Tempo SPAC Presentation Deck

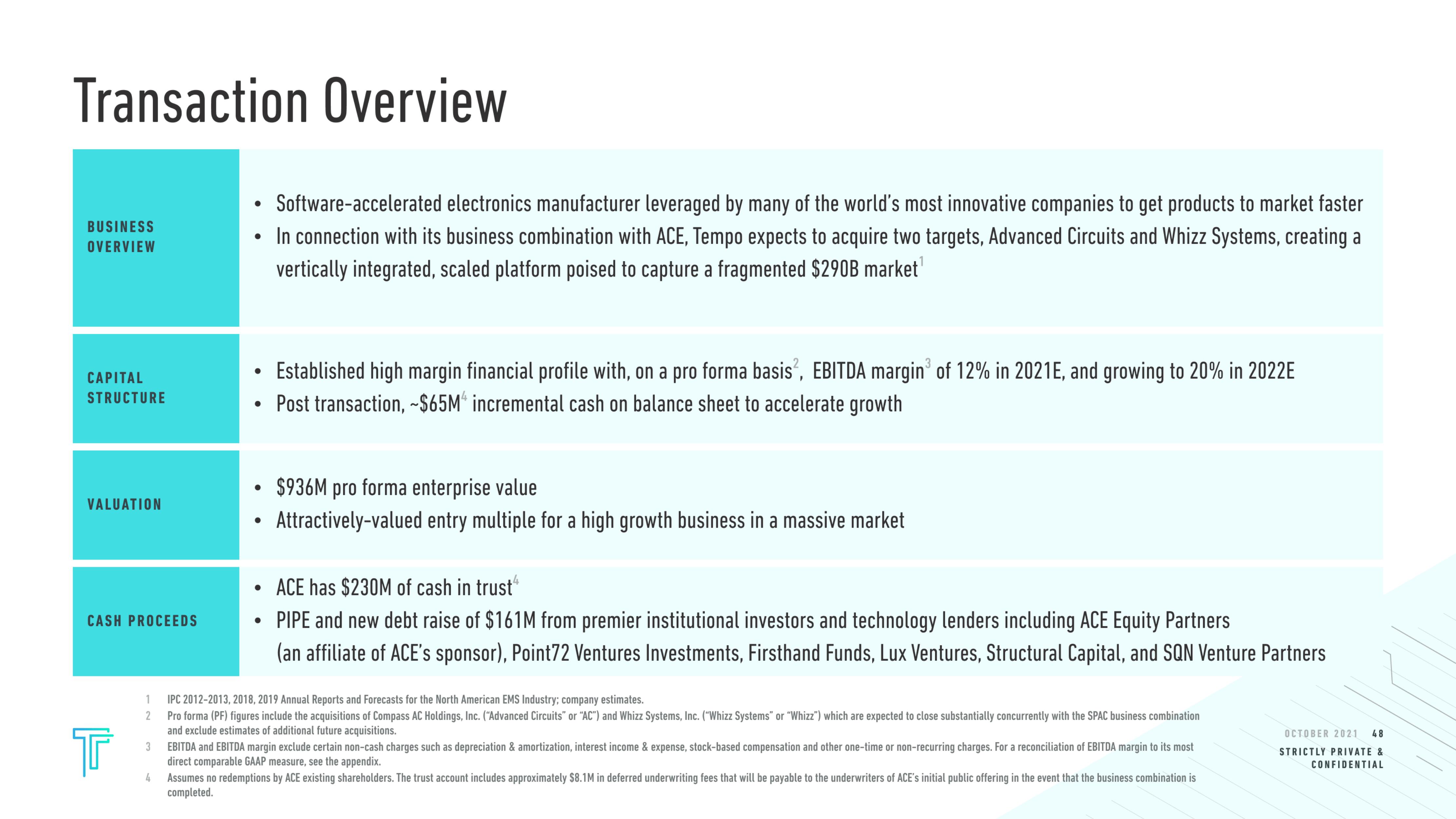

Transaction Overview

BUSINESS

OVERVIEW

CAPITAL

STRUCTURE

VALUATION

CASH PROCEEDS

Tr

1

2

3

• Software-accelerated electronics manufacturer leveraged by many of the world's most innovative companies to get products to market faster

• In connection with its business combination with ACE, Tempo expects to acquire two targets, Advanced Circuits and Whizz Systems, creating a

vertically integrated, scaled platform poised to capture a fragmented $290B market¹

●

Established high margin financial profile with, on a pro forma basis², EBITDA margin³ of 12% in 2021E, and growing to 20% in 2022E

Post transaction, ~$65M4 incremental cash on balance sheet to accelerate growth

●

$936M pro forma enterprise value

Attractively-valued entry multiple for a high growth business in a massive market

ACE has $230M of cash in trust"

• PIPE and new debt raise of $161M from premier institutional investors and technology lenders including ACE Equity Partners

(an affiliate of ACE's sponsor), Point 72 Ventures Investments, Firsthand Funds, Lux Ventures, Structural Capital, and SQN Venture Partners

IPC 2012-2013, 2018, 2019 Annual Reports and Forecasts for the North American EMS Industry; company estimates.

Pro forma (PF) figures include the acquisitions of Compass AC Holdings, Inc. ("Advanced Circuits" or "AC") and Whizz Systems, Inc. ("Whizz Systems" or "Whizz") which are expected to close substantially concurrently with the SPAC business combination

and exclude estimates of additional future acquisitions.

EBITDA and EBITDA margin exclude certain non-cash charges such as depreciation & amortization, interest income & expense, stock-based compensation and other one-time or non-recurring charges. For a reconciliation of EBITDA margin to its most

direct comparable GAAP measure, see the appendix.

4 Assumes no redemptions by ACE existing shareholders. The trust account includes approximately $8.1M in deferred underwriting fees that will be payable to the underwriters of ACE's initial public offering in the event that the business combination is

completed.

OCTOBER 2021 48

STRICTLY PRIVATE &

CONFIDENTIALView entire presentation