Dave Results Presentation Deck

Improving delinquency

performance

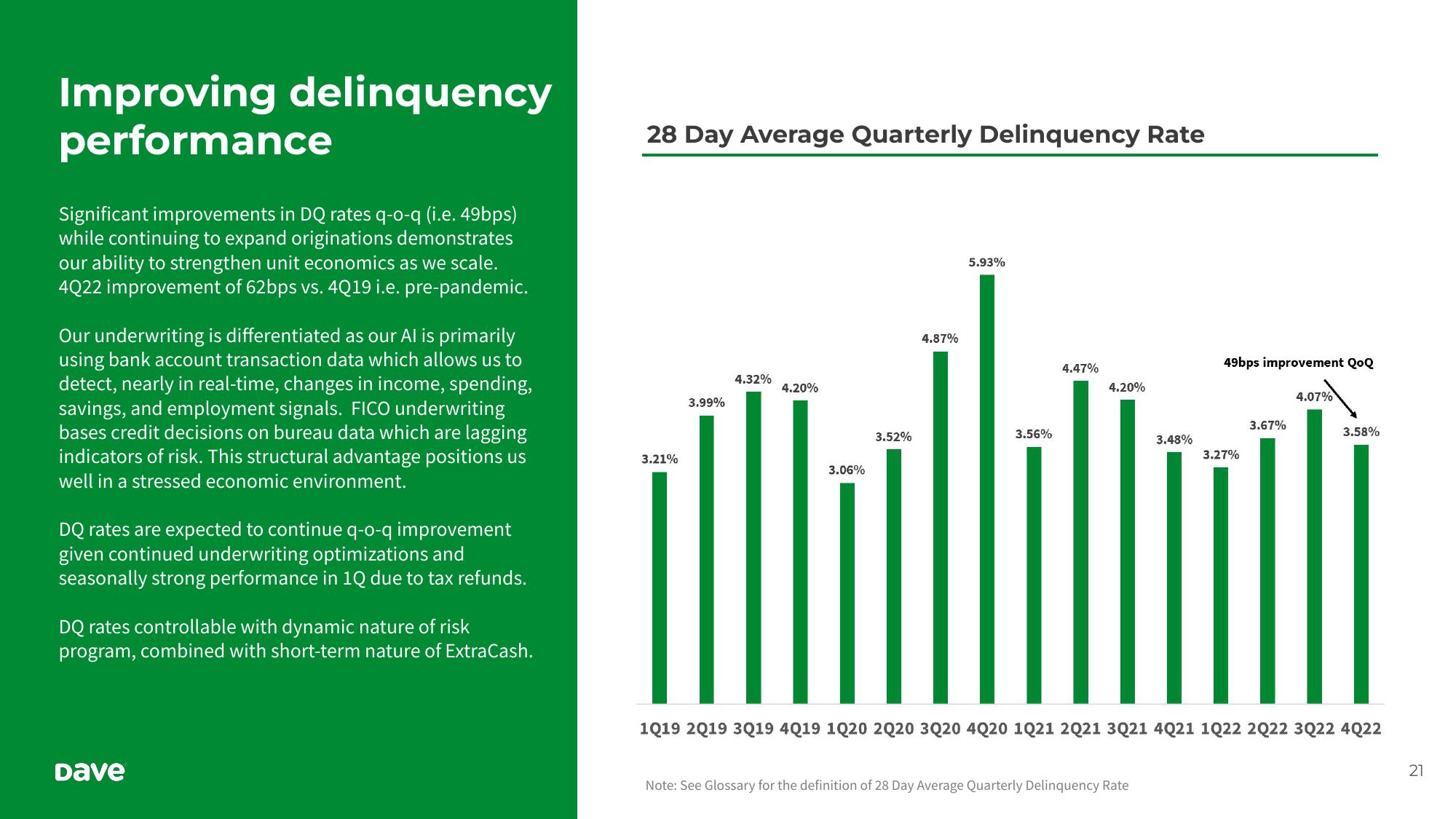

Significant improvements in DQ rates q-o-q (i.e. 49bps)

while continuing to expand originations demonstrates

our ability to strengthen unit economics as we scale.

4Q22 improvement of 62bps vs. 4Q19 i.e. pre-pandemic.

Our underwriting is differentiated as our Al is primarily

using bank account transaction data which allows us to

detect, nearly in real-time, changes in income, spending,

savings, and employment signals. FICO underwriting

bases credit decisions on bureau data which are lagging

indicators of risk. This structural advantage positions us

well in a stressed economic environment.

DQ rates are expected to continue q-o-q improvement

given continued underwriting optimizations and

seasonally strong performance in 1Q due to tax refunds.

DQ rates controllable with dynamic nature of risk

program, combined with short-term nature of ExtraCash.

Dave

28 Day Average Quarterly Delinquency Rate

3.21%

3.99%

4.32%

4.20%

3.06%

3.52%

4.87%

5.93%

3.56%

4.47%

4.20%

3.48%

Note: See Glossary for the definition of 28 Day Average Quarterly Delinquency Rate

49bps improvement QoQ

3.27%

3.67%

4.07%

3.58%

||| ||||||||

1Q19 2019 3Q19 4Q19 1020 2020 3Q20 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2022 3Q22 4Q22

21View entire presentation