Eos Energy Results Presentation Deck

Financial Results

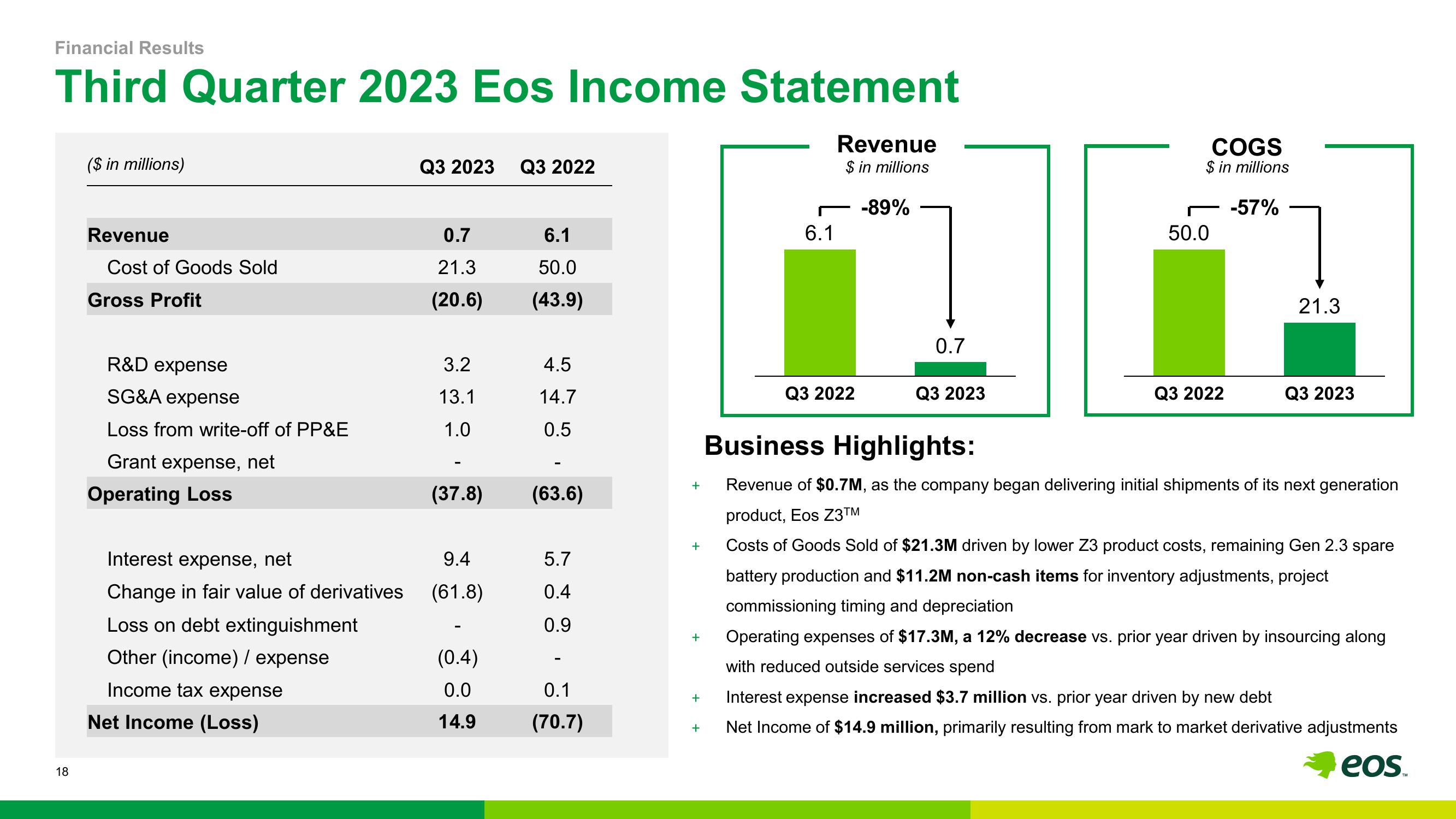

Third Quarter 2023 Eos Income Statement

18

($ in millions)

Revenue

Cost of Goods Sold

Gross Profit

R&D expense

SG&A expense

Loss from write-off of PP&E

Grant expense, net

Operating Loss

Interest expense, net

Change in fair value of derivatives

Loss on debt extinguishment

Other (income) / expense

Income tax expense

Net Income (Loss)

Q3 2023 Q3 2022

0.7

6.1

21.3

50.0

(20.6) (43.9)

3.2

13.1

1.0

(37.8)

9.4

(61.8)

(0.4)

0.0

14.9

4.5

14.7

0.5

(63.6)

5.7

0.4

0.9

I

0.1

(70.7)

6.1

+

Revenue

$ in millions

-89%

Q3 2022

0.7

Q3 2023

COGS

$ in millions

50.0

Q3 2022

-57%

21.3

Q3 2023

Business Highlights:

+ Revenue of $0.7M, as the company began delivering initial shipments of its next generation

product, Eos Z3™

Costs of Goods Sold of $21.3M driven by lower Z3 product costs, remaining Gen 2.3 spare

battery production and $11.2M non-cash items for inventory adjustments, project

commissioning timing and depreciation

+ Operating expenses of $17.3M, a 12% decrease vs. prior year driven by insourcing along

with reduced outside services spend

+ Interest expense increased $3.7 million vs. prior year driven by new debt

+ Net Income of $14.9 million, primarily resulting from mark to market derivative adjustments

eos.View entire presentation