Nikola Results Presentation Deck

NIKOLA.

PAGE/1 1

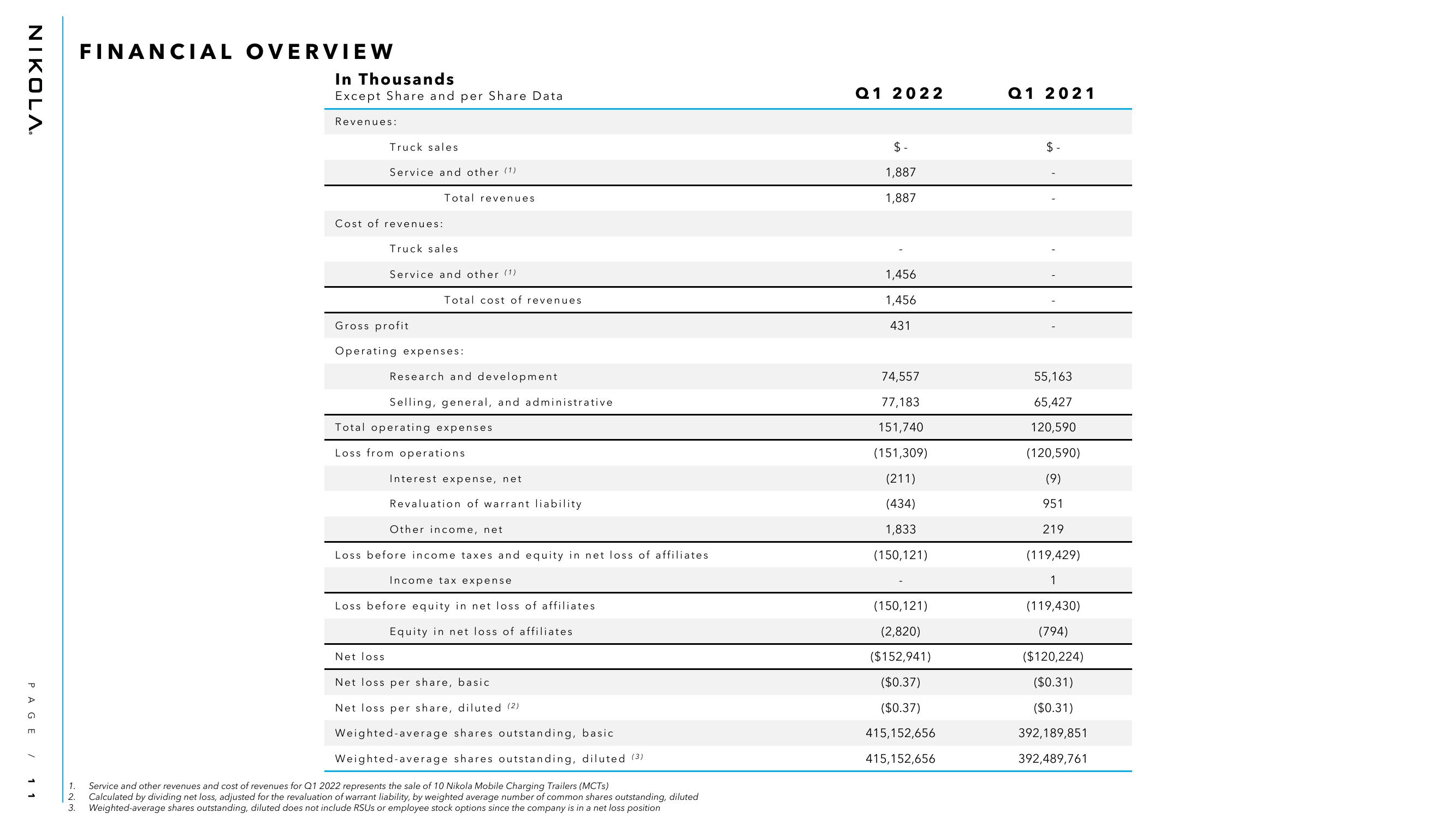

FINANCIAL OVERVIEW

In Thousands

Except Share and per Share Data

Revenues:

Truck sales

Service and other (1)

Cost of revenues:

Gross profit

Total revenues

Truck sales

Service and other (1)

Total cost of revenues

Operating expenses:

Net loss

Research and development

Selling, general, and administrative

Total operating expenses

Loss from operations

Interest expense, net

Revaluation of warrant liability.

Other income, net

Loss before income taxes and equity in net loss of affiliates

Income tax expense

Loss before equity in net loss of affiliates

Equity in net loss of affiliates

Net loss per share, basic

Net loss per share, diluted (2)

Weighted-average shares outstanding, basic

Weighted-average shares outstanding, diluted (3)

1. Service and other revenues and cost of revenues for Q1 2022 represents the sale of 10 Nikola Mobile Charging Trailers (MCTS)

2. Calculated by dividing net loss, adjusted for the revaluation of warrant liability, by weighted average number of common shares outstanding, diluted

3. Weighted-average shares outstanding, diluted does not include RSUS or employee stock options since the company is in a net loss position

Q1 2022

$-

1,887

1,887

1,456

1,456

431

74,557

77,183

151,740

(151,309)

(211)

(434)

1,833

(150,121)

(150,121)

(2,820)

($152,941)

($0.37)

($0.37)

415,152,656

415,152,656

Q1 2021

$-

55,163

65,427

120,590

(120,590)

(9)

951

219

(119,429)

1

(119,430)

(794)

($120,224)

($0.31)

($0.31)

392,189,851

392,489,761View entire presentation