Deutsche Bank Results Presentation Deck

Corporate Bank

In € m, unless stated otherwise

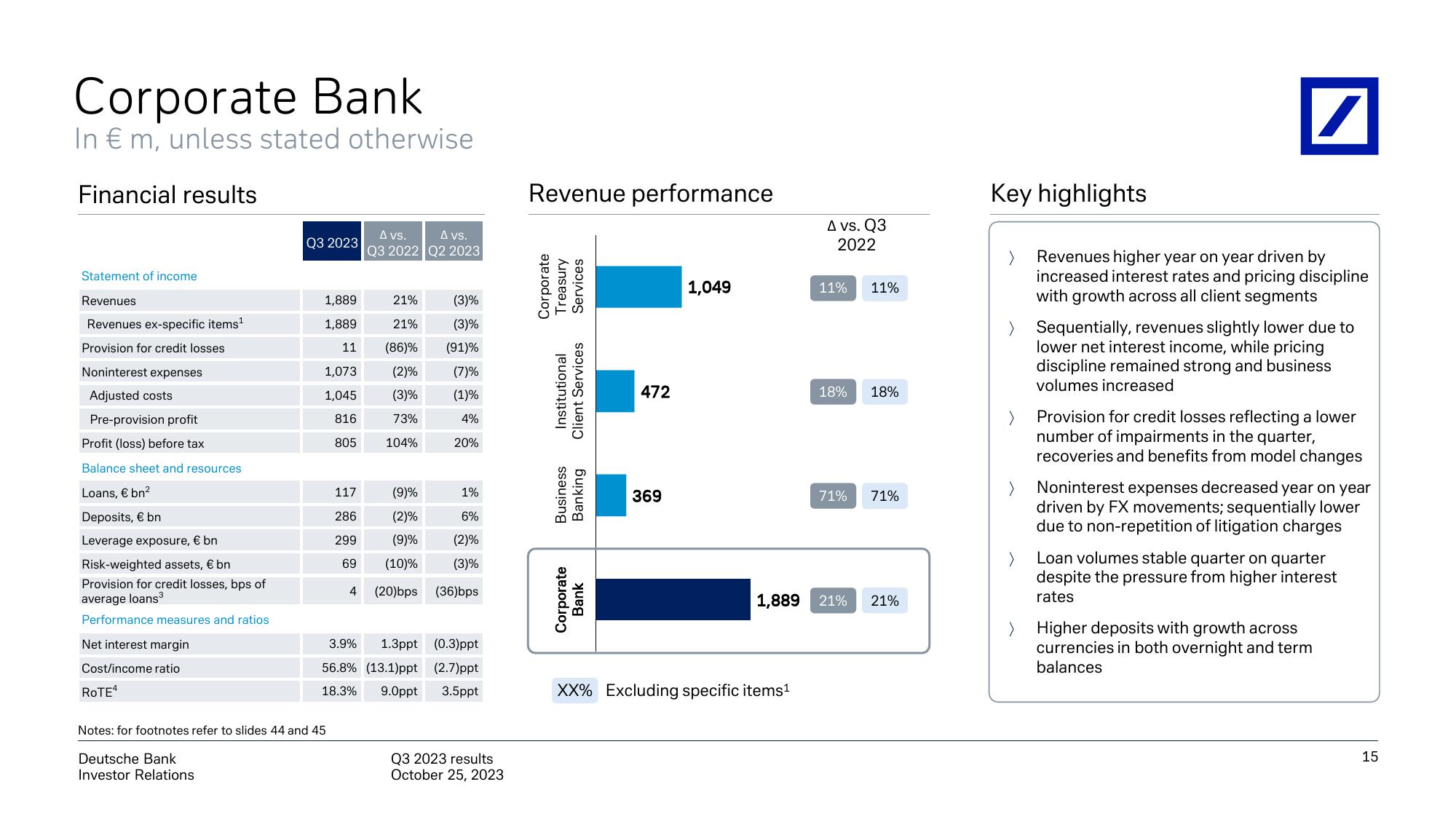

Financial results

Statement of income.

Revenues

Revenues ex-specific items¹

Provision for credit losses

Noninterest expenses

Adjusted costs

Pre-provision profit

Profit (loss) before tax

Balance sheet and resources

Loans, € bn²

Deposits, € bn

Leverage exposure, € bn

Risk-weighted assets, € bn

Provision for credit losses, bps of

average loans³

Performance measures and ratios

Net interest margin

Cost/income ratio

ROTE4

Q3 2023

Deutsche Bank

Investor Relations

1,889

1,889

11

1,073

1,045

816

805

Notes: for footnotes refer to slides 44 and 45

117

286

299

69

4

A vs.

A vs.

Q3 2022 Q2 2023

21%

(3)%

21%

(3)%

(86)% (91)%

(2)%

(7)%

(3)%

(1)%

73%

4%

104%

20%

(9)%

1%

(2)%

6%

(9)%

(2)%

(10)%

(3)%

(20)bps (36)bps

3.9%

1.3ppt (0.3)ppt

56.8% (13.1) ppt (2.7)ppt

18.3% 9.Oppt 3.5ppt

Q3 2023 results

October 25, 2023

Revenue performance

Corporate

Treasury

Services

Client Services

Institutional

Business

Banking

Corporate

Bank

472

369

1,049

A vs. Q3

2022

XX% Excluding specific items¹

11% 11%

18% 18%

71% 71%

1,889 21%

21%

Key highlights

/

Revenues higher year on year driven by

increased interest rates and pricing discipline

with growth across all client segments

> Sequentially, revenues slightly lower due to

lower net interest income, while pricing

discipline remained strong and business

volumes increased

Provision for credit losses reflecting a lower

number of impairments in the quarter,

recoveries and benefits from model changes

Noninterest expenses decreased year on year

driven by FX movements; sequentially lower

due to non-repetition of litigation charges

Loan volumes stable quarter on quarter

despite the pressure from higher interest

rates

Higher deposits with growth across

currencies in both overnight and term

balances

15View entire presentation