Owens&Minor Investor Conference Presentation Deck

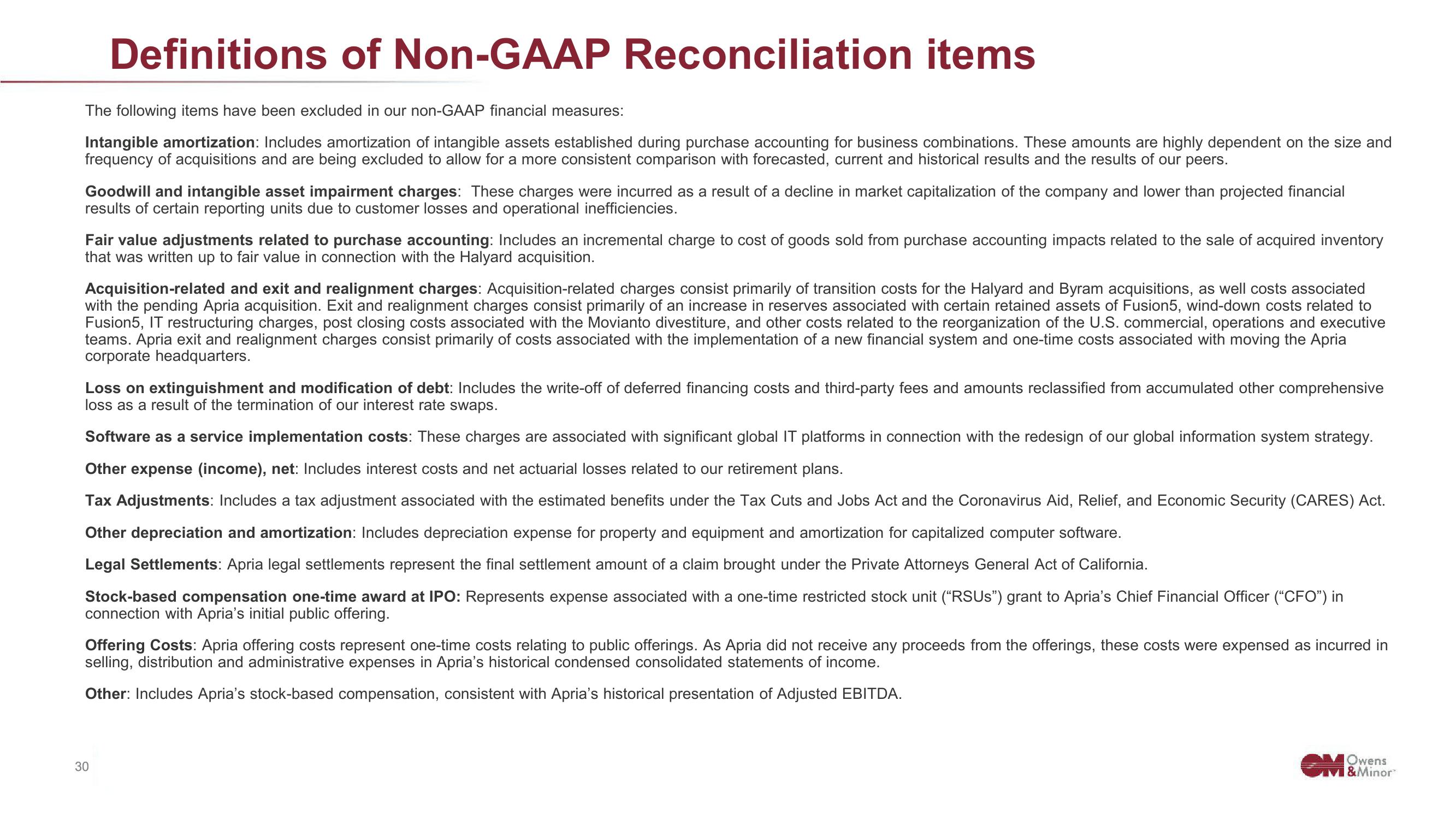

Definitions of Non-GAAP Reconciliation items

The following items have been excluded in our non-GAAP financial measures:

Intangible amortization: Includes amortization of intangible assets established during purchase accounting for business combinations. These amounts are highly dependent on the size and

frequency of acquisitions and are being excluded to allow for a more consistent comparison with forecasted, current and historical results and the results of our peers.

Goodwill and intangible asset impairment charges: These charges were incurred as a result of a decline in market capitalization of the company and lower than projected financial

results of certain reporting units due to customer losses and operational inefficiencies.

Fair value adjustments related to purchase accounting: Includes an incremental charge to cost of goods sold from purchase accounting impacts related to the sale of acquired inventory

that was written up to fair value in connection with the Halyard acquisition.

Acquisition-related and exit and realignment charges: Acquisition-related charges consist primarily of transition costs for the Halyard and Byram acquisitions, as well costs associated

with the pending Apria acquisition. Exit and realignment charges consist primarily of an increase in reserves associated with certain retained assets of Fusion5, wind-down costs related to

Fusion5, IT restructuring charges, post closing costs associated with the Movianto divestiture, and other costs related to the reorganization of the U.S. commercial, operations and executive

teams. Apria exit and realignment charges consist primarily of costs associated with the implementation of a new financial system and one-time costs associated with moving the Apria

corporate headquarters.

Loss on extinguishment and modification of debt: Includes the write-off of deferred financing costs and third-party fees and amounts reclassified from accumulated other comprehensive

loss as a result of the termination of our interest rate swaps.

Software as a service implementation costs: These charges are associated with significant global IT platforms in connection with the redesign of our global information system strategy.

Other expense (income), net: Includes interest costs and net actuarial losses related to our retirement plans.

Tax Adjustments: Includes a tax adjustment associated with the estimated benefits under the Tax Cuts and Jobs Act and the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Other depreciation and amortization: Includes depreciation expense for property and equipment and amortization for capitalized computer software.

Legal Settlements: Apria legal settlements represent the final settlement amount of a claim brought under the Private Attorneys General Act of California.

Stock-based compensation one-time award at IPO: Represents expense associated with a one-time restricted stock unit ("RSUS") grant to Apria's Chief Financial Officer ("CFO") in

connection with Apria's initial public offering.

Offering Costs: Apria offering costs represent one-time costs relating to public offerings. As Apria did not receive any proceeds from the offerings, these costs were expensed as incurred in

selling, distribution and administrative expenses in Apria's historical condensed consolidated statements of income.

Other: Includes Apria's stock-based compensation, consistent with Apria's historical presentation of Adjusted EBITDA.

30

Owens

VI & MinorView entire presentation