Main Street Capital Investor Day Presentation Deck

Supporting LMM Growth Through Acquisitions

As an equity owner, we are aligned with our LMM portfolio companies and our management

team partners in their efforts to grow their businesses and achieve their strategic objectives,

including (among others):

■

Geographic expansion, product/service expansion, cross-selling opportunities, purchasing power

benefits, and operating synergies

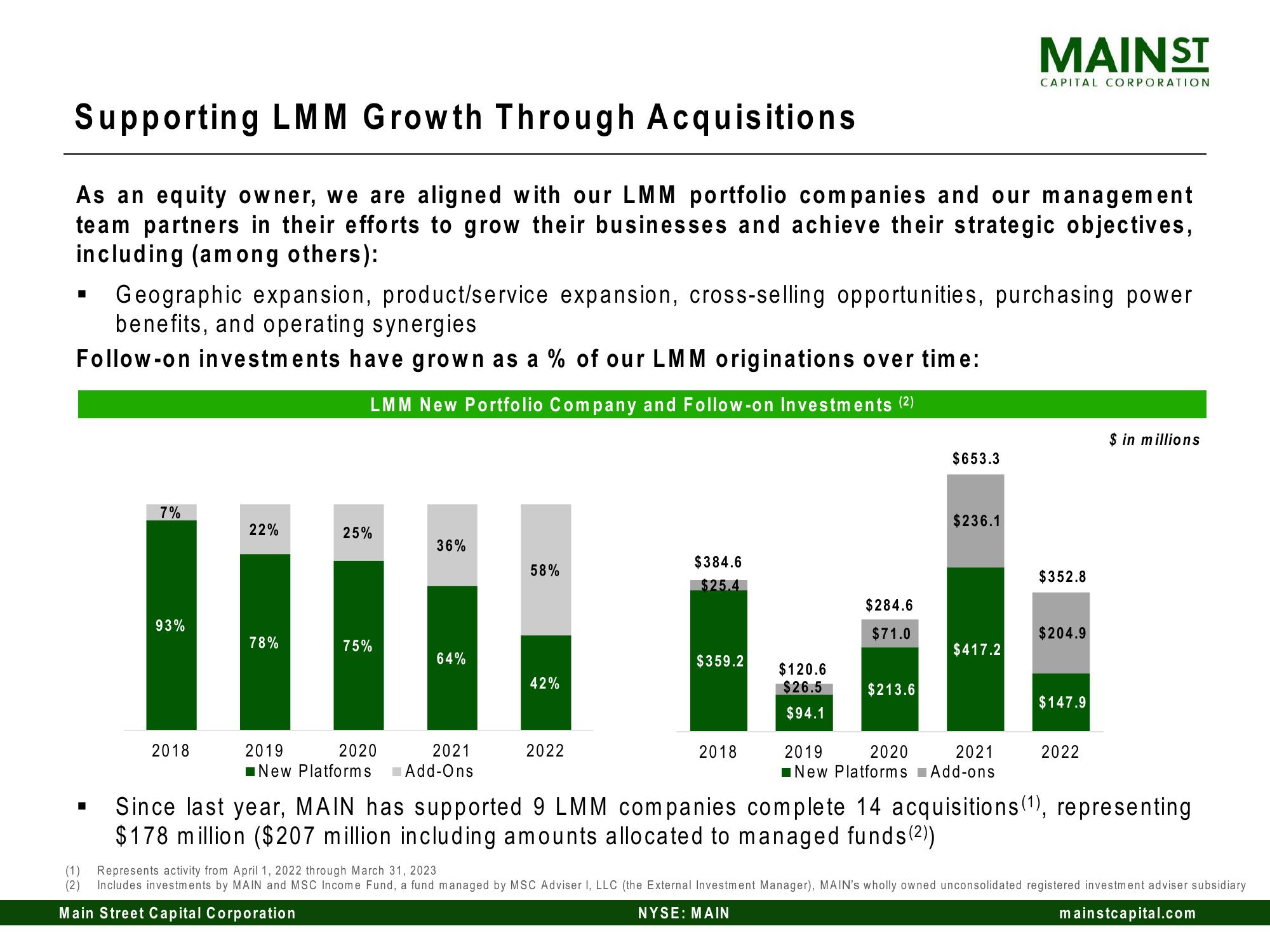

Follow-on investments have grown as a % of our LMM originations over time:

LMM New Portfolio Company and Follow-on Investments (2)

7%

93%

2018

22%

78%

25%

75%

36%

64%

2019

2020

2021

■New Platforms Add-Ons

58%

42%

2022

$384.6

$25.4

$359.2

2018

$120.6

$26.5

$94.1

$284.6

$71.0

$213.6

$653.3

$236.1

MAIN ST

$417.2

CAPITAL CORPORATION

2019

2020

2021

New Platforms Add-ons

$352.8

$204.9

$147.9

2022

$ in millions

Since last year, MAIN has supported 9 LMM companies complete 14 acquisitions (¹), representing

$178 million ($207 million including amounts allocated to managed funds (2))

(1) Represents activity from April 1, 2022 through March 31, 2023

(2) Includes investments by MAIN and MSC Income Fund, a fund managed by MSC Adviser I, LLC (the External Investment Manager), MAIN's wholly owned unconsolidated registered investment adviser subsidiary

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.comView entire presentation