First Citizens BancShares Results Presentation Deck

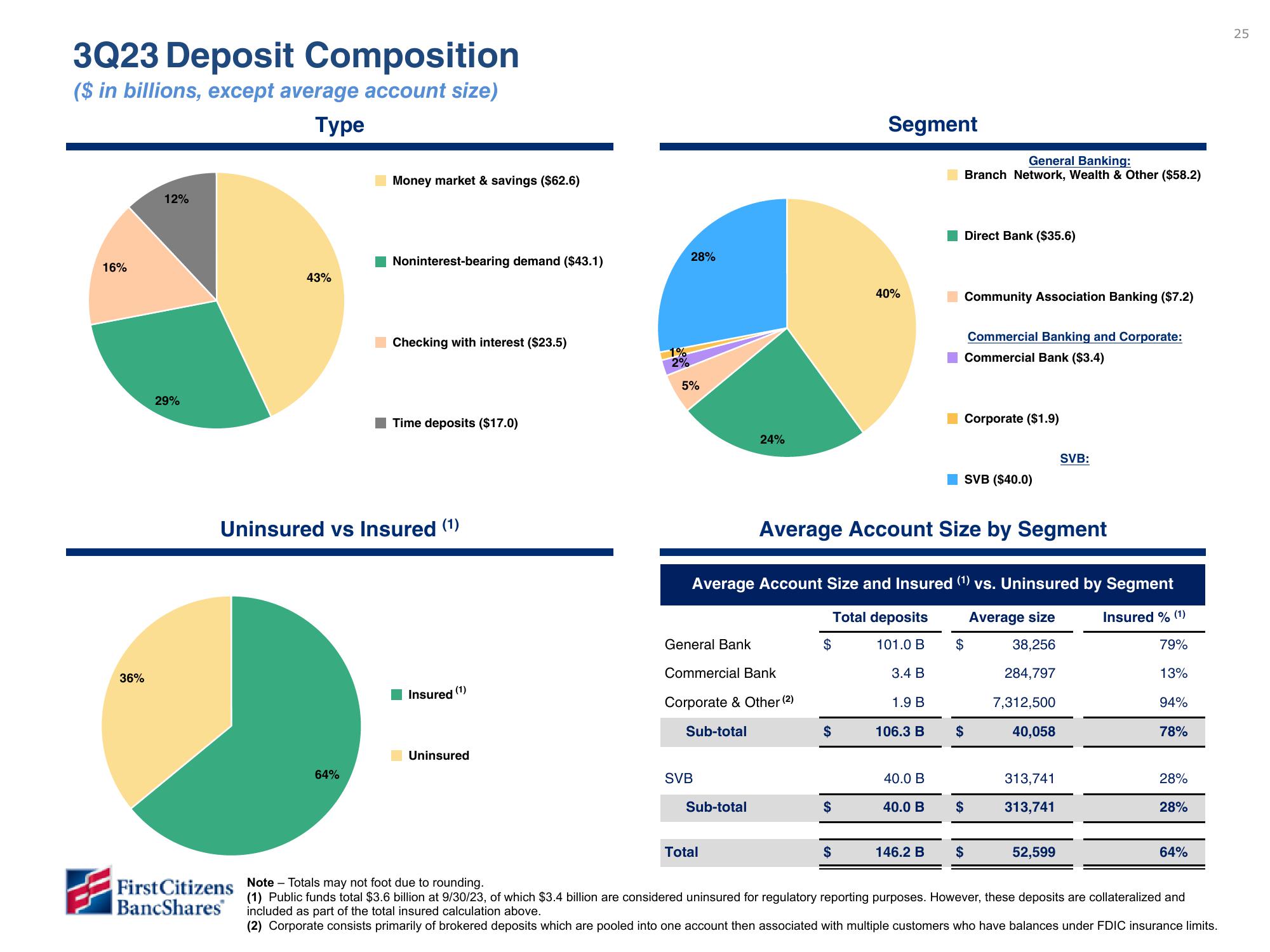

3Q23 Deposit Composition

($ in billions, except average account size)

Type

16%

36%

12%

29%

43%

First Citizens

BancShares

Money market & savings ($62.6)

64%

Noninterest-bearing demand ($43.1)

Checking with interest ($23.5)

Uninsured vs Insured (1)

Time deposits ($17.0)

Insured

(1)

Uninsured

28%

5%

General Bank

Sub-total

Commercial Bank

Corporate & Other (2)

SVB

24%

Sub-total

Total

$

$

Segment

$

40%

Average Account Size and Insured (¹) vs. Uninsured by Segment

Insured % (1)

Total deposits

101.0 B

Average size

38,256

284,797

7,312,500

40,058

$

3.4 B

Average Account Size by Segment

1.9 B

106.3 B

40.0 B

■

40.0 B

146.2 B

General Banking:

Branch Network, Wealth & Other ($58.2)

Direct Bank ($35.6)

Community Association Banking ($7.2)

Commercial Banking and Corporate:

Commercial Bank ($3.4)

Corporate ($1.9)

SVB ($40.0)

$

$

$

$

SVB:

313,741

313,741

52,599

79%

13%

94%

78%

28%

28%

64%

Note - Totals may not foot due to rounding.

(1) Public funds total $3.6 billion at 9/30/23, of which $3.4 billion are considered uninsured for regulatory reporting purposes. However, these deposits are collateralized and

included as part of the total insured calculation above.

(2) Corporate consists primarily of brokered deposits which are pooled into one account then associated with multiple customers who have balances under FDIC insurance limits.

25View entire presentation