SoftBank Results Presentation Deck

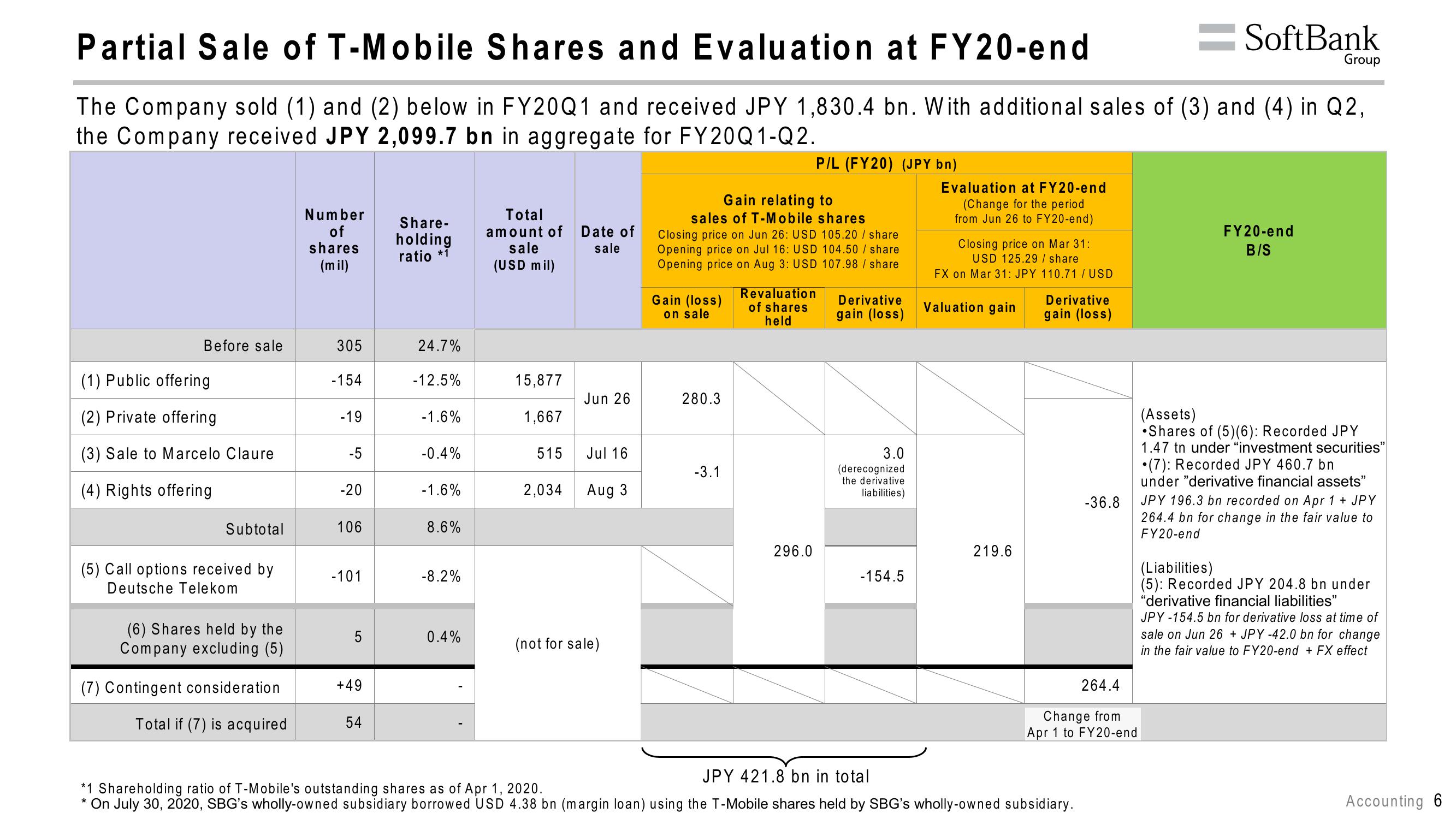

Partial Sale of T-Mobile Shares and Evaluation at FY20-end

The Company sold (1) and (2) below in FY20Q1 and received JPY 1,830.4 bn. With additional sales of (3) and (4) in Q2,

the Company received JPY 2,099.7 bn in aggregate for FY20Q1-Q2.

Before sale

(1) Public offering

(2) Private offering

(3) Sale to Marcelo Claure

(4) Rights offering

Subtotal

(5) Call options received by

Deutsche Telekom

(6) Shares held by the

Company excluding (5)

(7) Contingent consideration

Total if (7) is acquired

Number

of

shares

(mil)

305

-154

-19

-5

-20

106

-101

5

+49

54

Share-

holding

ratio *1

24.7%

-12.5%

-1.6%

-0.4%

-1.6%

8.6%

-8.2%

0.4%

Total

amount of Date of

sale

sale

(USD mil)

15,877

1,667

515

2,034

Jun 26

Jul 16

Aug 3

(not for sale)

Gain relating to

sales of T-Mobile shares

Closing price on Jun 26: USD 105.20 / share

Opening price on Jul 16: USD 104.50 / share

Opening price on Aug 3: USD 107.98 / share

Gain (loss)

on sale

280.3

-3.1

Revaluation

of shares

held

P/L (FY20) (JPY bn)

296.0

Derivative

gain (loss)

3.0

(derecognized

the derivative

liabilities)

-154.5

Evaluation at FY20-end

(Change for the period

from Jun 26 to FY20-end)

Closing price on Mar 31:

USD 125.29 / share

FX on Mar 31: JPY 110.71 / USD

Valuation gain

219.6

Derivative

gain (loss)

-36.8

264.4

Change from

Apr 1 to FY20-end

JPY 421.8 bn in total

*1 Shareholding ratio of T-Mobile's outstanding shares as of Apr 1, 2020.

* On July 30, 2020, SBG's wholly-owned subsidiary borrowed USD 4.38 bn (margin loan) using the T-Mobile shares held by SBG's wholly-owned subsidiary.

SoftBank

FY20-end

B/S

Group

(Assets)

Shares of (5) (6): Recorded JPY

1.47 tn under "investment securities"

(7): Recorded JPY 460.7 bn

under "derivative financial assets"

JPY 196.3 bn recorded on Apr 1 + JPY

264.4 bn for change in the fair value to

FY20-end

(Liabilities)

(5): Recorded JPY 204.8 bn under

"derivative financial liabilities"

JPY -154.5 bn for derivative loss at time of

sale on Jun 26 + JPY -42.0 bn for change

in the fair value to FY20-end + FX effect

Accounting 6View entire presentation