Trian Partners Activist Presentation Deck

Confidential-Not for Reproduction or Distribution

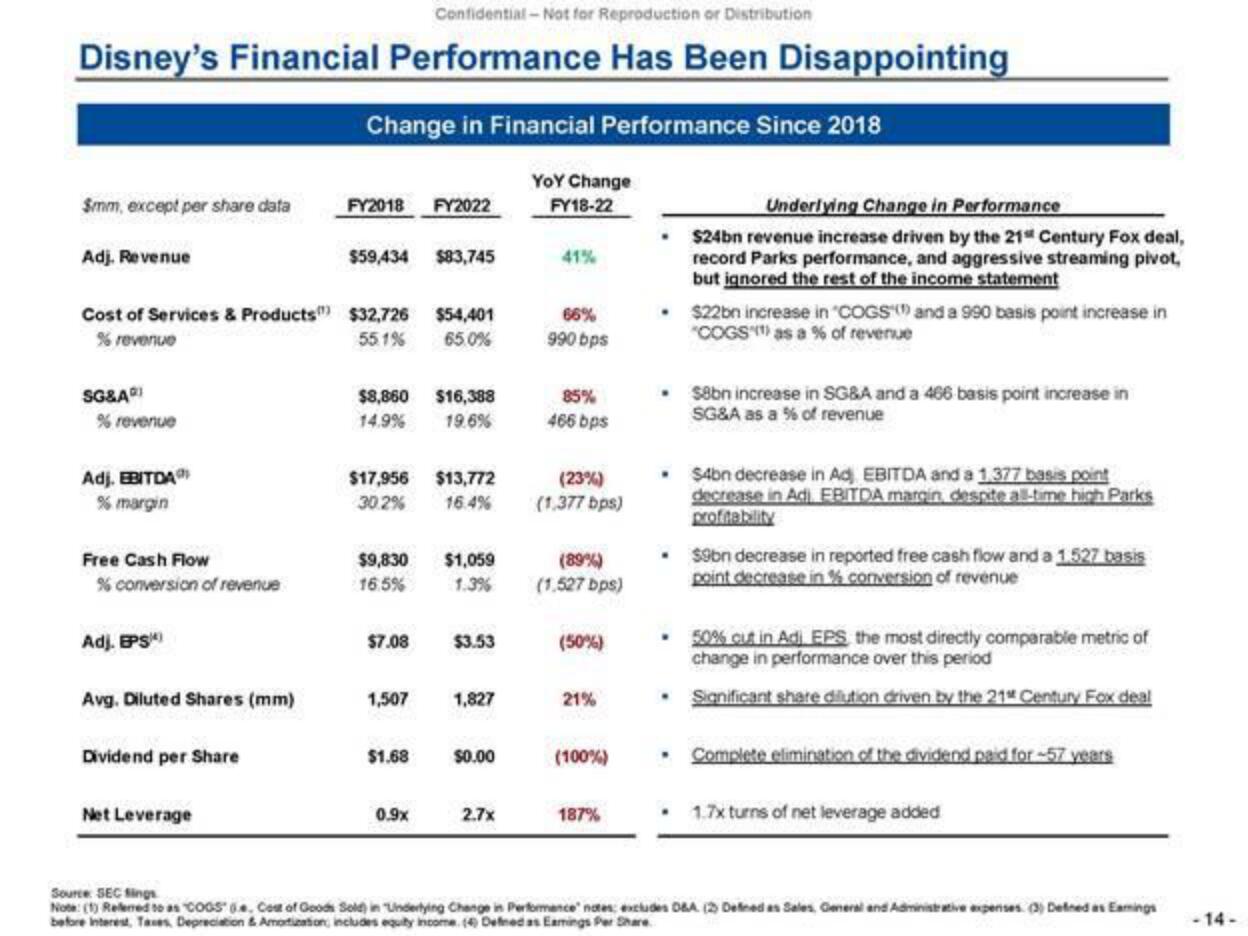

Disney's Financial Performance Has Been Disappointing

$mm, except per share data

Adj. Revenue

SG&A

Cost of Services & Products $32,726

% revenue

551%

% revenue

Adj. EBITDA

% margin

Free Cash Flow

% conversion of revenue

Adj. EPS)

Avg. Diluted Shares (mm)

Dividend per Share

Change in Financial Performance Since 2018

Net Leverage

FY2018 FY2022

$59,434 $83,745

$8,860 $16,388

14.9% 19.6%

$17,956 $13,772

30.2%

16.4%

$9,830

16.5%

$7.08

$54,401

65.0%

$1.68

0.9x

$1,059

1.3%

1,507 1,827

$3.53

$0.00

2.7x

YOY Change

FY18-22

41%

66%

990 bps

85%

466 bps

(23%)

(1,377 bps)

(89%)

(1.527 bps)

(50%)

21%

(100%)

187%

Underlying Change in Performance

• $24bn revenue increase driven by the 21st Century Fox deal,

record Parks performance, and aggressive streaming pivot,

but ignored the rest of the income statement

.

.

.

$22bn increase in "COGS and a 990 basis point increase in

"COGS) as a % of revenue

.

$8bn increase in SG&A and a 466 basis point increase in

SG&A as a % of revenue

• $9bn decrease in reported free cash flow and a 1.527 basis

point decrease in % conversion of revenue

$4bn decrease in Ad EBITDA and a 1,377 basis point

decrease in Ad). EBITDA margin, despite all-time high Parks

profitability

50% cut in Adi EPS the most directly comparable metric of

change in performance over this period

Significant share dilution driven by the 21st Century Fox deal

• Complete elimination of the dividend paid for-57 years

1.7x turns of net leverage added

Source SEC fings

Note: (1) Relemed to as "COGS" (e, Cost of Goods Sold) in "Underlying Change in Performance notes: excludes D&A (2) Defined as Sales, General and Administrative expenses (3) Defined as Earnings

before interest, Taves, Depreciation & Amortization, includes equity income (4) Defined as Eamings Per Share

-14-View entire presentation