Ashtead Group Results Presentation Deck

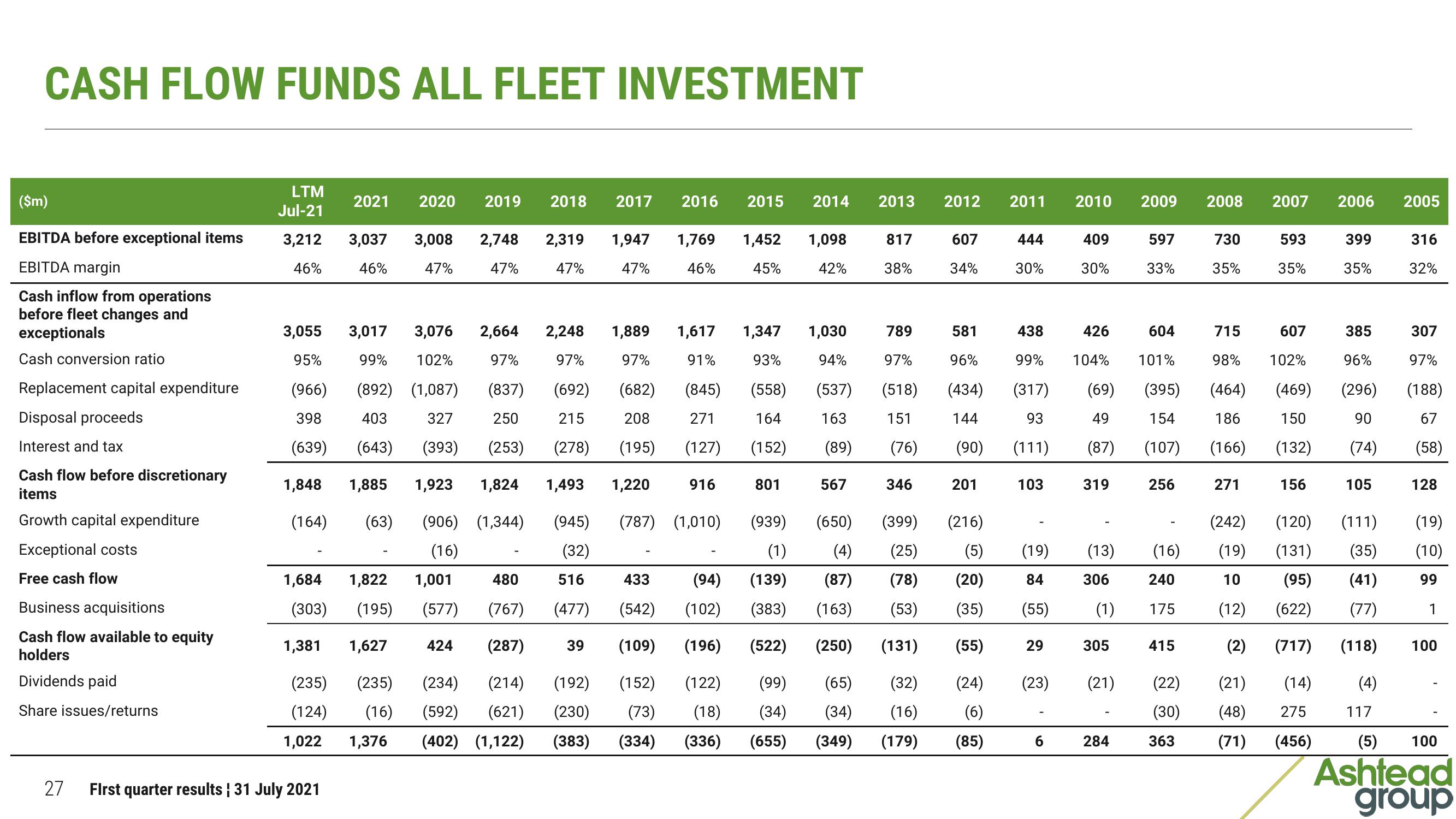

CASH FLOW FUNDS ALL FLEET INVESTMENT

($m)

EBITDA before exceptional items

EBITDA margin

Cash inflow from operations

before fleet changes and

exceptionals

Cash conversion ratio

Replacement capital expenditure

Disposal proceeds

Interest and tax

Cash flow before discretionary

items

Growth capital expenditure

Exceptional costs

Free cash flow

Business acquisitions

Cash flow available to equity

holders

Dividends paid

Share issues/returns

27

LTM

Jul-21

3,212 3,037 3,008 2,748 2,319 1,947 1,769 1,452 1,098

45% 42%

46%

46%

47%

47%

47%

47%

46%

3,055

95%

(966)

398

(639)

1,848

2,664 2,248

3,017

99%

3,076

102%

97%

97%

(892) (1,087)

(837)

(692)

(682)

403

327

250

215

208

(643)

(393)

(253)

(278)

(195)

1,885 1,923 1,824 1,493 1,220

(63)

(906) (1,344)

(945)

(16)

(32)

1,684 1,822 1,001

433

(303) (195) (577)

(542)

1,381

1,627

39 (109)

(287)

(235) (234) (214) (192) (152) (122)

(16) (592) (621) (230) (73)

(18)

(336)

1,376

(402) (1,122) (383) (334)

(164)

(235)

(124)

1,022

2021 2020 2019

First quarter results ¦ 31 July 2021

424

2018 2017

480

(767)

516

(477)

2016

1,889

97%

1,617

91%

1,347 1,030

(845)

93%

(558)

164

271

(127) (152)

916

2015

(787) (1,010)

801

2014

(94)

(102)

(196) (522)

(89)

2013 2012

567

817

38%

581

438

789

94% 97% 96%

(537) (518) (434) (317)

99%

163

151

144

93

(76)

(90) (111)

607

34%

346

201

(650) (399)

(939)

(1)

(139) (87)

(4)

(25)

(78)

(383) (163) (53)

(250) (131)

(99) (65) (32)

(34) (34) (16) (6)

(655) (349) (179) (85)

2011

444

30%

103

(216)

(5)

(20)

(35) (55)

(55) 29

(24) (23)

(19)

84

6

2010

409

30%

319

426

604

104% 101%

(69)

49

(395)

154

(107)

(87)

(13)

306

(1)

305

(21)

2009

284

597

33%

256

(16)

240

175

415

(22)

(30)

363

2008

730

35%

271

2007 2006

715

607

98% 102%

(464) (469)

186 150

(166) (132)

593

35%

(242)

(19)

10

156

399

35%

385

96%

(296)

90

(74)

105

(120)

(111)

(131) (35)

(95)

(41)

(12) (622)

(77)

(2) (717)

(118)

(21) (14)

(4)

(48)

275

(71)

(456)

117

2005

316

32%

307

97%

(188)

67

(58)

128

(19)

(10)

99

1

100

(5)

Ashtead

group

100View entire presentation