FlexJet SPAC Presentation Deck

Proven Flexible Subscription Based Business Model with Consistent Profitability

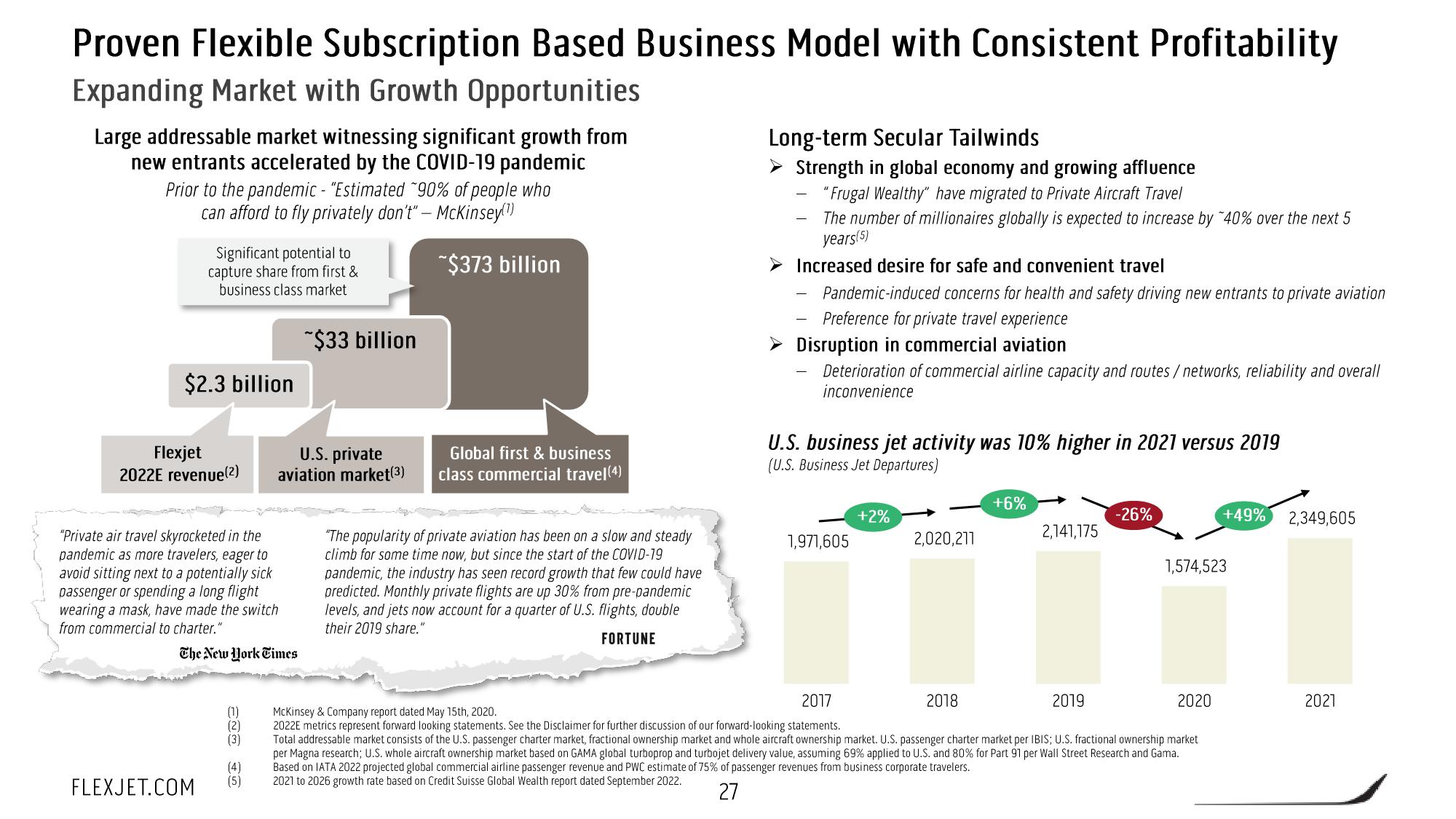

Expanding Market with Growth Opportunities

Large addressable market witnessing significant growth from

new entrants accelerated by the COVID-19 pandemic

Prior to the pandemic - "Estimated ~90% of people who

can afford to fly privately don't" - McKinsey(¹)

~$373 billion

Significant potential to

capture share from first &

business class market

$2.3 billion

Flexjet

2022E revenue(2)

FLEXJET.COM

"Private air travel skyrocketed in the

pandemic as more travelers, eager to

avoid sitting next to a potentially sick

passenger or spending a long flight

wearing a mask, have made the switch

from commercial to charter."

The New York Times

(1)

(2)

(3)

(4)

(5)

~$33 billion

U.S. private

aviation market (3)

Global first & business

class commercial travel (4)

"The popularity of private aviation has been on a slow and steady

climb for some time now, but since the start of the COVID-19

pandemic, the industry has seen record growth that few could have

predicted. Monthly private flights are up 30% from pre-pandemic

levels, and jets now account for a quarter of U.S. flights, double

their 2019 share."

FORTUNE

Long-term Secular Tailwinds

▸ Strength in global economy and growing affluence

"Frugal Wealthy" have migrated to Private Aircraft Travel

The number of millionaires globally is expected to increase by ~40% over the next 5

years(5)

Increased desire for safe and convenient travel

Pandemic-induced concerns for health and safety driving new entrants to private aviation

Preference for private travel experience

Disruption in commercial aviation

Deterioration of commercial airline capacity and routes / networks, reliability and overall

inconvenience

U.S. business jet activity was 10% higher in 2021 versus 2019

(U.S. Business Jet Departures)

1,971,605

+2%

2,020,211

2018

+6%

2,141,175

2019

-26%

1,574,523

2020

2017

McKinsey & Company report dated May 15th, 2020.

2022E metrics represent forward looking statements. See the Disclaimer for further discussion of our forward-looking statements.

Total addressable market consists of the U.S. passenger charter market, fractional ownership market and whole aircraft ownership market. U.S. passenger charter market per IBIS; U.S. fractional ownership market

per Magna research; U.S. whole aircraft ownership market based on GAMA global turboprop and turbojet delivery value, assuming 69% applied to U.S. and 80% for Part 91 per Wall Street Research and Gama.

Based on IATA 2022 projected global commercial airline passenger revenue and PWC estimate of 75% of passenger revenues from business corporate travelers.

2021 to 2026 growth rate based on Credit Suisse Global Wealth report dated September 2022.

27

+49% 2,349,605

2021View entire presentation