Rocket Companies Investor Presentation Deck

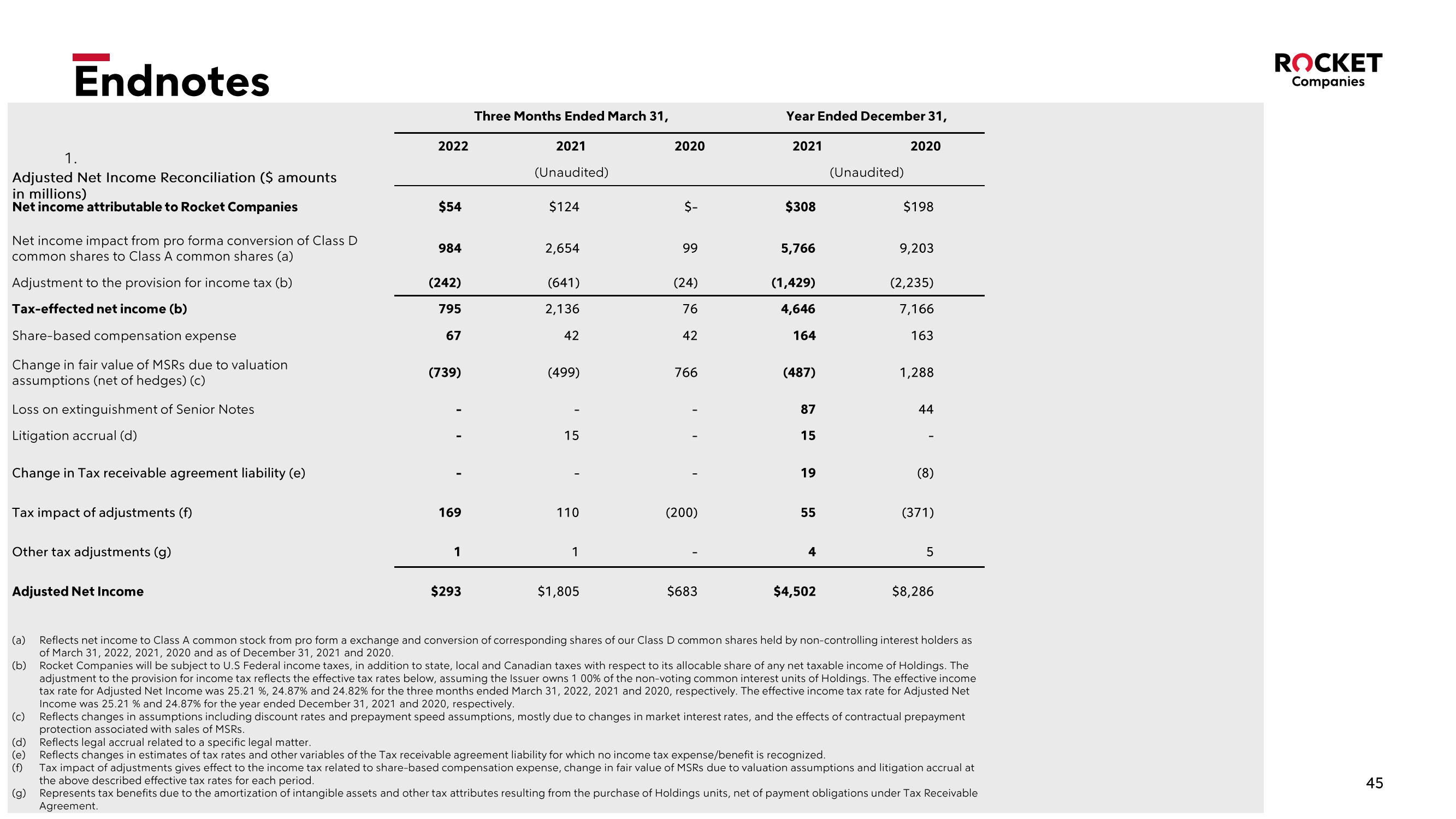

1.

Adjusted Net Income Reconciliation ($ amounts

in millions)

Net income attributable to Rocket Companies

Endnotes

Net income impact from pro forma conversion of Class D

common shares to Class A common shares (a)

Adjustment to the provision for income tax (b)

Tax-effected net income (b)

Share-based compensation expense

Change in fair value of MSRS due to valuation

assumptions (net of hedges) (c)

Loss on extinguishment of Senior Notes

Litigation accrual (d)

Change in Tax receivable agreement liability (e)

Tax impact of adjustments (f)

Other tax adjustments (g)

Adjusted Net Income

(c)

(d)

(e)

(f)

2022

6

$54

984

(242)

795

67

(739)

169

1

$293

Three Months Ended March 31,

2021

(Unaudited)

$124

2,654

(641)

2,136

42

(499)

15

110

1

$1,805

2020

$-

99

(24)

76

42

766

(200)

$683

Year Ended December 31,

2021

$308

5,766

(1,429)

4,646

164

(487)

87

15

19

55

4

$4,502

(Unaudited)

2020

$198

9,203

(2,235)

7,166

163

1,288

44

(8)

(371)

5

(a)

(b) Rocket Companies will be subject to U.S Federal income taxes, in addition to state, local and Canadian taxes with respect to its allocable share of any net taxable income of Holdings. The

adjustment to the provision for income tax reflects the effective tax rates below, assuming the Issuer owns 1 00% of the non-voting common interest units of Holdings. The effective income

tax rate for Adjusted Net Income was 25.21 %, 24.87% and 24.82% for the three months ended March 31, 2022, 2021 and 2020, respectively. The effective income tax rate for Adjusted Net

Income was 25.21 % and 24.87% for the year ended December 31, 2021 and 2020, respectively.

Reflects changes in assumptions including discount rates and prepayment speed assumptions, mostly due to changes in market interest rates, and the effects of contractual prepayment

protection associated with sales of MSRs.

$8,286

Reflects net income to Class A common stock from pro form a exchange and conversion of corresponding shares of our Class D common shares held by non-controlling interest holders as

of March 31, 2022, 2021, 2020 and as of December 31, 2021 and 2020.

Reflects legal accrual related to a specific legal matter.

Reflects changes in estimates of tax rates and other variables of the Tax receivable agreement liability for which no income tax expense/benefit is recognized.

Tax impact of adjustments gives effect to the income tax related to share-based compensation expense, change in fair value of MSRS due to valuation assumptions and litigation accrual at

the above described effective tax rates for each period.

(g) Represents tax benefits due to the amortization of intangible assets and other tax attributes resulting from the purchase of Holdings units, net of payment obligations under Tax Receivable

Agreement.

ROCKET

Companies

45View entire presentation