Main Street Capital Investor Day Presentation Deck

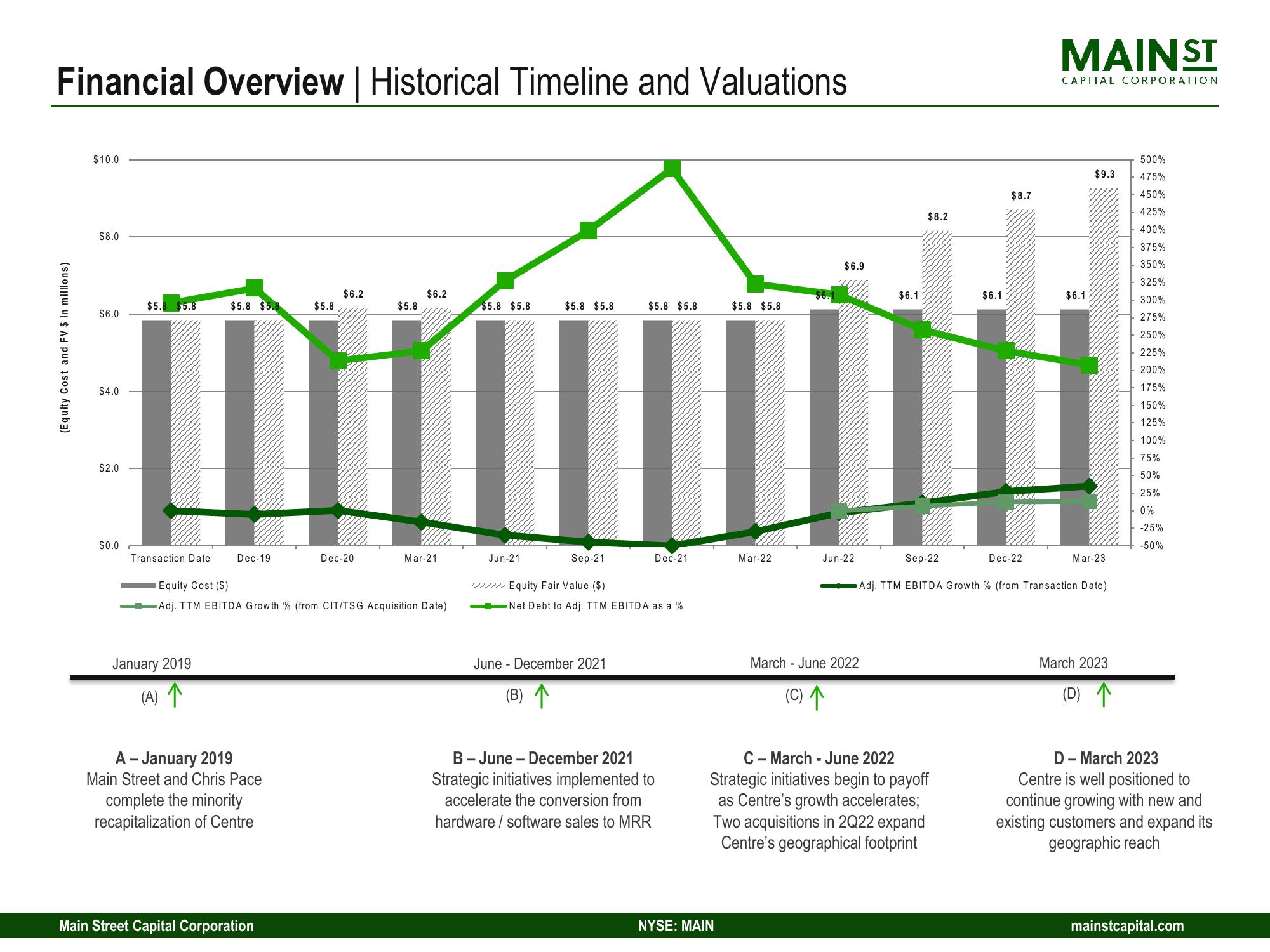

Financial Overview | Historical Timeline and Valuations

(Equity Cost and FV $ in millions)

$10.0

$8.0

$6.0

$4.0

$2.0

$0.0

$5.8 $5.8

Transaction Date

$5.8 $5.8

January 2019

(A) 个

Dec-19

A - January 2019

Main Street and Chris Pace

complete the minority

recapitalization of Centre

$5.8

Main Street Capital Corporation

$6.2

Dec-20

Equity Cost ($)

Adj. TTM EBITDA Growth % (from CIT/TSG Acquisition Date)

$5.8

$6.2

Mar-21

$5.8 $5.8

$5.8 $5.8

Jun-21

Sep-21

wwww.Equity Fair Value ($)

$5.8 $5.8

June - December 2021

(B) 个

Dec-21

Net Debt to Adj. TTM EBITDA as a %

B-June - December 2021

Strategic initiatives implemented to

accelerate the conversion from

hardware/software sales to MRR

$5.8 $5.8

NYSE: MAIN

Mar-22

$6.9

Jun-22

March June 2022

(C) 个

$6.1

$8.2

C March - June 2022

Strategic initiatives begin to payoff

as Centre's growth accelerates;

Two acquisitions in 2Q22 expand

Centre's geographical footprint

$6.1

$8.7

DOOG

MAIN ST

Dec-22

CAPITAL CORPORATION

$6.1

Sep-22

Adj. TTM EBITDA Growth % (from Transaction Date)

$9.3

Mar-23

March 2023

(D) 个

500%

475%

450%

425%

400%

375%

350%

325%

300%

275%

250%

225%

200%

175%

150%

125%

100%

75%

50%

25%

0%

-25%

-50%

D - March 2023

Centre is well positioned to

continue growing with new and

existing customers and expand its

geographic reach

mainstcapital.comView entire presentation