Pathward Financial Results Presentation Deck

CONSUMER CREDIT PROGRAMS

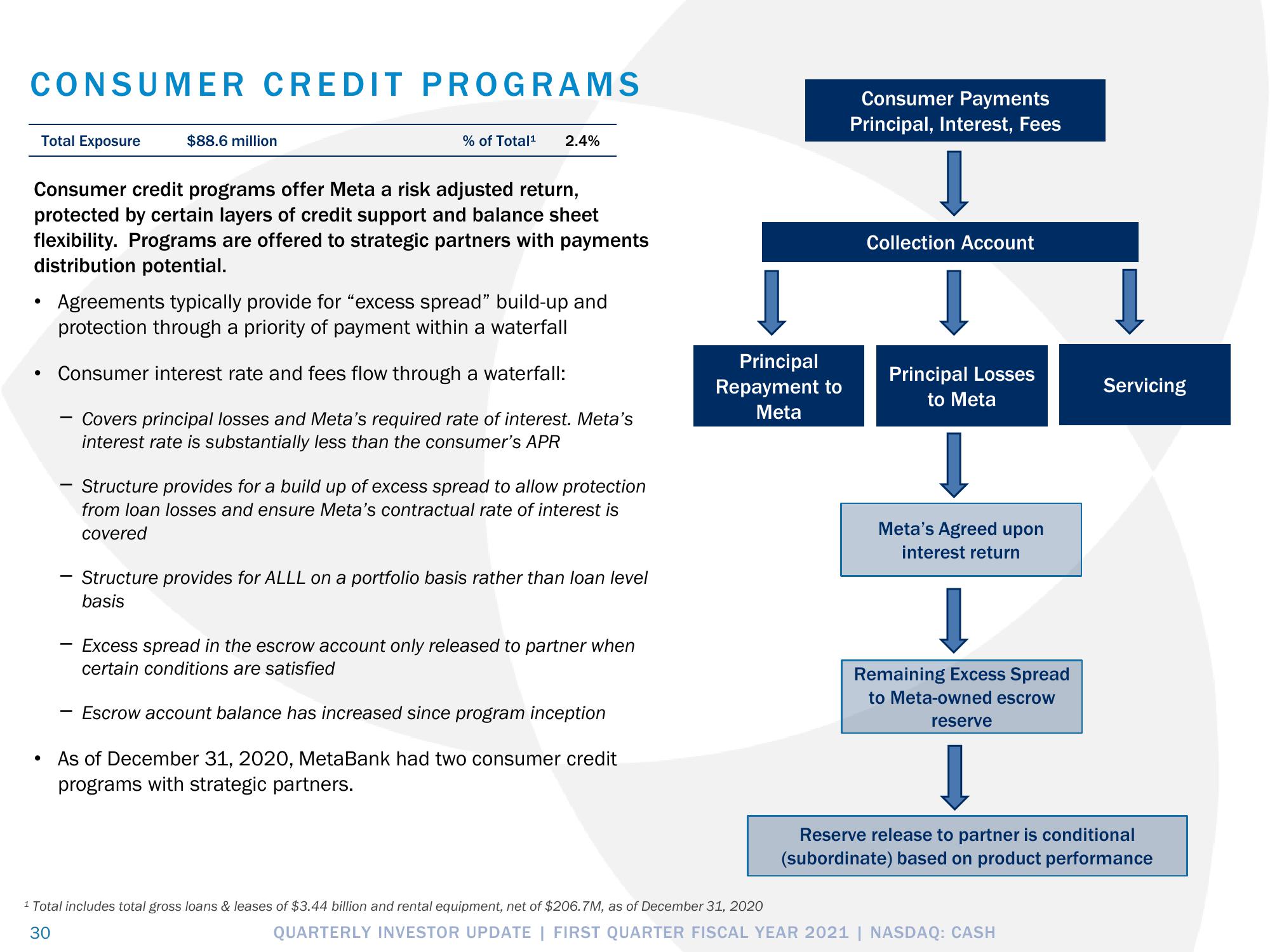

Total Exposure

●

Consumer credit programs offer Meta a risk adjusted return,

protected by certain layers of credit support and balance sheet

flexibility. Programs are offered to strategic partners with payments

distribution potential.

●

$88.6 million

●

% of Total¹ 2.4%

Agreements typically provide for "excess spread" build-up and

protection through a priority of payment within a waterfall

Consumer interest rate and fees flow through a waterfall:

Covers principal losses and Meta's required rate of interest. Meta's

interest rate is substantially less than the consumer's APR

Structure provides for a build up of excess spread to allow protection

from loan losses and ensure Meta's contractual rate of interest is

covered

Structure provides for ALLL on a portfolio basis rather than loan level

basis

Excess spread in the escrow account only released to partner when

certain conditions are satisfied

Escrow account balance has increased since program inception

As of December 31, 2020, MetaBank had two consumer credit

programs with strategic partners.

Principal

Repayment to

Meta

¹ Total includes total gross loans & leases of $3.44 billion and rental equipment, net of $206.7M, as of December 31, 2020

30

Consumer Payments

Principal, Interest, Fees

Collection Account

Principal Losses

to Meta

Meta's Agreed upon

interest return

Remaining Excess Spread

to Meta-owned escrow

reserve

Servicing

Reserve release to partner is conditional

(subordinate) based on product performance

QUARTERLY INVESTOR UPDATE | FIRST QUARTER FISCAL YEAR 2021 | NASDAQ: CASHView entire presentation