Bed Bath & Beyond Results Presentation Deck

APPENDIX

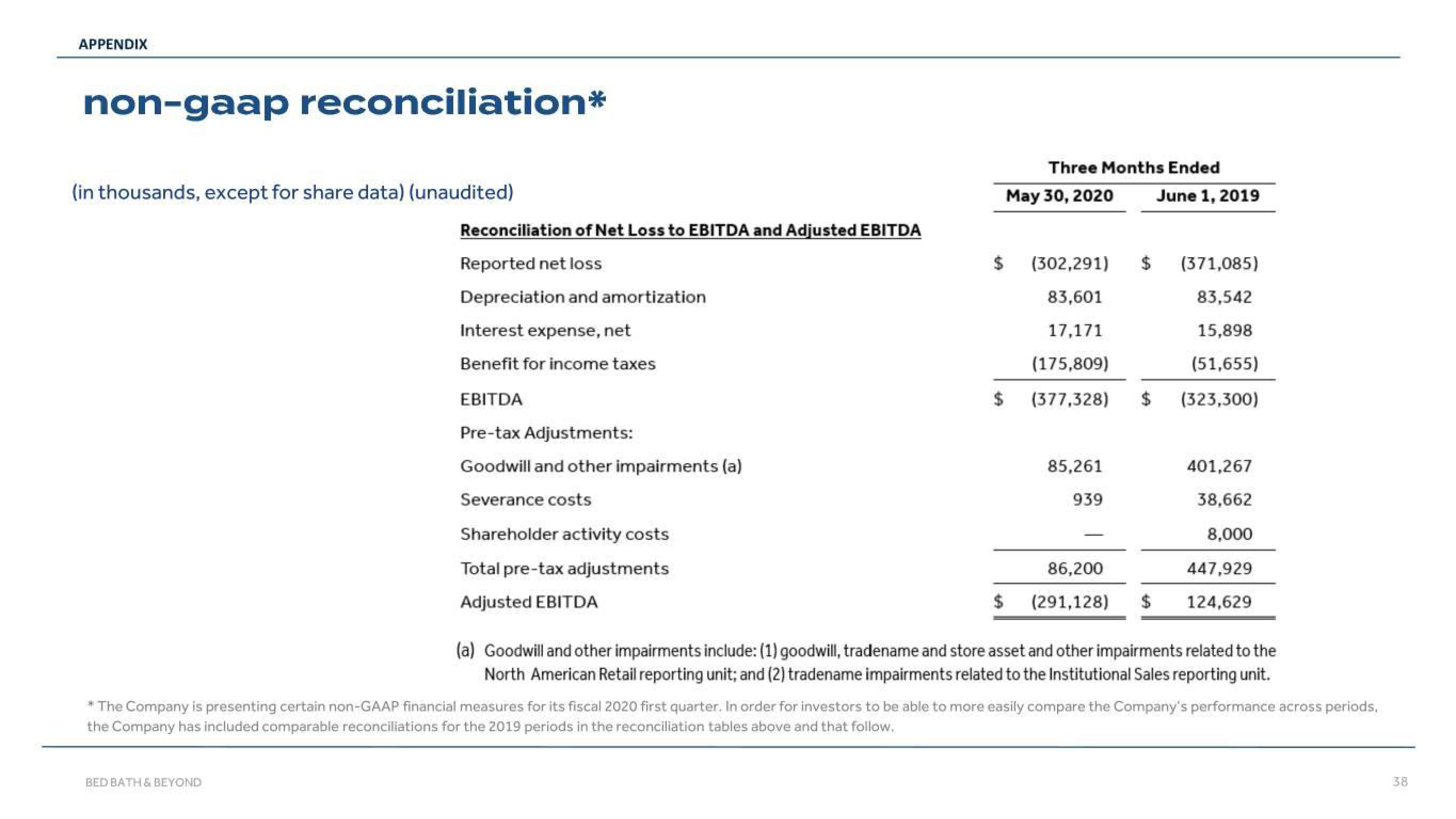

non-gaap reconciliation*

(in thousands, except for share data) (unaudited)

Reconciliation of Net Loss to EBITDA and Adjusted EBITDA

Reported net loss

Depreciation and amortization

BED BATH & BEYOND

Interest expense, net

Benefit for income taxes

EBITDA

Pre-tax Adjustments:

Goodwill and other impairments (a)

Severance costs

Shareholder activity costs

Total pre-tax adjustments

Adjusted EBITDA

$

$

$

Three Months Ended

May 30, 2020

(302,291)

83,601

17,171

(175,809)

(377,328)

85,261

939

86,200

(291,128) $

June 1, 2019

(371,085)

83,542

15,898

(51,655)

(323,300)

401,267

38,662

8,000

447,929

124,629

(a) Goodwill and other impairments include: (1) goodwill, tradename and store asset and other impairments related to the

North American Retail reporting unit; and (2) tradename impairments related to the Institutional Sales reporting unit.

* The Company is presenting certain non-GAAP financial measures for its fiscal 2020 first quarter. In order for investors to be able to more easily compare the Company's performance across periods.

the Company has included comparable reconciliations for the 2019 periods in the reconciliation tables above and that follow.

38View entire presentation