Bed Bath & Beyond Results Presentation Deck

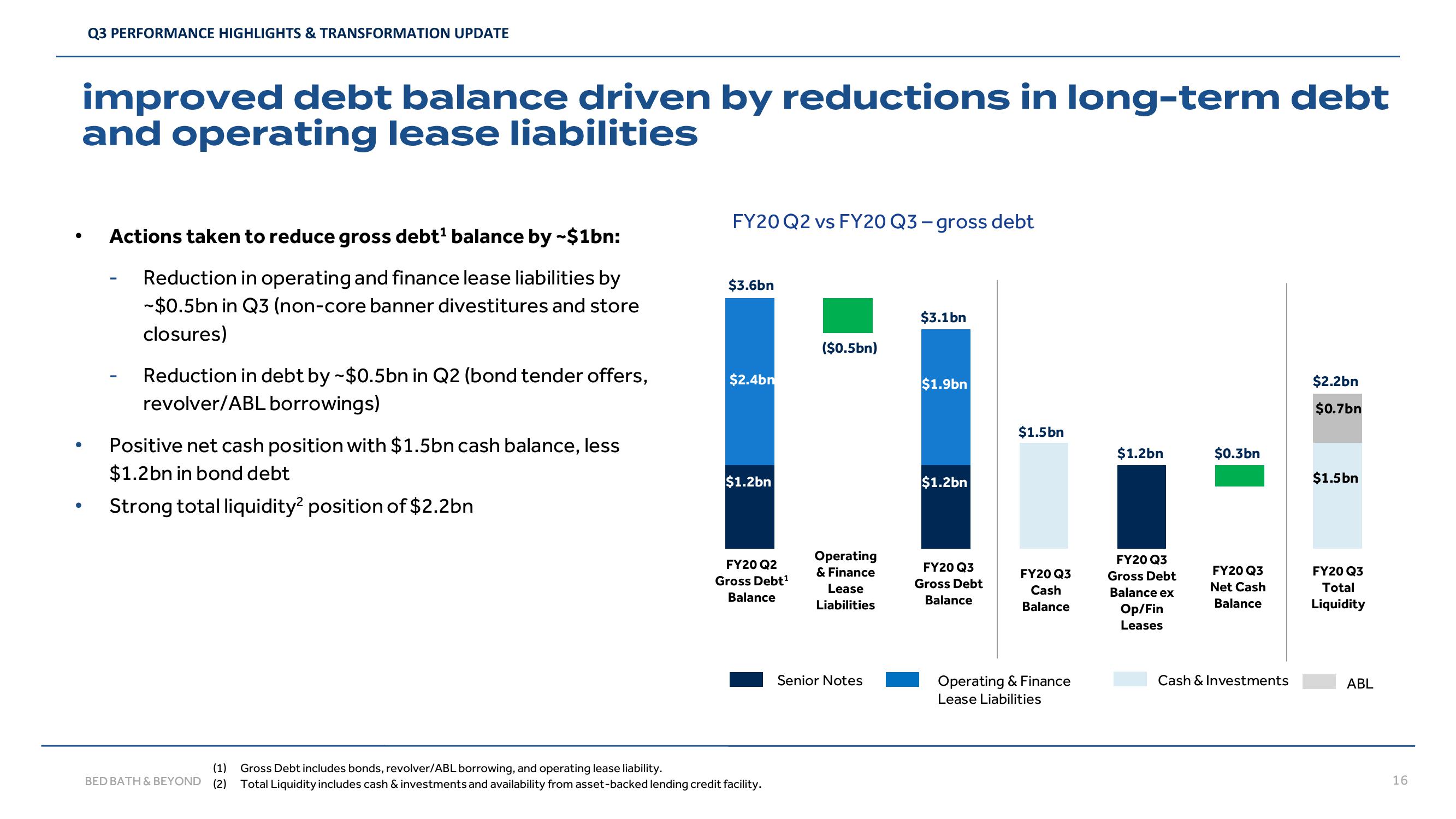

improved debt balance driven by reductions in long-term debt

and operating lease liabilities

●

Q3 PERFORMANCE HIGHLIGHTS & TRANSFORMATION UPDATE

●

Actions taken to reduce gross debt¹ balance by ~$1bn:

Reduction in operating and finance lease liabilities by

-$0.5bn in Q3 (non-core banner divestitures and store

closures)

Reduction in debt by ~$0.5bn in Q2 (bond tender offers,

revolver/ABL borrowings)

Positive net cash position with $1.5bn cash balance, less

$1.2bn in bond debt

Strong total liquidity2 position of $2.2bn

FY20 Q2 vs FY20 Q3 - gross debt

BED BATH & BEYOND (2)

$3.6bn

$2.4bn

$1.2bn

FY20 Q2

Gross Debt¹

Balance

(1) Gross Debt includes bonds, revolver/ABL borrowing, and operating lease liability.

Total Liquidity includes cash & investments and availability from asset-backed lending credit facility.

($0.5bn)

Operating

& Finance

Lease

Liabilities

Senior Notes

$3.1bn

$1.9bn

$1.2bn

FY20 Q3

Gross Debt

Balance

$1.5bn

FY20 Q3

Cash

Balance

Operating & Finance

Lease Liabilities

$1.2bn

FY20 Q3

Gross Debt

Balance ex

Op/Fin

Leases

$0.3bn

FY20 Q3

Net Cash

Balance

Cash & Investments

$2.2bn

$0.7bn

$1.5bn

FY20 Q3

Total

Liquidity

ABL

16View entire presentation