Credit Suisse Investment Banking Pitch Book

Selected Osprey management commentary on Osprey's

recent financial performance and market outlook

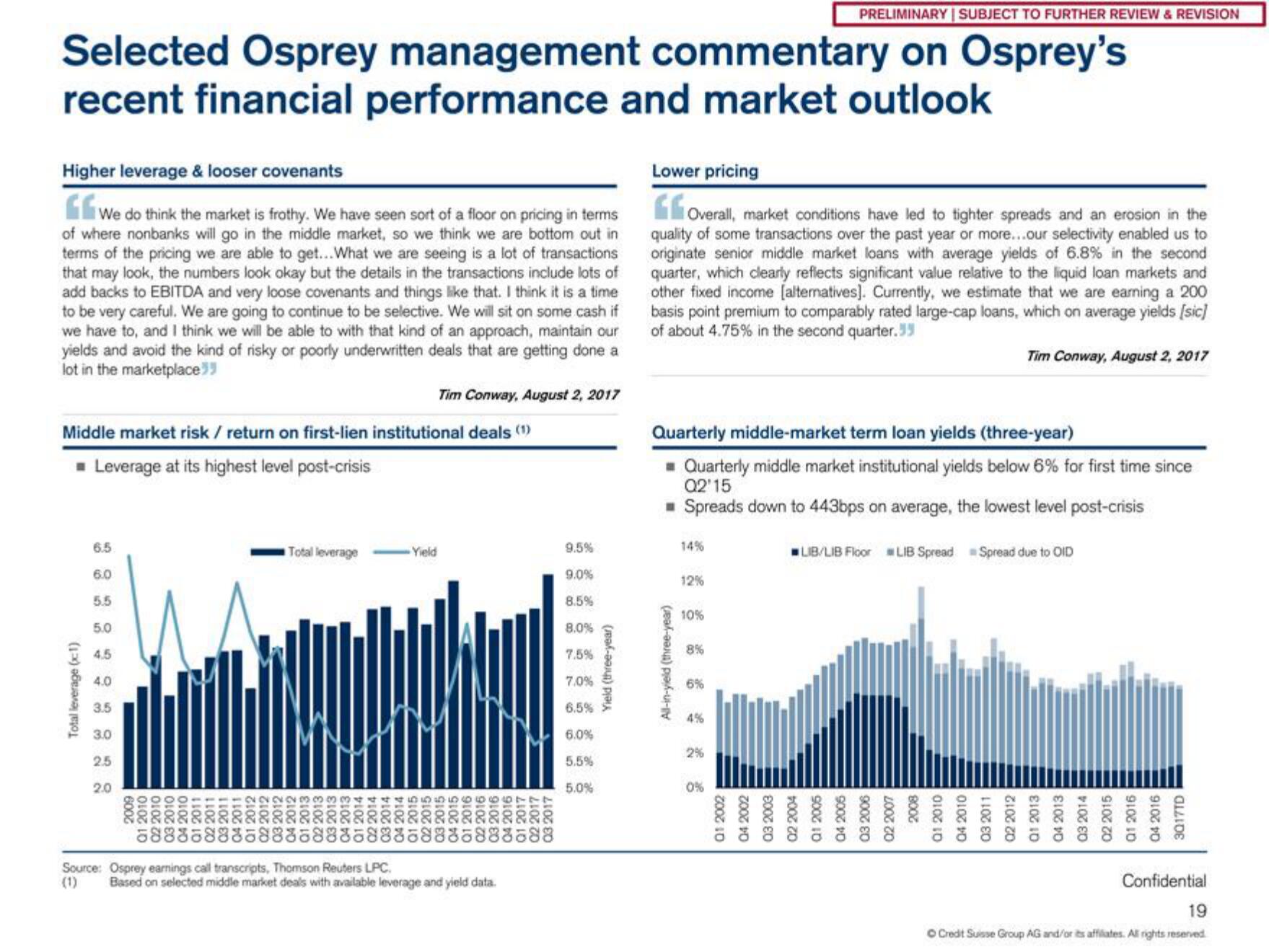

Higher leverage & looser covenants

We do think the market is frothy. We have seen sort of a floor on pricing in terms

of where nonbanks will go in the middle market, so we think we are bottom out in

terms of the pricing we are able to get... What we are seeing is a lot of transactions

that may look, the numbers look okay but the details in the transactions include lots of

add backs to EBITDA and very loose covenants and things like that. I think it is a time

to be very careful. We are going to continue to be selective. We will sit on some cash if

we have to, and I think we will be able to with that kind of an approach, maintain our

yields and avoid the kind of risky or poorly underwritten deals that are getting done a

lot in the marketplace"

Middle market risk / return on first-lien institutional deals (1)

■ Leverage at its highest level post-crisis

Totalleverage (x1)

6.5

6.0

5.5

5.0

4.0

3.5

3.0

2.5

2.0

600

Total leverage

Tim Conway, August 2, 2017

Yield

Source: Osprey earnings call transcripts, Thomson Reuters

Q1 2010

02 2010

03 2010

04 2010

Q1 2011

02 2011

03 2011

Q4 2011

Q1 2012

02 2012

03 2012

04 2012

01 2013

02 2013

03 2013

04 2013

Q1 2014

02 2014

03 2014

Q4 2014

Q1 2015

02 2015

03 2015

Q4 2015

Q1 2016

02 2016

Q3 2016

04 2016

Q1 2017

02 2017

03 2017

LPC.

Based on selected middle market deals with available leverage and yield data.

9.5%

9.0%

8.5%

8.0%

7.5%

7.0%

6.5%

6.0%

5.5%

5.0%

Yield (three-year)

Lower pricing

Overall, market conditions have led to tighter spreads and an erosion in the

quality of some transactions over the past year or more...our selectivity enabled us to

originate senior middle market loans with average yields of 6.8% in the second

quarter, which clearly reflects significant value relative to the liquid loan markets and

other fixed income [alternatives]. Currently, we estimate that we are earning a 200

basis point premium to comparably rated large-cap loans, which on average yields [sic]

of about 4.75% in the second quarter.39

All-in-yield (three-year)

Quarterly middle-market term loan yields (three-year)

■ Quarterly middle market institutional yields below 6% for first time since

Q2'15

■ Spreads down to 443bps on average, the lowest level post-crisis

LIB/LIB Floor LIB Spread Spread due to OID

14%

12%

10%

8%

6%

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

4%

2%

0%

01 2002

04 2002

03 2003

02 2004

2005

04 2005

03 2006

02 2007

2008

Q1 2010

Q1

Tim Conway, August 2, 2017

04 2010

03 2011

02 2012

Q1 2013

04 2013

03 2014

02 2015

Q1 2016

04 2016

3Q17TD

Confidential

19

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation