Informatica Investor Day Presentation Deck

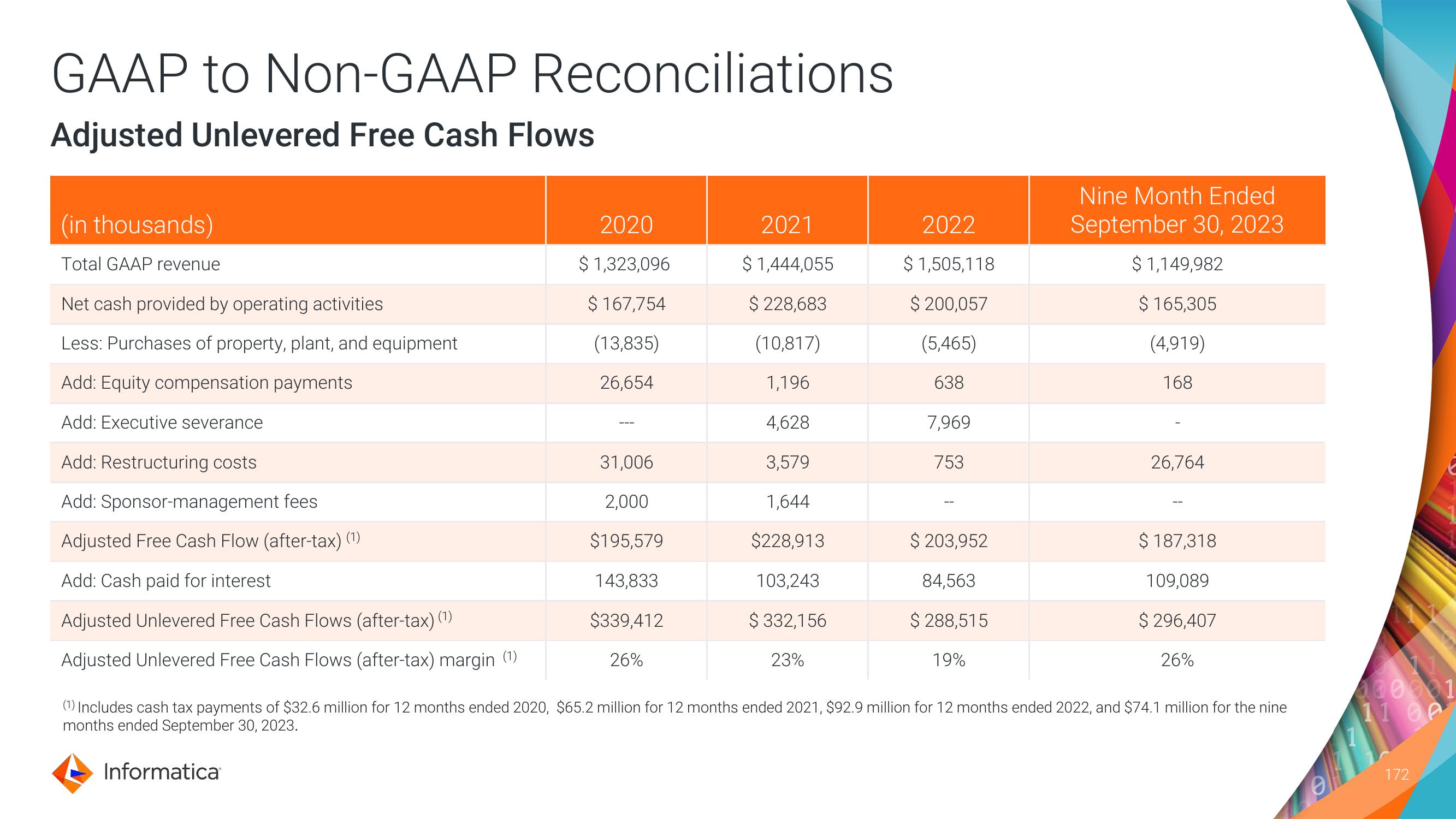

GAAP to Non-GAAP Reconciliations

Adjusted Unlevered Free Cash Flows

(in thousands)

Total GAAP revenue

Net cash provided by operating activities

Less: Purchases of property, plant, and equipment

Add: Equity compensation payments

Add: Executive severance

Add: Restructuring costs

Add: Sponsor-management fees

Adjusted Free Cash Flow (after-tax) (1)

Add: Cash paid for interest

Adjusted Unlevered Free Cash Flows (after-tax) (1)

Adjusted Unlevered Free Cash Flows (after-tax) margin (¹)

2020

$ 1,323,096

$ 167,754

(13,835)

26,654

Informatica

31,006

2,000

$195,579

143,833

$339,412

26%

2021

$ 1,444,055

$ 228,683

(10,817)

1,196

4,628

3,579

1,644

$228,913

103,243

$ 332,156

23%

2022

$1,505,118

$ 200,057

(5,465)

638

7,969

753

$203,952

84,563

$288,515

19%

Nine Month Ended

September 30, 2023

$ 1,149,982

$ 165,305

(4,919)

168

26,764

$ 187,318

109,089

$ 296,407

26%

(1) Includes cash tax payments of $32.6 million for 12 months ended 2020, $65.2 million for 12 months ended 2021, $92.9 million for 12 months ended 2022, and $74.1 million for the nine

months ended September 30, 2023.

11

100001

11 00

172View entire presentation