Evercore Investment Banking Pitch Book

Unitholder Tax Analysis

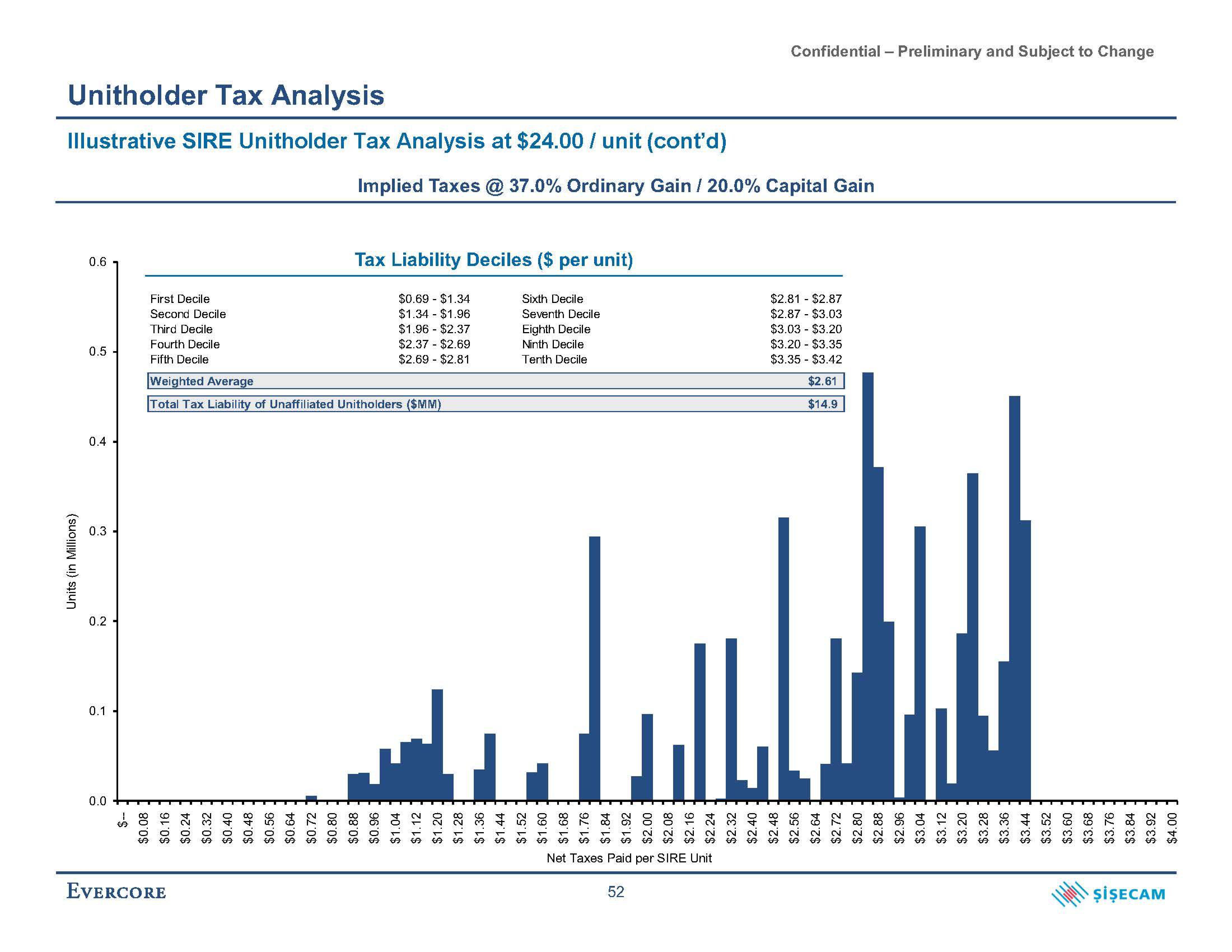

Illustrative SIRE Unitholder Tax Analysis at $24.00 / unit (cont'd)

Millions)

Units

0.6

0.5

0.4

0.3

0.2

0.1

0.0

--$

First Decile

Second Decile

Third Decile

Fourth Decile

Fifth Decile

Implied Taxes @ 37.0% Ordinary Gain / 20.0% Capital Gain

Tax Liability Deciles ($ per unit)

$0.69 $1.34

$1.34 $1.96

$1.96 - $2.37

$2.37 $2.69

Sixth Decile

Seventh Decile

Eighth Decile

Ninth Decile

Tenth Decile

$2.69 $2.81

Weighted Average

Total Tax Liability of Unaffiliated Unitholders ($MM)

EVERCORE

$0.08

$0.16

$0.24

$0.32

$0.40

$0.48

$0.56

$0.64

$0.72

$0.80

$0.88

$0.96

$1.04

$1.12

$1.20

$1.28

$1.36

$1.44

$1.52

$1.60

$1.68

$1.76

Confidential - Preliminary and Subject to Change

Net Taxes Paid per SIRE Unit

52

$2.81 - $2.87

$2.87 $3.03

$3.03 - $3.20

$3.20 - $3.35

$3.35 - $3.42

$2.61

$14.9

$2.16

$2.24

$2.32

$2.40

$2.48

$2.56

$2.64

$2.72

$2.80

$2.88

$2.96

$3.04

$3.12

$3.20

$3.28

$3.36

$3.44

$3.52

$3.60

$3.68

$3.76

$3.84

$3.92

$4.00

ŞİŞECAMView entire presentation