Getty SPAC Presentation Deck

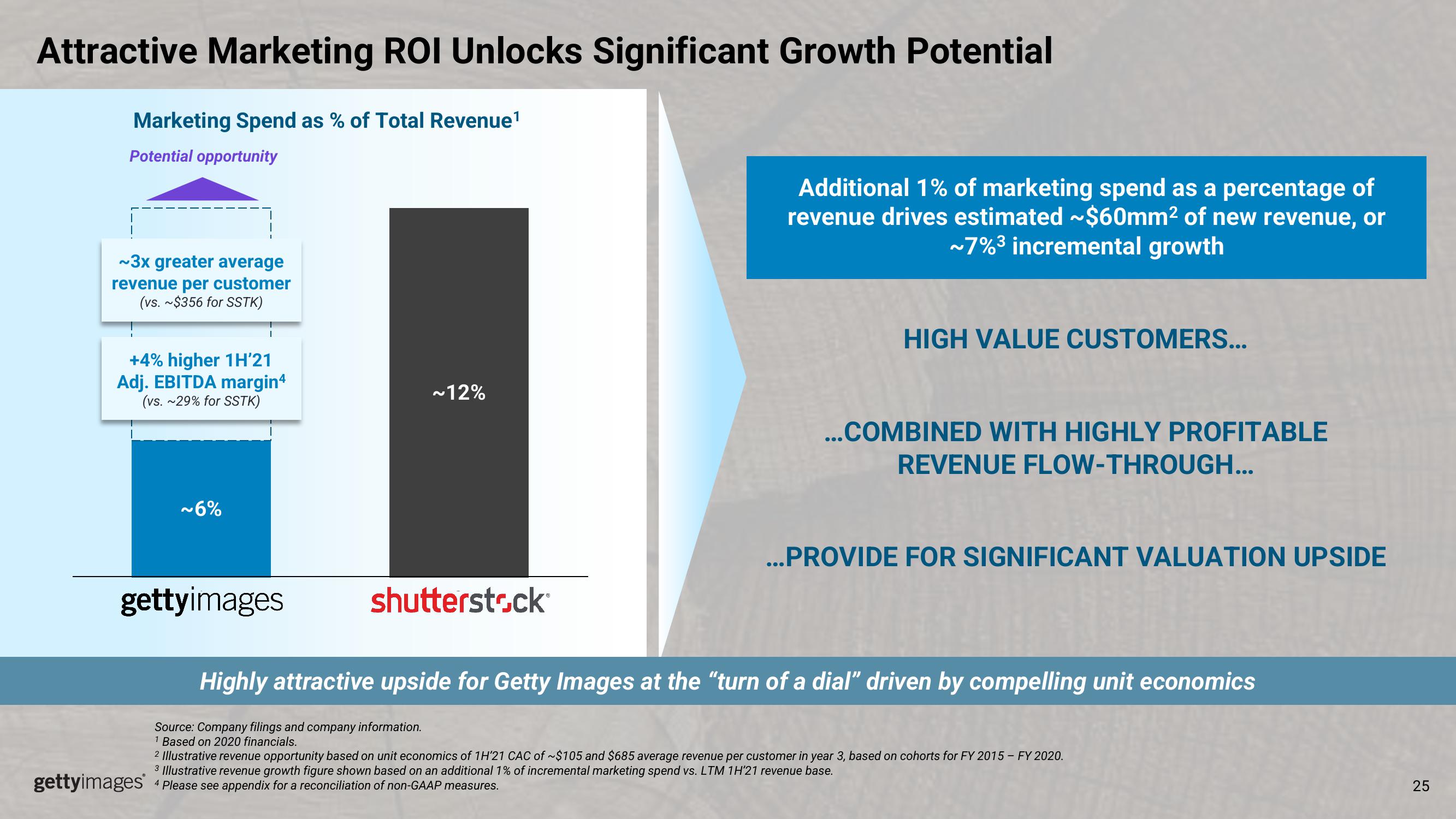

Attractive Marketing ROI Unlocks Significant Growth Potential

Marketing Spend as % of Total Revenue¹

Potential opportunity

~3x greater average

revenue per customer

(vs. ~$356 for SSTK)

+4% higher 1H'21

Adj. EBITDA margin4

(vs. ~29% for SSTK)

~6%

gettyimages

~12%

shutterstock®

Source: Company filings and company information.

1 Based on 2020 financials.

Additional 1% of marketing spend as a percentage of

revenue drives estimated ~$60mm² of new revenue, or

~7%³ incremental growth

HIGH VALUE CUSTOMERS...

gettyimages 4 Please see appendix for a reconciliation of non-GAAP measures.

...COMBINED WITH HIGHLY PROFITABLE

REVENUE FLOW-THROUGH...

Highly attractive upside for Getty Images at the "turn of a dial" driven by compelling unit economics

...PROVIDE FOR SIGNIFICANT VALUATION UPSIDE

2 Illustrative revenue opportunity based on unit economics of 1H'21 CAC of ~$105 and $685 average revenue per customer in year 3, based on cohorts for FY 2015 - FY 2020.

3 Illustrative revenue growth figure shown based on an additional 1% of incremental marketing spend vs. LTM 1H'21 revenue base.

25View entire presentation