Bank of America Investment Banking Pitch Book

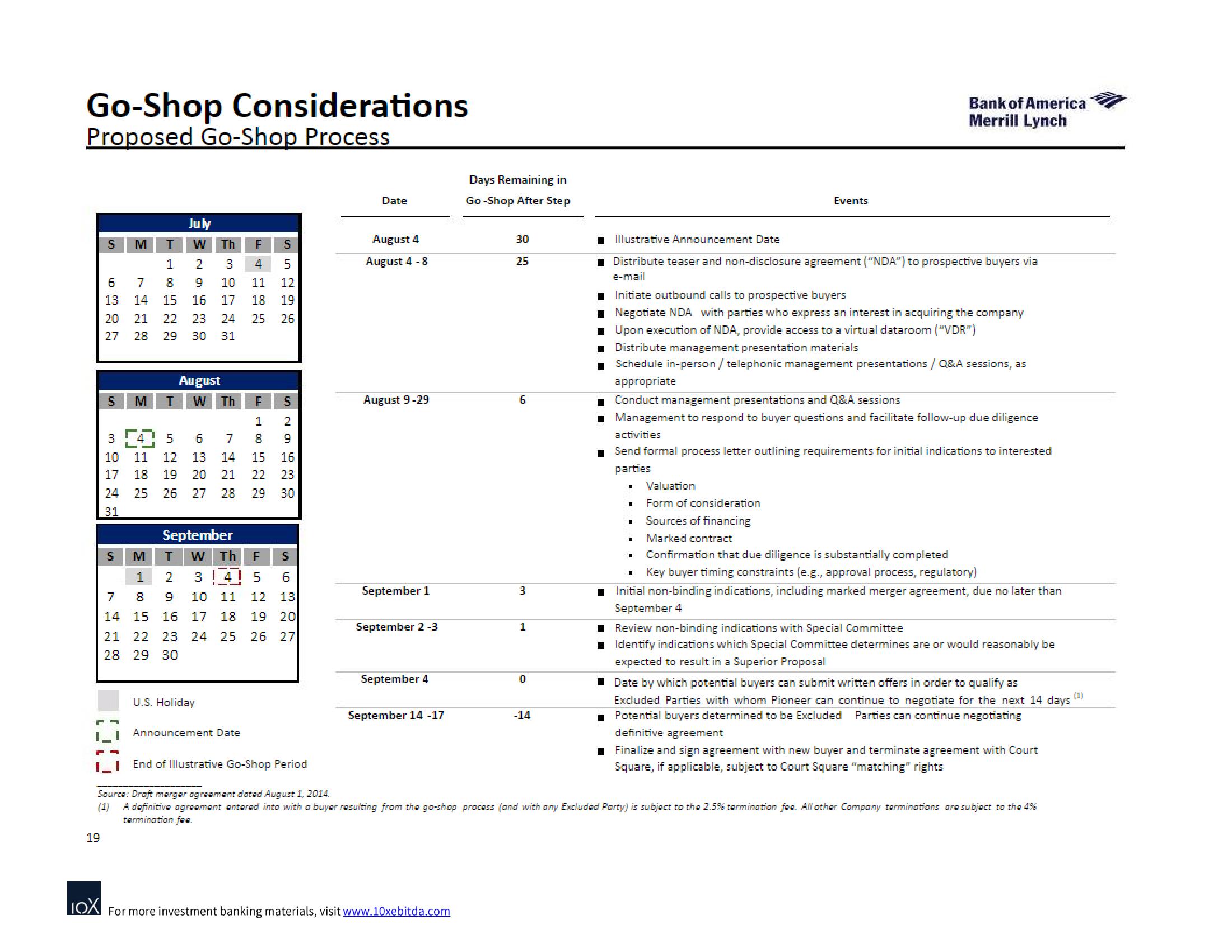

Go-Shop Considerations

Proposed Go-Shop Process

July

W

2

6

7

9

13 14 15 16 17

S

19

5

M

T

1

20 21 22 23 24

S

77

27 28 29 30 31

M T

Th F

00

3

10

August

W

3 [4] 5

6

10 11 12

13

17 18 19 20 21

24 25 26

27

31

U.S. Holiday

Th

September

W Th

4 11 18 25

F

1

8

Announcement Date

5

5

F

299

12

19

M

T

1 2

31 41

5

8

9

10 11

12

13

19 20

14

15 16

17 18

21 22 23 24 25 26 27

28 29 30

26

7

14 15

16

22

2.3

28 29 30

5

NO

Nas

6

End of Illustrative Go-Shop Period

Date

August 4

August 4-8

August 9-29

September 1

September 2-3

September 4

September 14 -17

Days Remaining in

Go-Shop After Step

IOX For more investment banking materials, visit www.10xebitda.com

30

25

6

3

1

0

-14

Illustrative Announcement Date

■ Distribute teaser and non-disclosure agreement ("NDA") to prospective buyers via

e-mail

Initiate outbound calls to prospective buyers

■ Negotiate NDA with parties who express an interest in acquiring the company

■Upon execution of NDA, provide access to a virtual dataroom ("VDR")

■ Distribute management presentation materials

Schedule in-person / telephonic management presentations / Q&A sessions, as

appropriate

I

■ Conduct management presentations and Q&A sessions

■ Management to respond to buyer questions and facilitate follow-up due diligence

activities

■ Send formal process letter outlining requirements for initial indications to interested

parties

"

■

Events

■

Bank of America

Merrill Lynch

■

■

Valuation

Form of consideration

Sources of financing

Marked contract

Confirmation that due diligence is substantially completed

Key buyer timing constraints (e.g., approval process, regulatory)

Initial non-binding indications, including marked merger agreement, due no later than

September 4

■ Review non-binding indications with Special Committee

Identify indications which Special Committee determines are or would reasonably be

expected to result in a Superior Proposall

Source: Draft merger agreement dated August 1, 2014.

A definitive agreement entered into with a buyer resulting from the go-shop process (and with any Excluded Party) is subject to the 2.5% termination fee. All other Company terminations are subject to the 4%

termination fee.

(1)

Date by which potential buyers can submit written offers in order to qualify as

Excluded Parties with whom Pioneer can continue to negotiate for the next 14 days

1 Potential buyers determined to be Excluded Parties can continue negotiating

definitive agreement

■Finalize and sign agreement with new buyer and terminate agreement with Court

Square, if applicable, subject to Court Square "matching" rightsView entire presentation