Active and Passive Investing

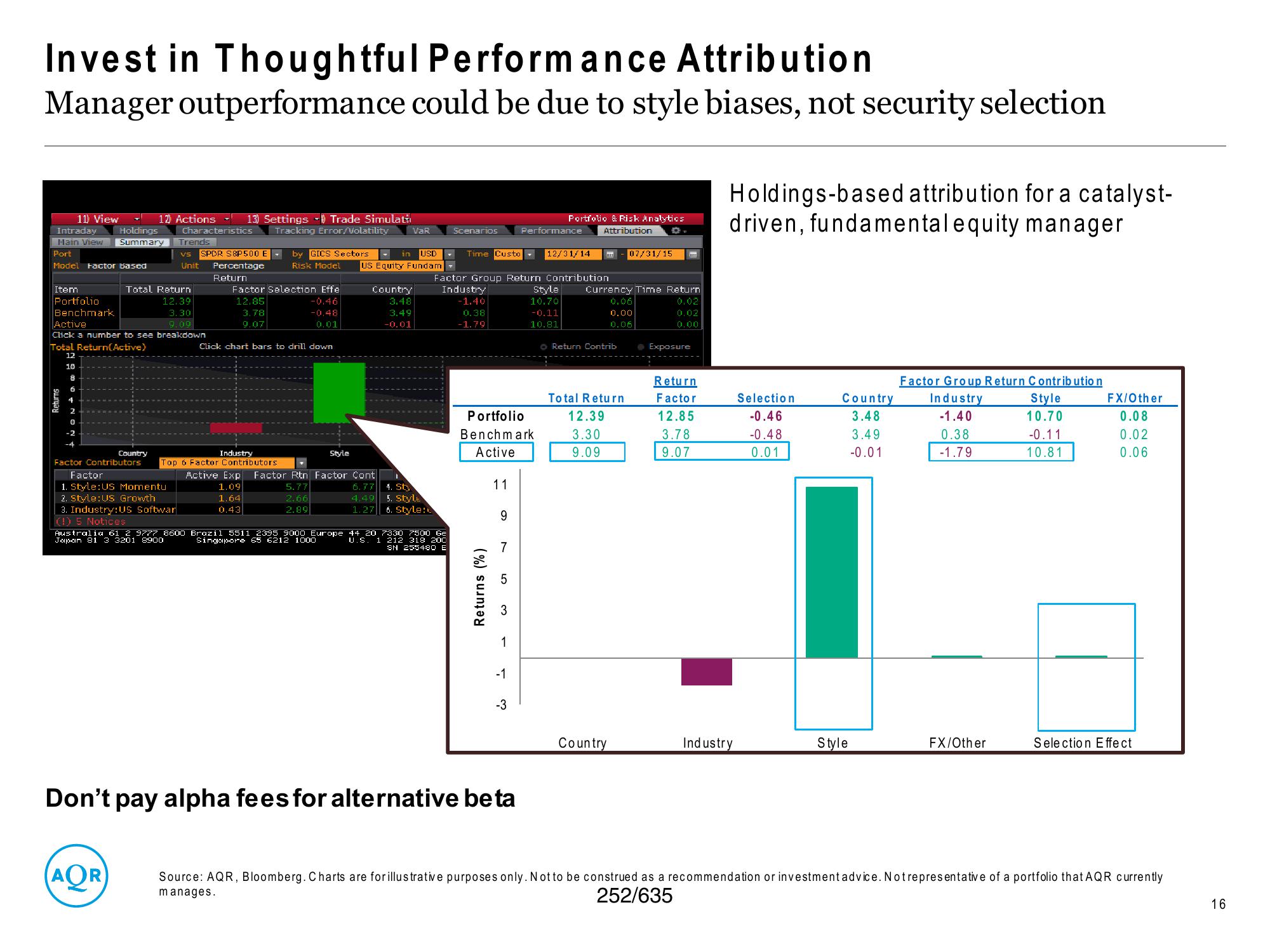

Invest in Thoughtful Performance Attribution

Manager outperformance could be due to style biases, not security selection

11) View

Intraday

Main View

Port

Model Factor based

Item

Portfolio

Benchmark

8

4

Holdings

Summary

Total Return

12.39

3.30

Active

9.09

Click a number to see breakdown

Total Return(Active)

12

10

12) Actions - 13) Settings - Trade Simulati

Characteristics Tracking Error/Volatility

Country

Factor Contributors

Factor

1. Style: US Momentu

2. Style: US Growth

(AOR

Trends

VS

Unit

3. Industry: US Softwar

(1) 5 Notices

SPDR S&P500

Percentage

Return

Factor Selection Effe

12.85

Industry

Top 6 Factor Contributors

Active Exp

1.09

3.78

9.07

1.64

0.43

by GICS Sectors

in USD

Risk Model US Equity Fundam

Click chart bars to drill down

-0.46

-0.48

0.01

Style

VaR

Australia 61 2 9777 8600 Brazil 5511 2395 9000 Europe

Japan 81 3 3201 8900

Singapore 65 6212 1000

Country

3.48

3.49

-0.01

Factor Rtn Factor Cont

5.77

6.77

4. Sty

4.49 5. Style

2.66

2.89

1.27 6. Style:

Scenarios

44 20 7330 7500 Ge

U.S. 1 212 318 200

SN 255480 E

Time Custo

Factor Group Return Contribution

Industry

-1.40

0.38

-1.79

Returns (%)

11

Portfolio

Benchmark

Active

9

7

1

-1

-3

Don't pay alpha fees for alternative beta

Performance

Portfolio & Risk Analytics

Attribution

12/31/14

Style

10.70

-0.11

10.81

Currency Time Return

0.02

0.02

0.00

Return Contrib

07/31/15

0.00

0.06

Total Return

12.39

3.30

9.09

Country

● Exposure

Return

Factor

12.85

3.78

9.07

Holdings-based attribution for a catalyst-

driven, fundamental equity manager

Industry

Selection

-0.46

-0.48

0.01

Country Industry

3.48

-1.40

Style

Factor Group Return Contribution

3.49

-0.01

0.38

-1.79

FX/Other

Style

10.70

-0.11

10.81

FX/Other

0.08

0.02

0.06

Selection Effect

Source: AQR, Bloomberg. Charts are for illustrative purposes only. Not to be construed as a recommendation or investment advice. Notre presentative of a portfolio that AQR currently

manages.

252/635

16View entire presentation