Kinnevik Results Presentation Deck

Intro

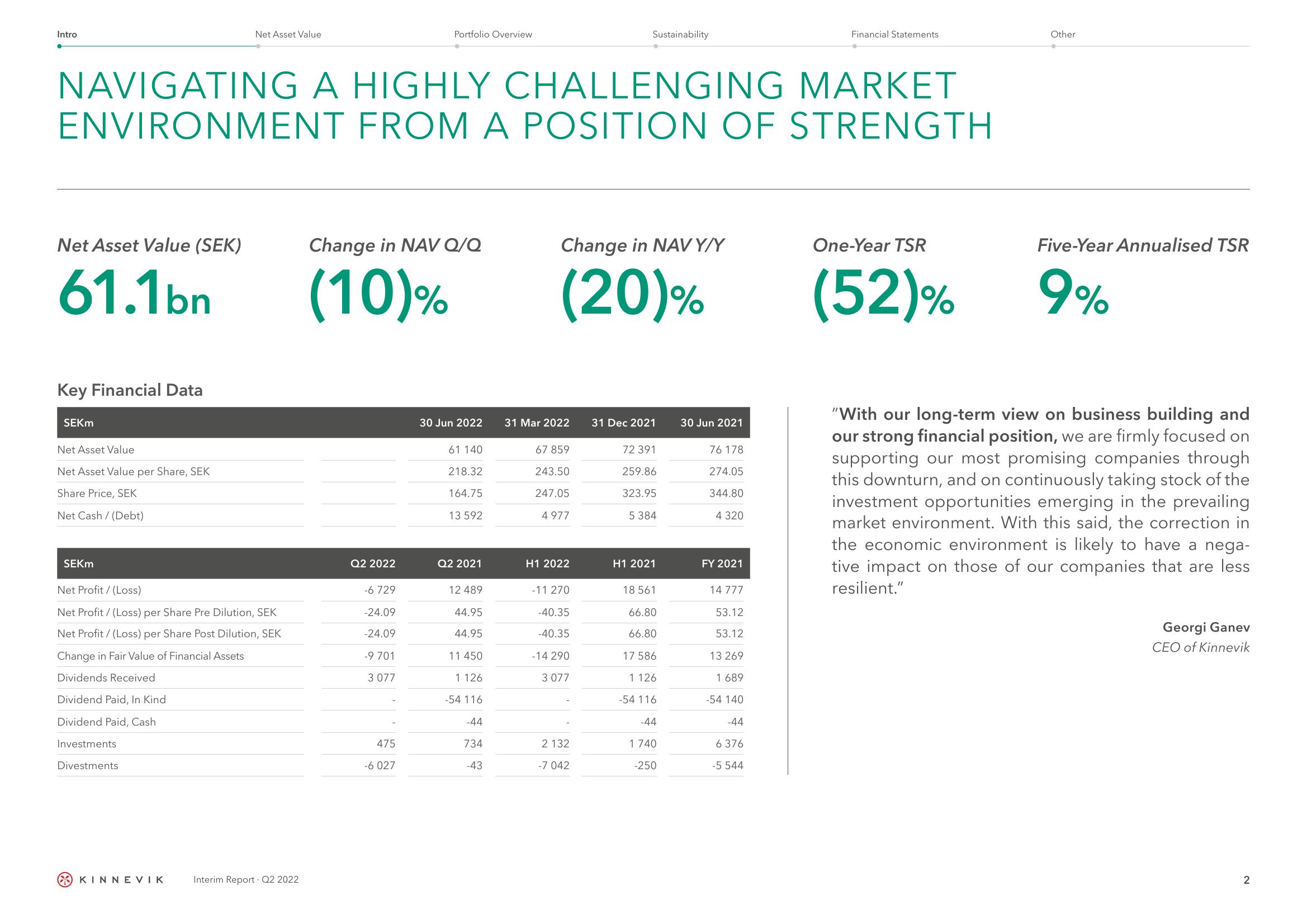

Net Asset Value (SEK)

61.1bn

Key Financial Data

SEKM

NAVIGATING A HIGHLY CHALLENGING MARKET

ENVIRONMENT FROM A POSITION OF STRENGTH

Net Asset Value

Net Asset Value per Share, SEK

Share Price, SEK

Net Cash/ (Debt)

SEKM

Net Asset Value

Net Profit/(Loss)

Net Profit / (Loss) per Share Pre Dilution, SEK

Net Profit / (Loss) per Share Post Dilution, SEK

Change in Fair Value of Financial Assets

Dividends Received

Dividend Paid, In Kind

Dividend Paid, Cash

Investments

Divestments

KINNEVIK

Interim Report. Q2 2022

Change in NAV Q/Q

(10)%

Q2 2022

-6 729

-24.09

-24.09

-9 701

Portfolio Overview

3 077

475

-6 027

61 140

30 Jun 2022 31 Mar 2022 31 Dec 2021

218.32

164.75

13 592

Q2 2021

12 489

44.95

44.95

11 450

1126

-54 116

-44

734

-43

Change in NAVY/Y

(20)%

67 859

243.50

247.05

4 977

H1 2022

Sustainability

-11 270

-40.35

-40.35

-14 290

3 077

2 132

-7 042

72 391

259.86

323.95

5 384

H1 2021

18 561

66.80

66.80

17 586

1 126

-54 116

-44

1 740

-250

30 Jun 2021

76 178

274.05

344.80

4 320

FY 2021

14 777

53.12

53.12

13 269

1 689

-54 140

Financial Statements

-44

6 376

-5 544

One-Year TSR

(52)%

Other

Five-Year Annualised TSR

9%

"With our long-term view on business building and

our strong financial position, we are firmly focused on

supporting our most promising companies through

this downturn, and on continuously taking stock of the

investment opportunities emerging in the prevailing

market environment. With this said, the correction in

the economic environment is likely to have a nega-

tive impact on those of our companies that are less

resilient."

Georgi Ganev

CEO of Kinnevik

2View entire presentation