Dave SPAC Presentation Deck

Transaction Overview

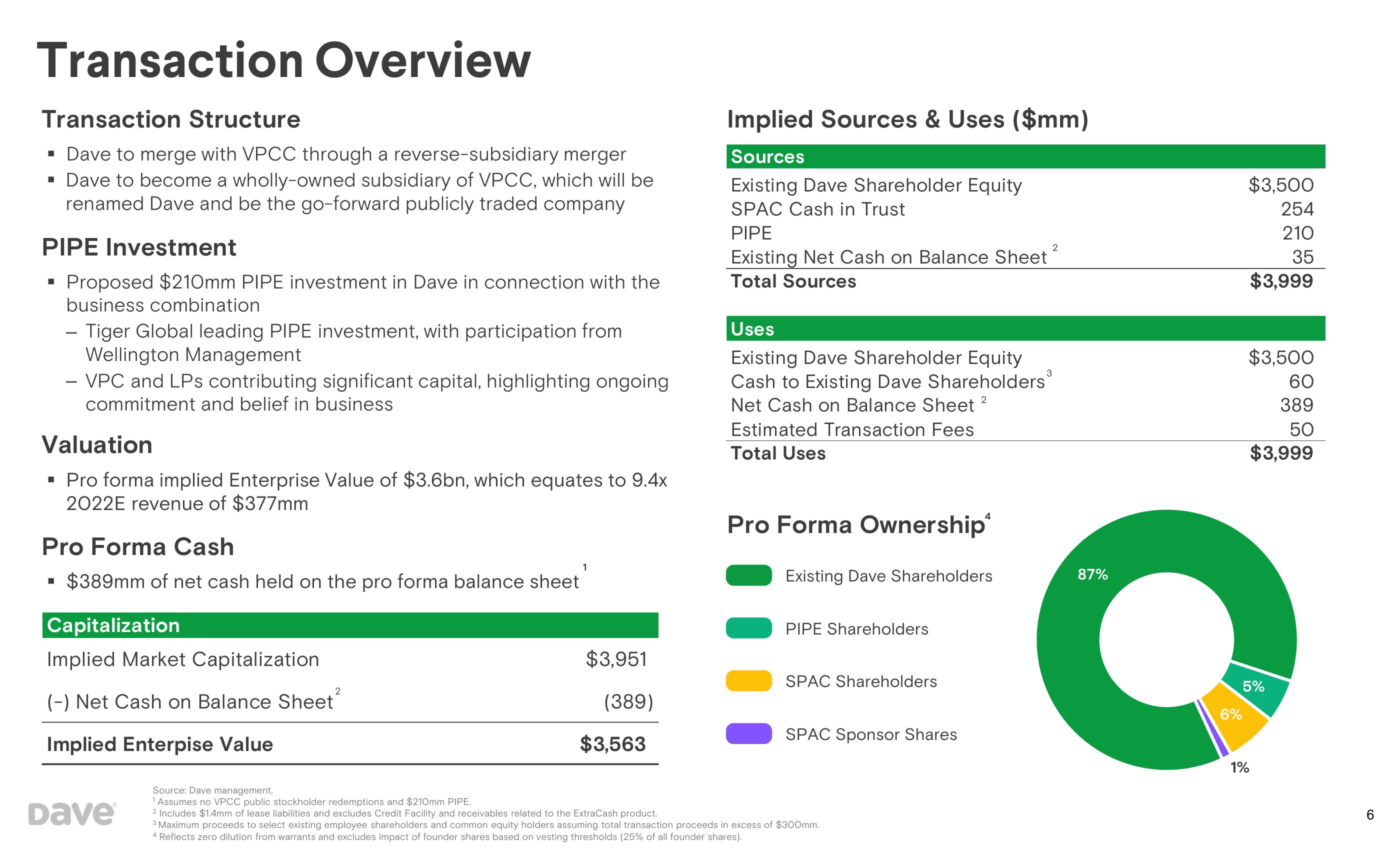

Transaction Structure

▪ Dave to merge with VPCC through a reverse-subsidiary merger

▪ Dave to become a wholly-owned subsidiary of VPCC, which will be

renamed Dave and be the go-forward publicly traded company

PIPE Investment

■

Proposed $210mm PIPE investment in Dave in connection with the

business combination

- Tiger Global leading PIPE investment, with participation from

Wellington Management

■

- VPC and LPs contributing significant capital, highlighting ongoing

commitment and belief in business

Valuation

▪ Pro forma implied Enterprise Value of $3.6bn, which equates to 9.4x

2022E revenue of $377mm

Pro Forma Cash

$389mm of net cash held on the pro forma balance sheet

Capitalization

Implied Market Capitalization

(-) Net Cash on Balance Sheet

Implied Enterpise Value

Dave

2

1

$3,951

(389)

$3,563

Implied Sources & Uses ($mm)

Sources

Existing Dave Shareholder Equity

SPAC Cash in Trust

PIPE

Existing Net Cash on Balance Sheet

Total Sources

Uses

Existing Dave Shareholder Equity

Cash to Existing Dave Shareholders³

2

Net Cash on Balance Sheet ²

Estimated Transaction Fees

Total Uses

Pro Forma Ownership

Existing Dave Shareholders

PIPE Shareholders

SPAC Shareholders

SPAC Sponsor Shares

4

Source: Dave management.

1 Assumes no VPCC public stockholder redemptions and $210mm PIPE.

2 Includes $1.4mm of lease liabilities and excludes Credit Facility and receivables related to the ExtraCash product.

3 Maximum proceeds to select existing employee shareholders and common equity holders assuming total transaction proceeds in excess of $300mm.

4 Reflects zero dilution from warrants and excludes impact of founder shares based on vesting thresholds (25% of all founder shares).

2

87%

6%

$3,500

254

210

35

$3,999

1%

$3,500

60

389

50

$3,999

5%

6View entire presentation