Main Street Capital Investor Day Presentation Deck

Follow-on Investment Case Studies

Heritage Vet Partners

Company Description

Initial Transaction

Leading provider of veterinary services and

animal health products primarily for livestock

producers throughout the Midwest U.S.

■

Company sought a financial partner that would

assist with its strategic plan and growth initiatives

and provide acquisition expertise

Acquisition Strategy / Rationale

Increased scale to improve buying power and

cost saving benefits, strengthening margins and

profitability

Expand geographic reach

Strengthen competitive position

Completed nine acquisitions from December

2021 through June 2023

■

Minority recapitalization with access to additional

debt financing for future growth

St. Anna

Veterinary

Clinic

CORNERSTONE

VETERINARY SERVICES

$ in millions

■

Representative Acquisitions

▪ Traditional vet practice evenly split between

product and service sales

Immediately allowed for increased product

sales to existing customers, improving cost

of goods sold and profitability

▪ Products-focused practice with pre-existing

distributor relationships

Increased buying power with distributors,

expanded product offering and expanded

geographical coverage

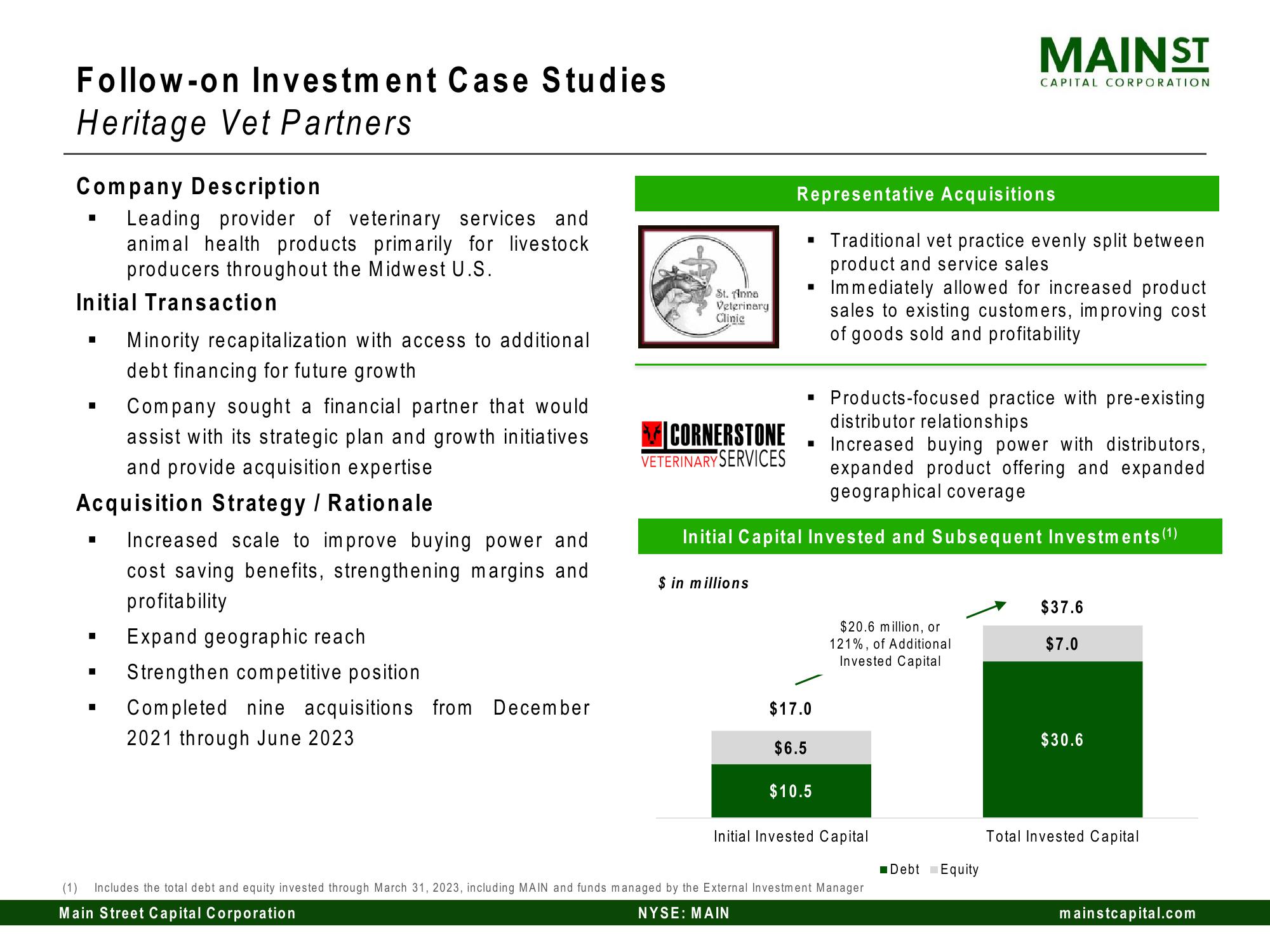

Initial Capital Invested and Subsequent Investments (¹)

■

$17.0

$6.5

$10.5

$20.6 million, or

121%, of Additional

Invested Capital

Initial Invested Capital

(1) Includes the total debt and equity invested through March 31, 2023, including MAIN and funds managed by the External Investment Manager

Main Street Capital Corporation

NYSE: MAIN

MAIN ST

■Debt

CAPITAL CORPORATION

Equity

$37.6

$7.0

$30.6

Total Invested Capital

mainstcapital.comView entire presentation