Vale Investor Day Presentation Deck

47

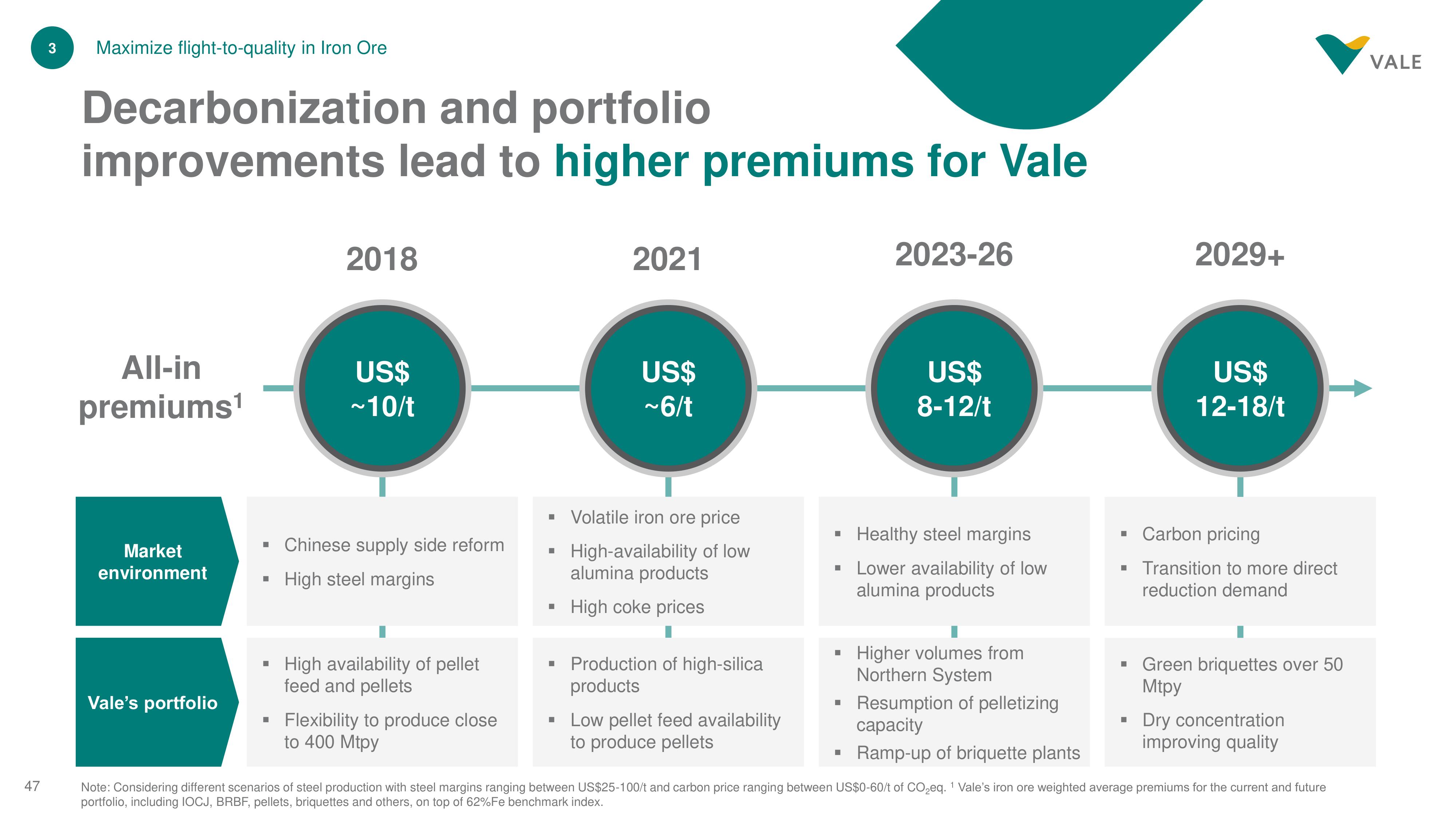

3 Maximize flight-to-quality in Iron Ore

Decarbonization and portfolio

improvements lead to higher premiums for Vale

All-in

premiums¹

Market

environment

Vale's portfolio

I

■

I

2018

US$

~10/t

Chinese supply side reform

High steel margins

High availability of pellet

feed and pellets

▪ Flexibility to produce close

to 400 Mtpy

■

■

I

2021

US$

~6/t

Volatile iron ore price

High-availability of low

alumina products

High coke prices

Production of high-silica

products

▪ Low pellet feed availability

to produce pellets

■

Healthy steel margins

▪ Lower availability of low

alumina products

■

■

2023-26

I

US$

8-12/t

Higher volumes from

Northern System

Resumption of pelletizing

capacity

Ramp-up of briquette plants

2029+

US$

12-18/t

▪ Carbon pricing

▪ Transition to more direct

reduction demand

I

▪ Green briquettes over 50

Mtpy

Dry concentration

improving quality

Note: Considering different scenarios of steel production with steel margins ranging between US$25-100/t and carbon price ranging between US$0-60/t of CO₂eq. 1 Vale's iron ore weighted average premiums for the current and future

portfolio, including IOCJ, BRBF, pellets, briquettes and others, on top of 62% Fe benchmark index.

VALEView entire presentation