Silicon Valley Bank Results Presentation Deck

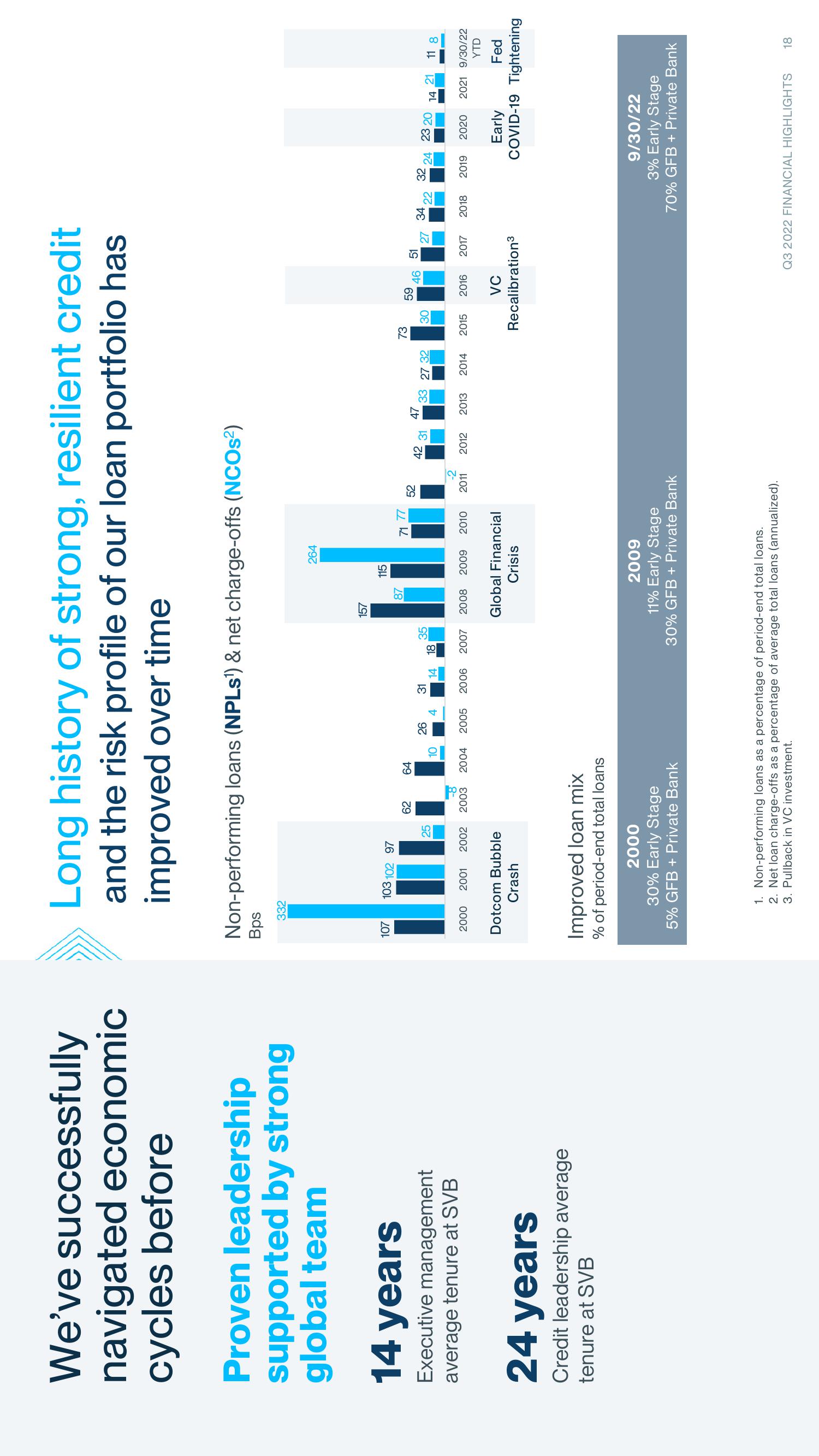

We've successfully

navigated economic

cycles before

Proven leadership

supported by strong

global team

14 years

Executive management

average tenure at SVB

24 years

Credit leadership average

tenure at SVB

Non-performing loans (NPLs¹) & net charge-offs (NCOs²)

Bps

Long history of strong, resilient credit

and the risk profile of our loan portfolio has

improved over time

107

332

103 102 97

25

2000 2001 2002

Dotcom Bubble

Crash

62

64

10

Improved loan mix

% of period-end total loans

2000

30% Early Stage

5% GFB+ Private Bank

26

-8

2003 2004 2005

4

31

14 18

2006

35

2007

157

87

264

115

71 77

2008 2009 2010

Global Financial

Crisis

52

-2

2011

2009

11% Early Stage

30% GFB + Private Bank

1. Non-performing loans as a percentage of period-end total loans.

2. Net loan charge-offs as a percentage of average total loans (annualized).

3. Pullback in VC investment.

47

42 31

33 27 32

2012 2013

2014

73

30

59

46 51

2015 2016

32

27 34 22 24 23 20

2017

VC

Recalibration³

14 21 11 8

2018 2019 2020 2021 9/30/22

YTD

Fed

Early

COVID-19 Tightening

9/30/22

3% Early Stage

70% GFB + Private Bank

Q3 2022 FINANCIAL HIGHLIGHTS 18View entire presentation