Evercore Investment Banking Pitch Book

SIRE Situation Analysis

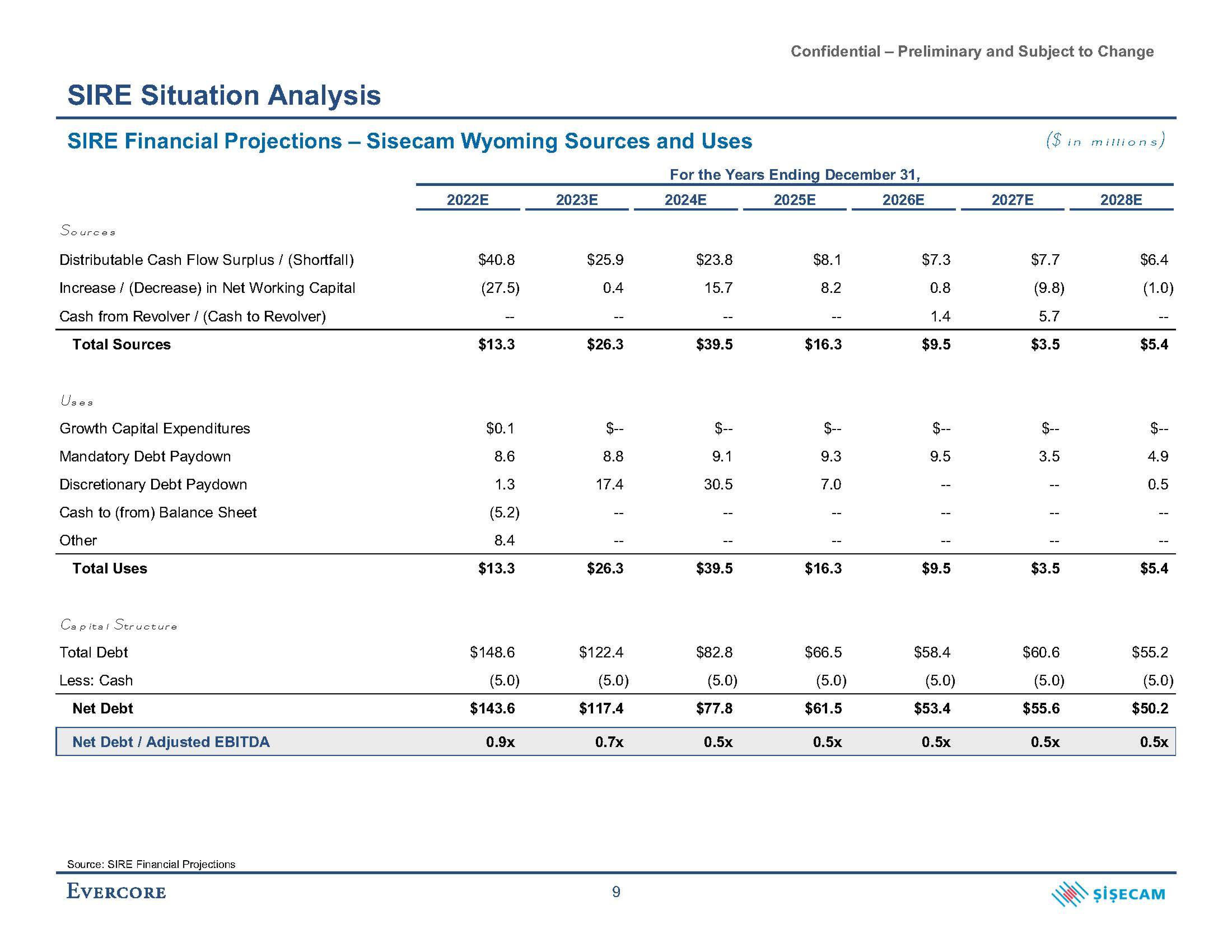

SIRE Financial Projections - Sisecam Wyoming Sources and Uses

Sources

Distributable Cash Flow Surplus / (Shortfall)

Increase / (Decrease) in Net Working Capital

Cash from Revolver / (Cash to Revolver)

Total Sources

Uses

Growth Capital Expenditures

Mandatory Debt Paydown

Discretionary Debt Paydown

Cash to (from) Balance Sheet

Other

Total Uses

Capital Structure

Total Debt

Less: Cash

Net Debt

Net Debt / Adjusted EBITDA

Source: SIRE Financial Projections

EVERCORE

2022E

$40.8

(27.5)

$13.3

$0.1

8.6

1.3

(5.2)

8.4

$13.3

$148.6

(5.0)

$143.6

0.9x

2023E

$25.9

0.4

$26.3

$--

8.8

17.4

1

$26.3

$122.4

(5.0)

$117.4

0.7x

9

For the Years Ending December 31,

2024E

2025E

2026E

$23.8

15.7

$39.5

$--

9.1

30.5

$39.5

$82.8

(5.0)

$77.8

Confidential - Preliminary and Subject to Change

0.5x

$8.1

8.2

$16.3

$--

9.3

7.0

$16.3

$66.5

(5.0)

$61.5

0.5x

$7.3

0.8

1.4

$9.5

$--

9.5

$9.5

$58.4

(5.0)

$53.4

0.5x

2027E

($ in millions)

$7.7

(9.8)

5.7

$3.5

$--

3.5

$3.5

$60.6

(5.0)

$55.6

0.5x

2028E

$6.4

(1.0)

$5.4

$--

4.9

0.5

1

$5.4

$55.2

(5.0)

$50.2

0.5x

ŞİŞECAMView entire presentation