Allwyn Results Presentation Deck

Consolidated P&L

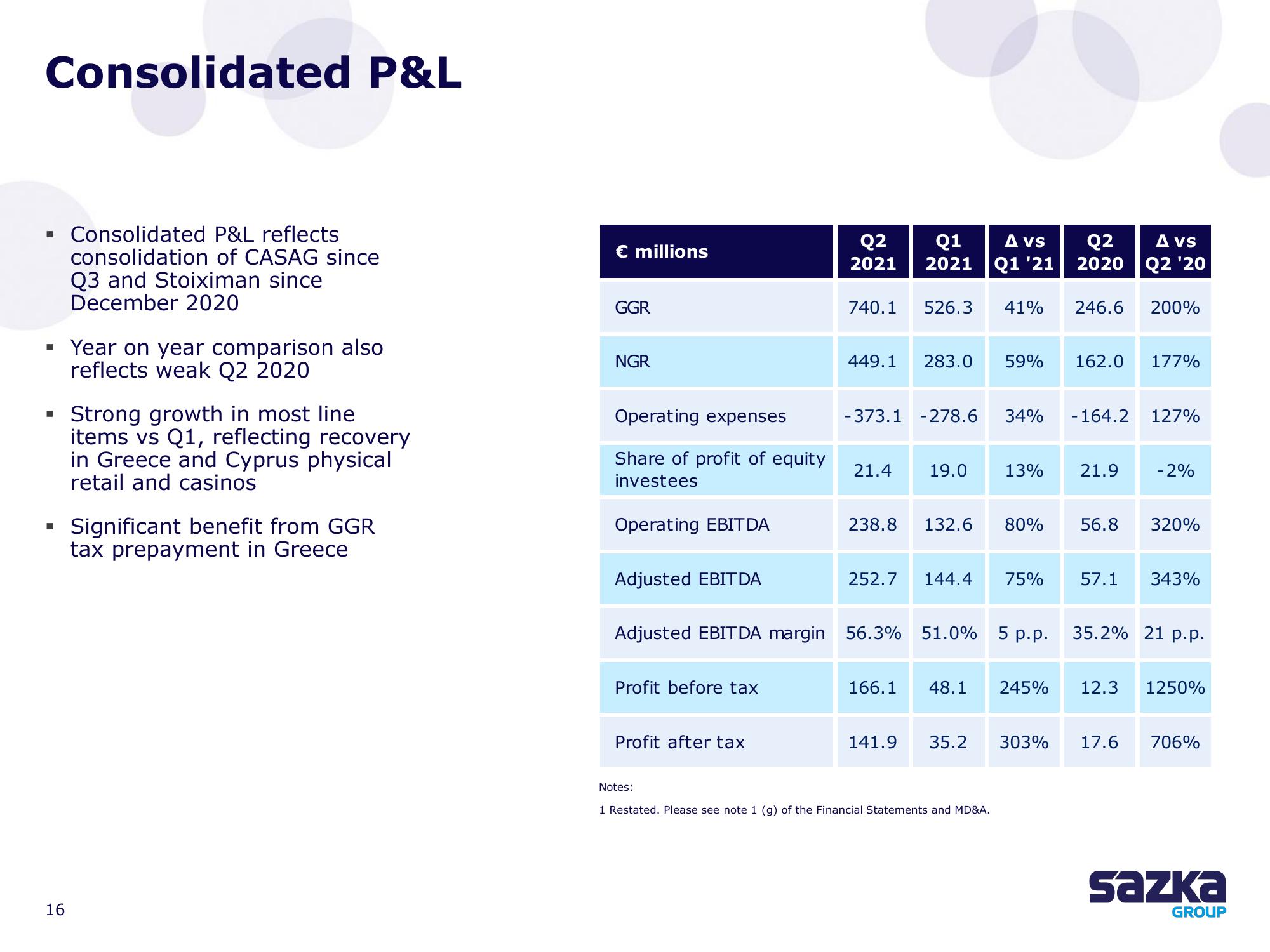

■ Consolidated P&L reflects

consolidation of CASAG since

Q3 and Stoiximan since

December 2020

▪ Year on year comparison also

reflects weak Q2 2020

I

16

Strong growth in most line

items vs Q1, reflecting recovery

in Greece and Cyprus physical

retail and casinos

Significant benefit from GGR

tax prepayment in Greece

€ millions

GGR

NGR

Operating expenses

Share of profit of equity

investees

Operating EBIT DA

Adjusted EBIT DA

Profit before tax

Profit after tax

Q2

2021

Notes:

740.1

449.1

Q1

2021

21.4

-373.1 -278.6

526.3 41% 246.6

283.0 59%

19.0

Adjusted EBITDA margin 56.3% 51.0%

238.8 132.6

A vs

Q1 '21

141.9 35.2

34%

252.7 144.4 75%

1 Restated. Please see note 1 (g) of the Financial Statements and MD&A.

13%

166.1 48.1 245%

5 p.p.

Q2

2020

80% 56.8

303%

162.0

- 164.2

21.9

57.1

A vs

Q2 '20

200%

17.6

177%

127%

- 2%

320%

343%

35.2% 21 p.p.

12.3 1250%

706%

Sazka

GROUPView entire presentation