Granite Ridge Investor Presentation Deck

●

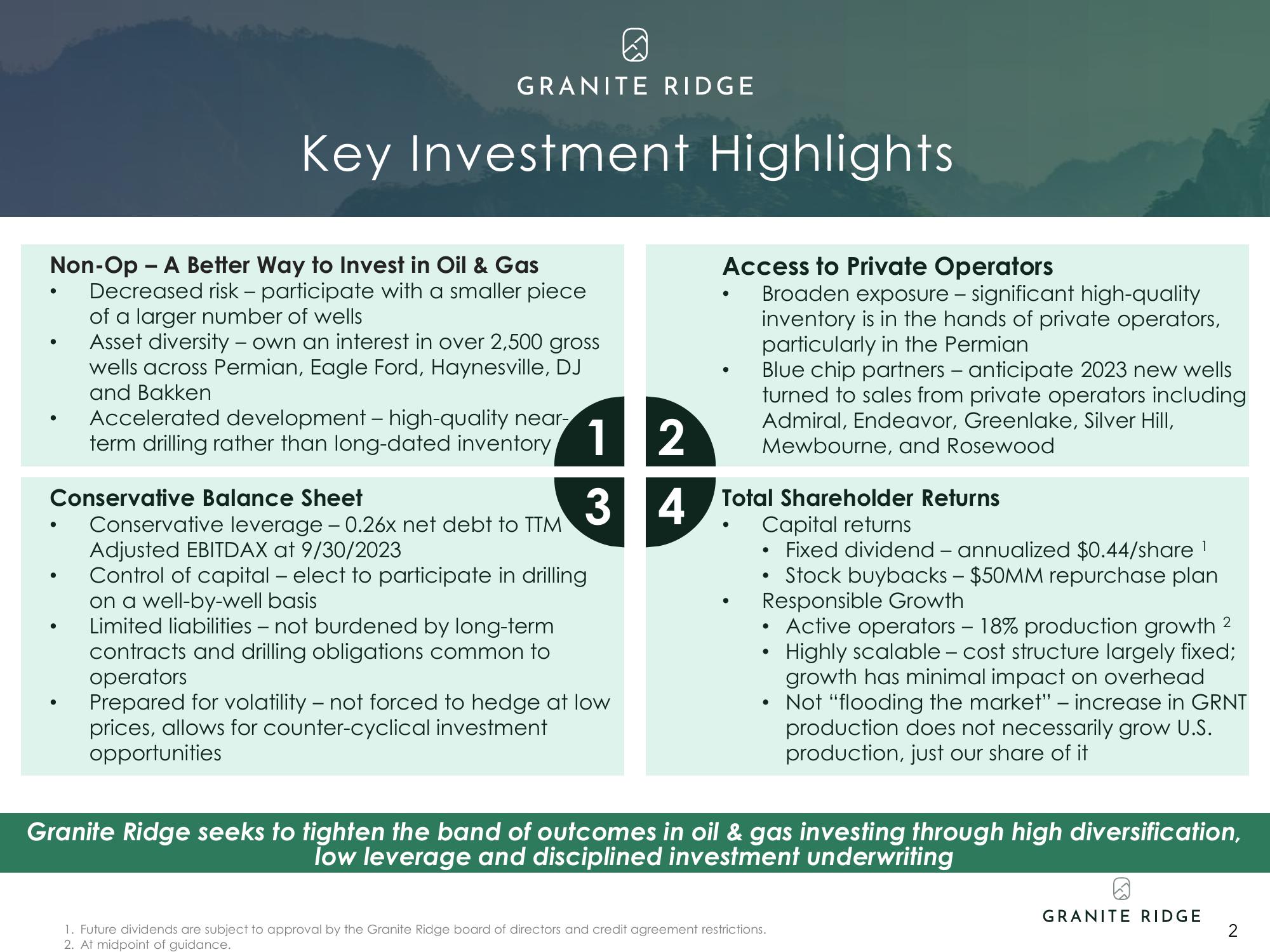

Non-Op - A Better Way to Invest in Oil & Gas

Decreased risk - participate with a smaller piece

of a larger number of wells

Asset diversity - own an interest in over 2,500 gross

wells across Permian, Eagle Ford, Haynesville, DJ

and Bakken

●

GRANITE RIDGE

●

Key Investment Highlights

●

Conservative Balance Sheet

3

Conservative leverage - 0.26x net debt to TTM

Adjusted EBITDAX at 9/30/2023

Control of capital - elect to participate in drilling

on a well-by-well basis

Limited liabilities - not burdened by long-term

contracts and drilling obligations common to

operators

Prepared for volatility - not forced to hedge at low

prices, allows for counter-cyclical investment

opportunities

Accelerated development - high-quality near-

term drilling rather than long-dated inventory 12

Access to Private Operators

Broaden exposure – significant high-quality

inventory is in the hands of private operators,

particularly in the Permian

Blue chip partners - anticipate 2023 new wells

turned to sales from private operators including

Admiral, Endeavor, Greenlake, Silver Hill,

Mewbourne, and Rosewood

●

4 Total Shareholder Returns

Capital returns

Fixed dividend - annualized $0.44/share 1

Stock buybacks - $50MM repurchase plan

Responsible Growth

Active operators – 18% production growth 2

Highly scalable - cost structure largely fixed;

growth has minimal impact on overhead

Not "flooding the market" - increase in GRNT

production does not necessarily grow U.S.

production, just our share of it

●

●

●

●

●

Granite Ridge seeks to tighten the band of outcomes in oil & gas investing through high diversification,

low leverage and disciplined investment underwriting

1. Future dividends are subject to approval by the Granite Ridge board of directors and credit agreement restrictions.

2. At midpoint of guidance.

GRANITE RIDGE

2View entire presentation