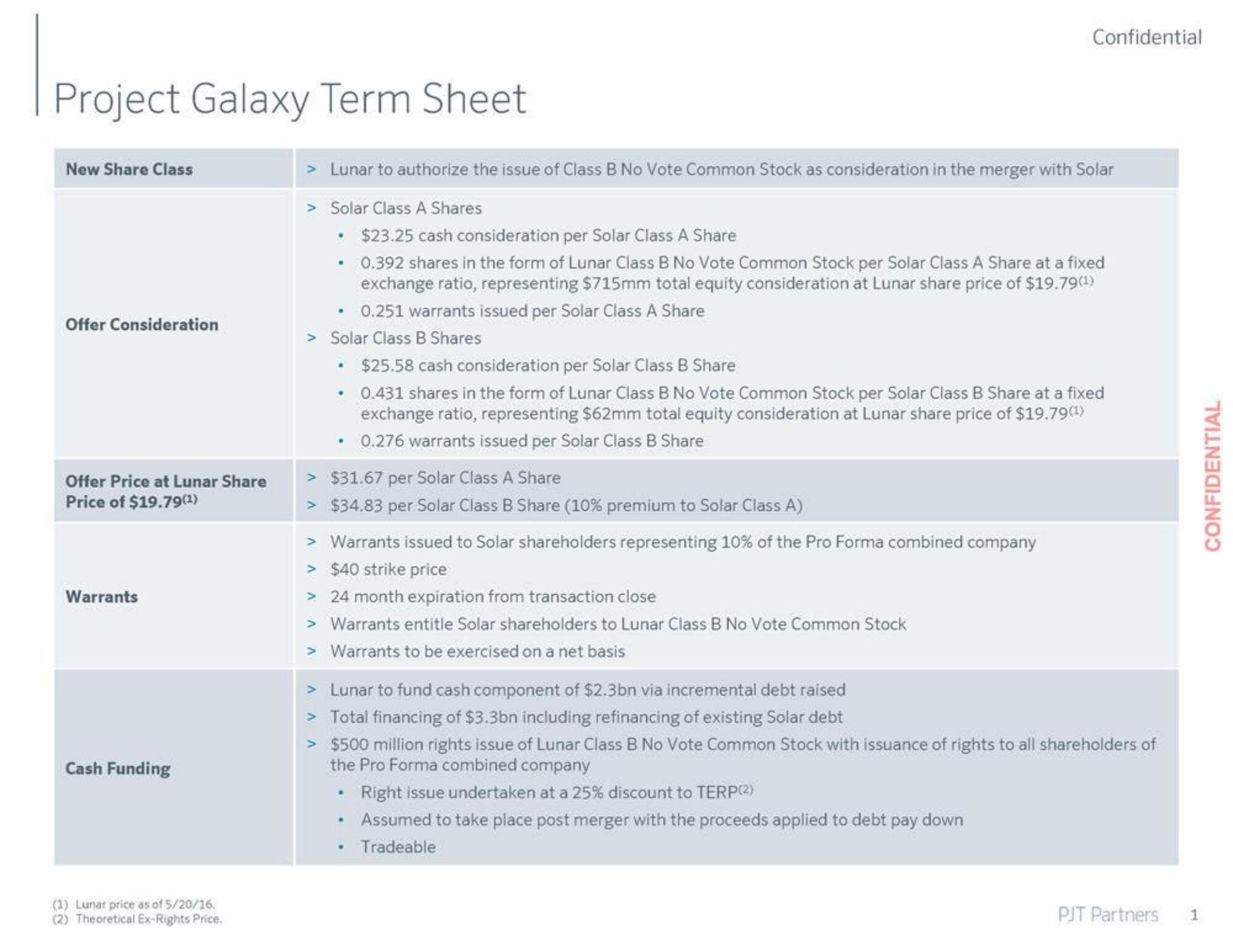

Project Galaxy Term Sheet

New Share Class

Offer Consideration

Offer Price at Lunar Share

Price of $19.79(1)

Warrants

Cash Funding

(1) Lunar price as of 5/20/16.

(2) Theoretical Ex-Rights Price.

> Lunar to authorize the issue of Class B No Vote Common Stock as consideration in the merger with Solar

> Solar Class A Shares

•

.

> Solar Class B Shares

.

.

.

$23.25 cash consideration per Solar Class A Share

0.392 shares in the form of Lunar Class B No Vote Common Stock per Solar Class A Share at a fixed

exchange ratio, representing $715mm total equity consideration at Lunar share price of $19.79(1)

0.251 warrants issued per Solar Class A Share

> $31.67 per Solar Class A Share

> $34.83 per Solar Class B Share (10% premium to Solar Class A)

Confidential

> Warrants issued to Solar shareholders representing 10% of the Pro Forma combined company

> $40 strike price

> 24 month expiration from transaction close

> Warrants entitle Solar shareholders to Lunar Class B No Vote Common Stock

> Warrants to be exercised on a net basis

.

$25.58 cash consideration per Solar Class B Share

0.431 shares in the form of Lunar Class B No Vote Common Stock per Solar Class B Share at a fixed

exchange ratio, representing $62mm total equity consideration at Lunar share price of $19.79(1)

0.276 warrants issued per Solar Class B Share

.

> Lunar to fund cash component of $2.3bn via incremental debt raised

> Total financing of $3.3bn including refinancing of existing Solar debt

>

$500 million rights issue of Lunar Class B No Vote Common Stock with issuance of rights to all shareholders of

the Pro Forma combined company

Right issue undertaken at a 25% discount to TERP(2)

Assumed to take place post merger with the proceeds applied to debt pay down

Tradeable

PJT Partners

1

CONFIDENTIALView entire presentation