Netstreit Investor Presentation Deck

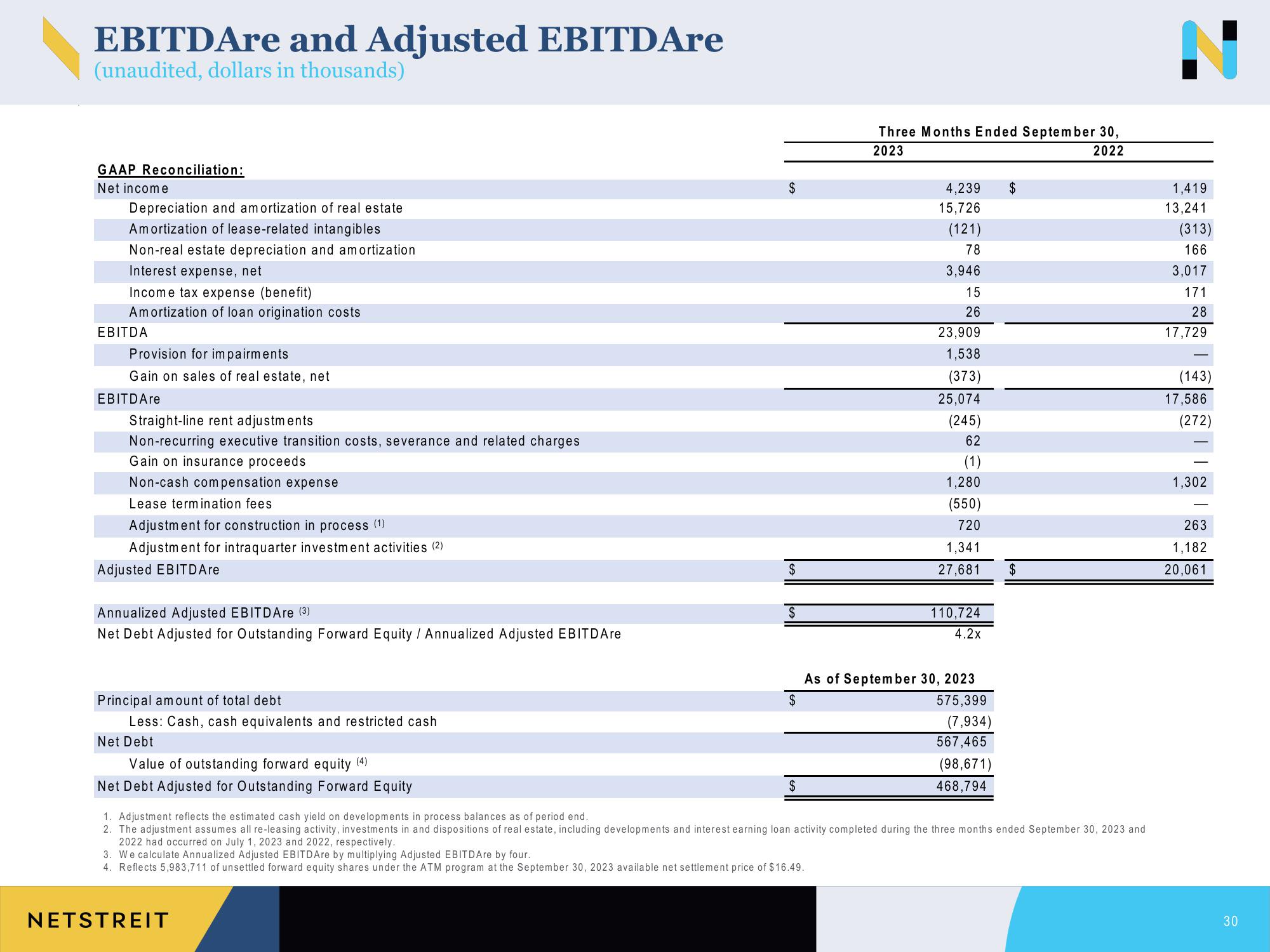

EBITDAre and Adjusted EBITDAre

(unaudited, dollars in thousands)

GAAP Reconciliation:

Net income

Depreciation and amortization of real estate

Amortization of lease-related intangibles

Non-real estate depreciation and amortization

Interest expense, net

Income tax expense (benefit)

Amortization of loan origination costs

EBITDA

Provision for impairments

Gain on sales of real estate, net

EBITDAre

Straight-line rent adjustments

Non-recurring executive transition costs, severance and related charges

Gain on insurance proceeds

Non-cash compensation expense

Lease termination fees

Adjustment for construction in process (¹)

Adjustment for intraquarter investment activities (2)

Adjusted EBITD Are

Annualized Adjusted EBITDAre (3)

Net Debt Adjusted for Outstanding Forward Equity / Annualized Adjusted EBITDAre

Principal amount of total debt

Less: Cash, cash equivalents and restricted cash

Net Debt

Value of outstanding forward equity (4)

Net Debt Adjusted for Outstanding Forward Equity

$

$

NETSTREIT

$

$

Three Months Ended September 30,

2023

2022

3. We calculate Annualized Adjusted EBITDAre by multiplying Adjusted EBITDAre by four.

4. Reflects 5,983,711 of unsettled forward equity shares under the ATM program at the September 30, 2023 available net settlement price of $16.49.

4,239 $

15,726

(121)

78

3,946

15

26

23,909

1,538

(373)

25,074

(245)

62

(1)

1,280

(550)

720

1,341

27,681

As of September 30, 2023

$

575,399

110,724

4.2x

(7,934)

567,465

(98,671)

468,794

1. Adjustment refle

cash yield on developments process balances as of period end.

2. The adjustment assumes all re-leasing activity, investments in and dispositions of real estate, including developments and interest earning loan activity completed during the three months ended September 30, 2023 and

2022 had occurred on July 1, 2023 and 2022, respectively.

$

1,419

13,241

(313)

166

3,017

171

28

17,729

(143)

17,586

(272)

1,302

263

1,182

20,061

30View entire presentation