OpenText Investor Presentation Deck

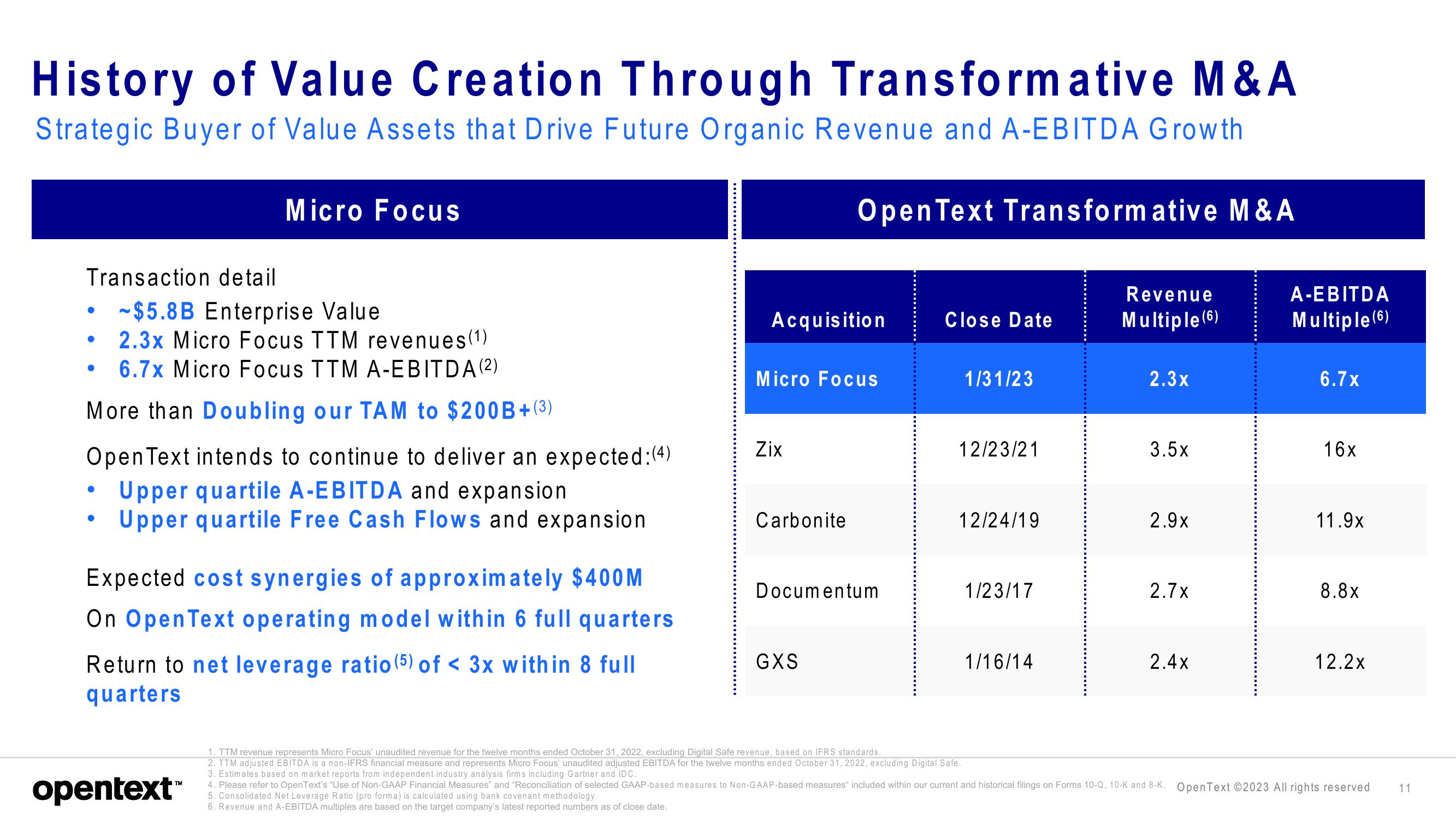

History of Value Creation Through Transformative M & A

Strategic Buyer of Value Assets that Drive Future Organic Revenue and A-EBITDA Growth

Open Text Transformative M & A

Transaction detail

-$5.8B Enterprise Value

2.3x Micro Focus TTM revenues (1)

6.7x Micro Focus TTM A-EBITDA (2)

More than Doubling our TAM to $200B+(³)

Open Text intends to continue to deliver an expected: (4)

Upper quartile A-EBITDA and expansion

Upper quartile Free Cash Flows and expansion

●

●

●

●

Micro Focus

Expected cost synergies of approximately $400M

On Open Text operating model within 6 full quarters

Return to net leverage ratio (5) of < 3x within 8 full

quarters

opentext™

Acquisition

Micro Focus

Zix

Carbonite

Documentum

GXS

Close Date

1/31/23

12/23/21

12/24/19

1/23/17

1/16/14

Revenue

Multiple (6)

2.3x

3.5x

2.9x

2.7x

2.4x

A-EBITDA

Multiple (6)

6.7x

16x

11.9x

8.8x

12.2x

1. TTM revenue represents Micro Focus' unaudited revenue for the twelve months ended October 31, 2022, excluding Digital Safe revenue, based on IFRS standards.

2. TTM adjusted EBITDA is a non-IFRS financial measure and represents Micro Focus' unaudited adjusted EBITDA for the twelve months ended October 31, 2022, excluding Digital Safe.

3. Estimates based on market reports from independent industry analysis firms including Gartner and IDC.

4. Please refer to OpenText's "Use of Non-GAAP Financial Measures" and "Reconciliation of selected GAAP-based measures to Non-GAAP-based measures included within our current and historical filings on Forms 10-Q, 10-K and 8-K. Open Text ©2023 All rights reserved

5. Consolidated Net Leverage Ratio (pro forma) is calculated using bank covenant methodology.

6. Revenue and A-EBITDA multiples are based on the target company's latest reported numbers as of close date.

11View entire presentation