SoftBank Results Presentation Deck

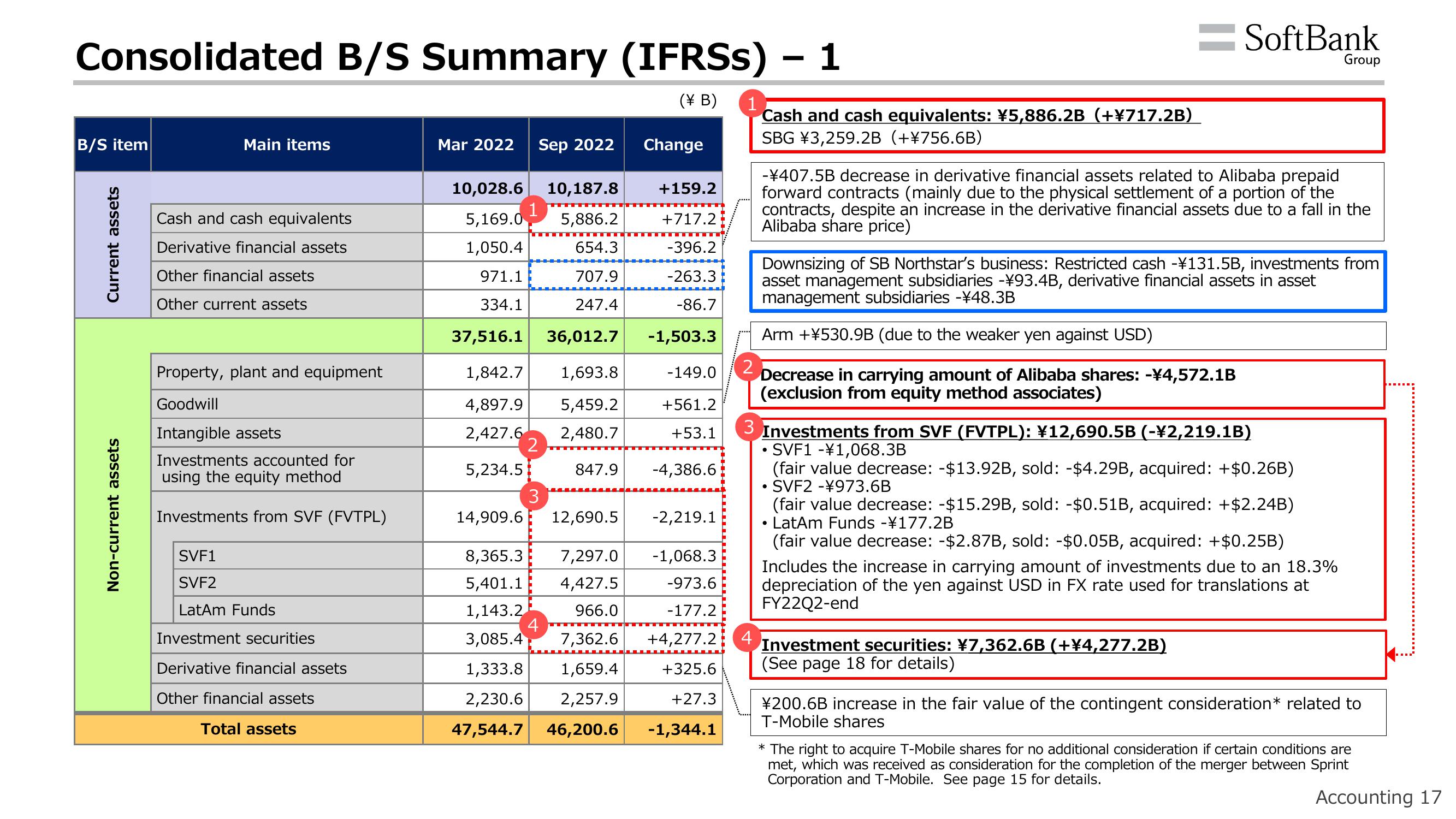

Consolidated B/S Summary (IFRSs)

(\ B)

B/S item

Current assets

Non-current assets

Main items

Cash and cash equivalents

Derivative financial assets

Other financial assets

Other current assets

Property, plant and equipment

Goodwill

Intangible assets

Investments accounted for

using the equity method

Investments from SVF (FVTPL)

SVF1

SVF2

LatAm Funds

Investment securities

Derivative financial assets

Other financial assets

Total assets

Mar 2022

Sep 2022

10,028.6 10,187.8

1

5,169.0 5,886.2

1,050.4

654.3

707.9

971.1

334.1

247.4

37,516.1

36,012.7

1,693.8

1,842.7

4,897.9

2,427.6

5,459.2

2,480.7

5,234.5

14,909.6

2

3

847.9

12,690.5

8,365.3 7,297.0

5,401.1 4,427.5

1,143.2

966.0

3,085.4 7,362.6

1,333.8 1,659.4

2,230.6 2,257.9

47,544.7 46,200.6

Change

+159.2

+717.2

-396.2

-263.3

-86.7

-1,503.3

-149.0

+561.2

+53.1

-4,386.6

-2,219.1

-1,068.3

-973.6

-177.2

+4,277.2

+325.6

+27.3

-1,344.1

1

Cash and cash equivalents: ¥5,886.2B (+¥717.2B)

SBG ¥3,259.2B (+¥756.6B)

2

4

– 1

-¥407.5B decrease in derivative financial assets related to Alibaba prepaid

forward contracts (mainly due to the physical settlement of a portion of the

contracts, despite an increase in the derivative financial assets due to a fall in the

Alibaba share price)

Decrease in carrying amount of Alibaba shares: -¥4,572.1B

(exclusion from equity method associates)

Downsizing of SB Northstar's business: Restricted cash -¥131.5B, investments from

asset management subsidiaries -¥93.4B, derivative financial assets in asset

management subsidiaries -¥48.3B

Arm +¥530.9B (due to the weaker yen against USD)

3 Investments from SVF (FVTPL): ¥12,690.5B (-¥2,219.1B)

SVF1 -¥1,068.3B

(fair value decrease: -$13.92B, sold: -$4.29B, acquired: +$0.26B)

SVF2 -¥973.6B

(fair value decrease: -$15.29B, sold: -$0.51B, acquired: +$2.24B)

LatAm Funds -¥177.2B

(fair value decrease: -$2.87B, sold: -$0.05B, acquired: +$0.25B)

●

SoftBank

●

Group

Includes the increase in carrying amount of investments due to an 18.3%

depreciation of the yen against USD in FX rate used for translations at

FY22Q2-end

Investment securities: ¥7,362.6B (+¥4,277.2B)

(See page 18 for details)

¥200.6B increase in the fair value of the contingent consideration* related to

T-Mobile shares

* The right to acquire T-Mobile shares for no additional consideration if certain conditions are

met, which was received as consideration for the completion of the merger between Sprint

Corporation and T-Mobile. See page 15 for details.

Accounting 17View entire presentation