Barclays Credit Presentation Deck

STRATEGY, TARGETS

& GUIDANCE

Income

£2.6bn

Q420: £2.6bn

Cost: income

ratio

65%

Q420: 69%

PBT

£1.0bn

Q420: £0.8bn

Average

equity¹

£28.7bn

Q420: £26.3bn

PERFORMANCE

RWAS

£200.7bn

Sep-21:

£192.5bn

Costs

£1.7bn

Q420: £1.8bn

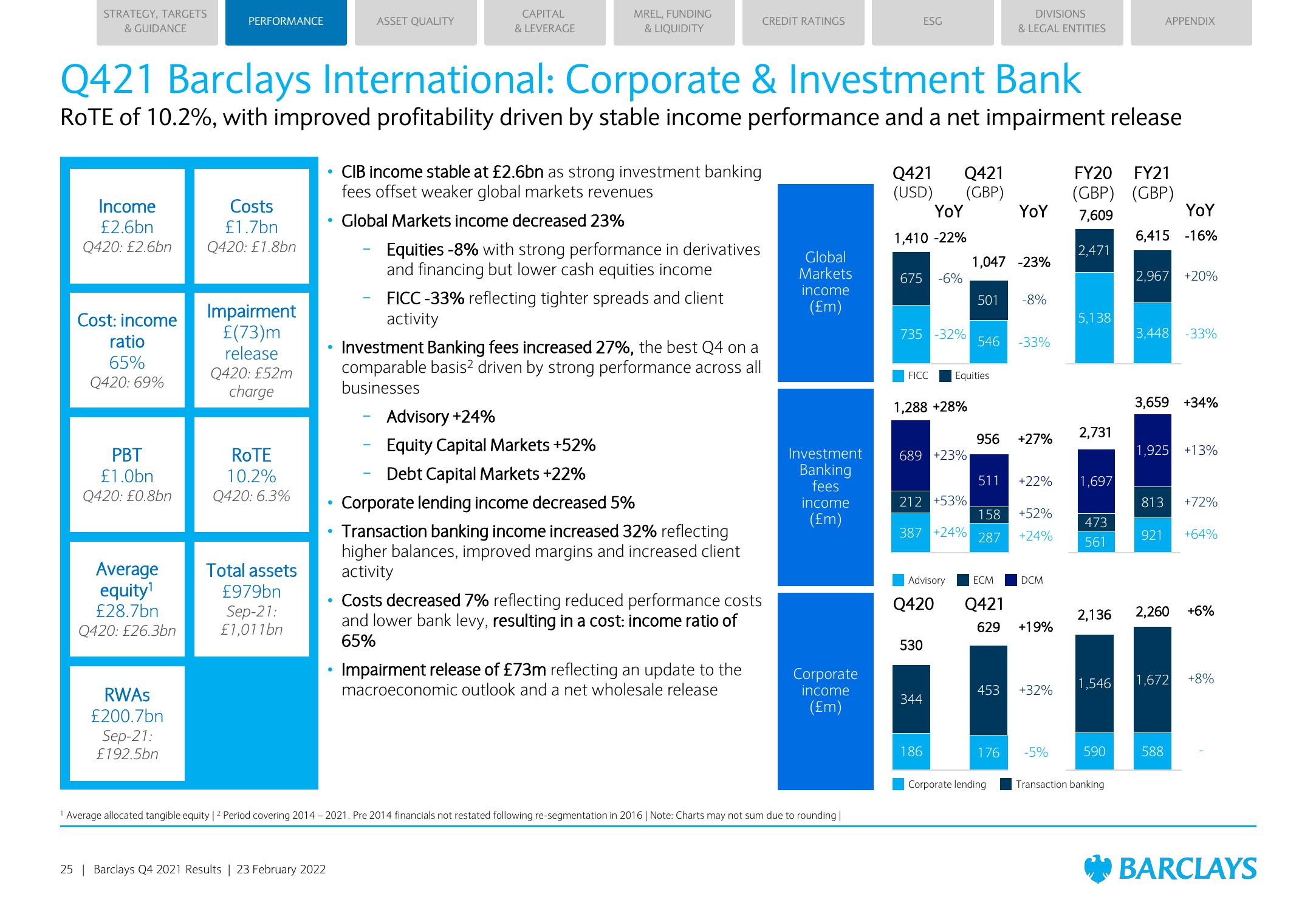

Q421 Barclays International: Corporate & Investment Bank

ROTE of 10.2%, with improved profitability driven by stable income performance and a net impairment release

Impairment

£(73)m

release

Q420: £52m

charge

ROTE

10.2%

Q420: 6.3%

Total assets

£979bn

Sep-21:

£1,011bn

●

25 | Barclays Q4 2021 Results | 23 February 2022

●

●

●

●

ASSET QUALITY

●

CAPITAL

& LEVERAGE

MREL, FUNDING

& LIQUIDITY

CIB income stable at £2.6bn as strong investment banking

fees offset weaker global markets revenues

Global Markets income decreased 23%

Equities -8% with strong performance in derivatives

and financing but lower cash equities income

FICC -33% reflecting tighter spreads and client

activity

Investment Banking fees increased 27%, the best Q4 on a

comparable basis² driven by strong performance across all

businesses

Advisory +24%

Equity Capital Markets +52%

Debt Capital Markets +22%

Corporate lending income decreased 5%

Transaction banking income increased 32% reflecting

higher balances, improved margins and increased client

activity

CREDIT RATINGS

Costs decreased 7% reflecting reduced performance costs

and lower bank levy, resulting in a cost: income ratio of

65%

Impairment release of £73m reflecting an update to the

macroeconomic outlook and a net wholesale release

Global

Markets

income

(£m)

Investment

Banking

fees

income

(£m)

Corporate

income

(£m)

Average allocated tangible equity | 2 Period covering 2014-2021. Pre 2014 financials not restated following re-segmentation in 2016 | Note: Charts may not sum due to rounding |

Q421 Q421

(USD) (GBP)

ESG

YoY

1,410 -22%

675 -6%

735 -32%

1,288 +28%

689 +23%

FICC Equities

212 +53%

387 +24%

Advisory

Q420

530

344

186

1,047 -23%

501 -8%

DIVISIONS

& LEGAL ENTITIES

546 -33%

YoY

956 +27%

511 +22%

ECM

Q421

158 +52%

287 +24%

453

176

629 +19%

Corporate lending

DCM

+32%

-5%

FY20 FY21

(GBP) (GBP)

7,609

2,471

5,138

2,731

1,697

473

561

APPENDIX

1,546

590

Transaction banking

YoY

6,415 -16%

2,967 +20%

3,448 -33%

3,659 +34%

1,925 +13%

2,136 2,260 +6%

813 +72%

921 +64%

1,672 +8%

588

BARCLAYSView entire presentation