Snap Inc Results Presentation Deck

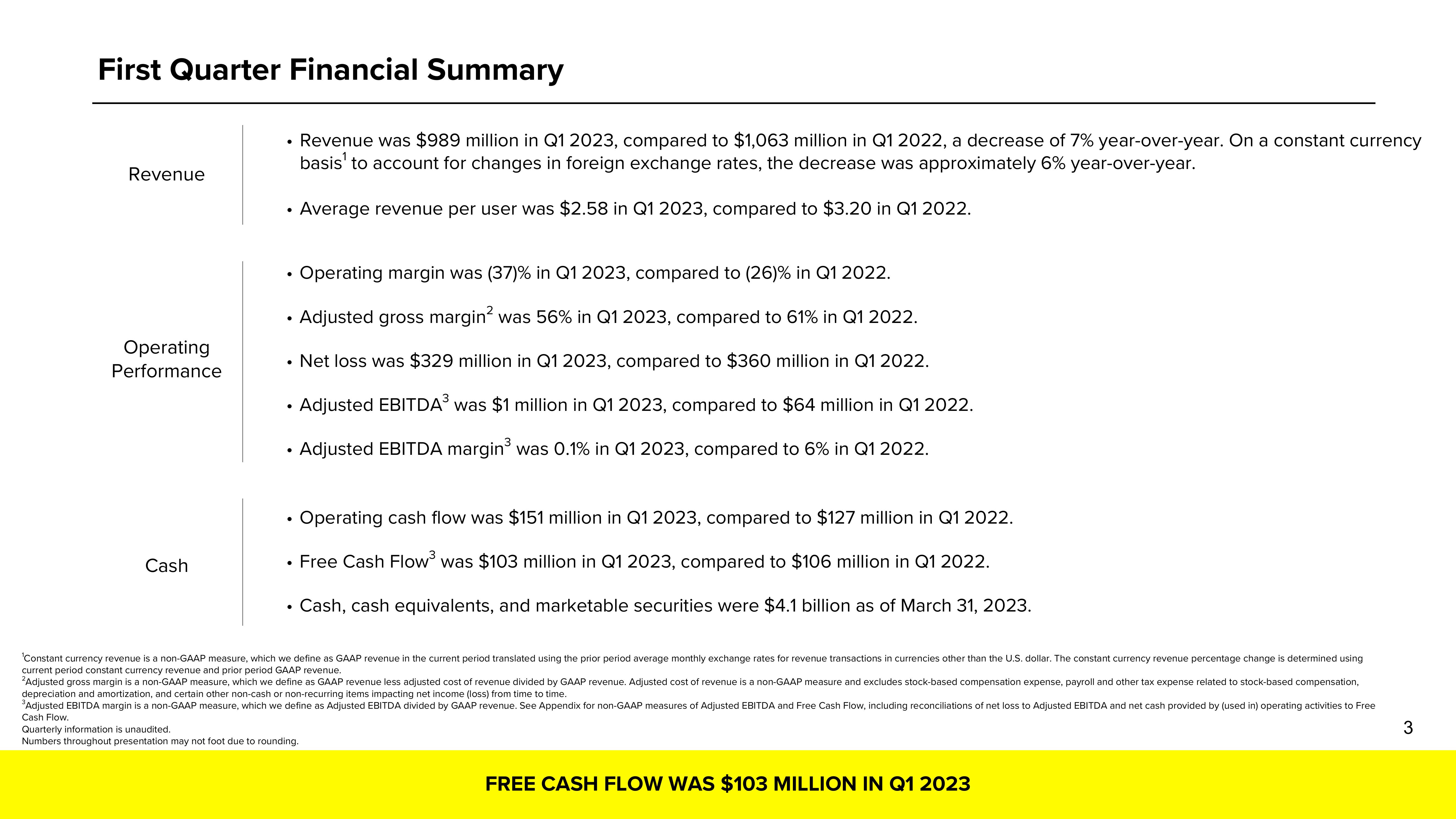

First Quarter Financial Summary

Revenue

Operating

Performance

Cash

●

.

●

Operating margin was (37) % in Q1 2023, compared to (26) % in Q1 2022.

Adjusted gross margin² was 56% in Q1 2023, compared to 61% in Q1 2022.

• Net loss was $329 million in Q1 2023, compared to $360 million in Q1 2022.

• Adjusted EBITDA³ was $1 million in Q1 2023, compared to $64 million in Q1 2022.

• Adjusted EBITDA margin³ was 0.1% in Q1 2023, compared to 6% in Q1 2022.

●

●

●

Revenue was $989 million in Q1 2023, compared to $1,063 million in Q1 2022, a decrease of 7% year-over-year. On a constant currency

basis to account for changes in foreign exchange rates, the decrease was approximately 6% year-over-year.

Average revenue per user was $2.58 in Q1 2023, compared to $3.20 in Q1 2022.

●

Operating cash flow was $151 million in Q1 2023, compared to $127 million in Q1 2022.

Free Cash Flow³ was $103 million in Q1 2023, compared to $106 million in Q1 2022.

Cash, cash equivalents, and marketable securities were $4.1 billion as of March 31, 2023.

'Constant currency revenue is a non-GAAP measure, which we define as GAAP revenue in the current period translated using the prior period average monthly exchange rates for revenue transactions in currencies other than the U.S. dollar. The constant currency revenue percentage change is determined using

current period constant currency revenue and prior period GAAP revenue.

²Adjusted gross margin is a non-GAAP measure, which we define as GAAP revenue less adjusted cost of revenue divided by GAAP revenue. Adjusted cost of revenue is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation,

depreciation and amortization, and certain other non-cash or non-recurring items impacting net income (loss) from time to time.

³Adjusted EBITDA margin s a non-GAAP measure, which we define as Adjusted EBITDA divided by GAAP revenue. See Appendix for non-GAAP measures of Adjusted EBITDA and Free Cash Flow, including reconciliations of net loss to Adjusted EBITDA and net cash provided by (used in) operating activities to Free

Cash Flow.

Quarterly information is unaudited.

Numbers throughout presentation may not foot due to rounding.

FREE CASH FLOW WAS $103 MILLION IN Q1 2023

3View entire presentation