Apollo Global Management Investor Day Presentation Deck

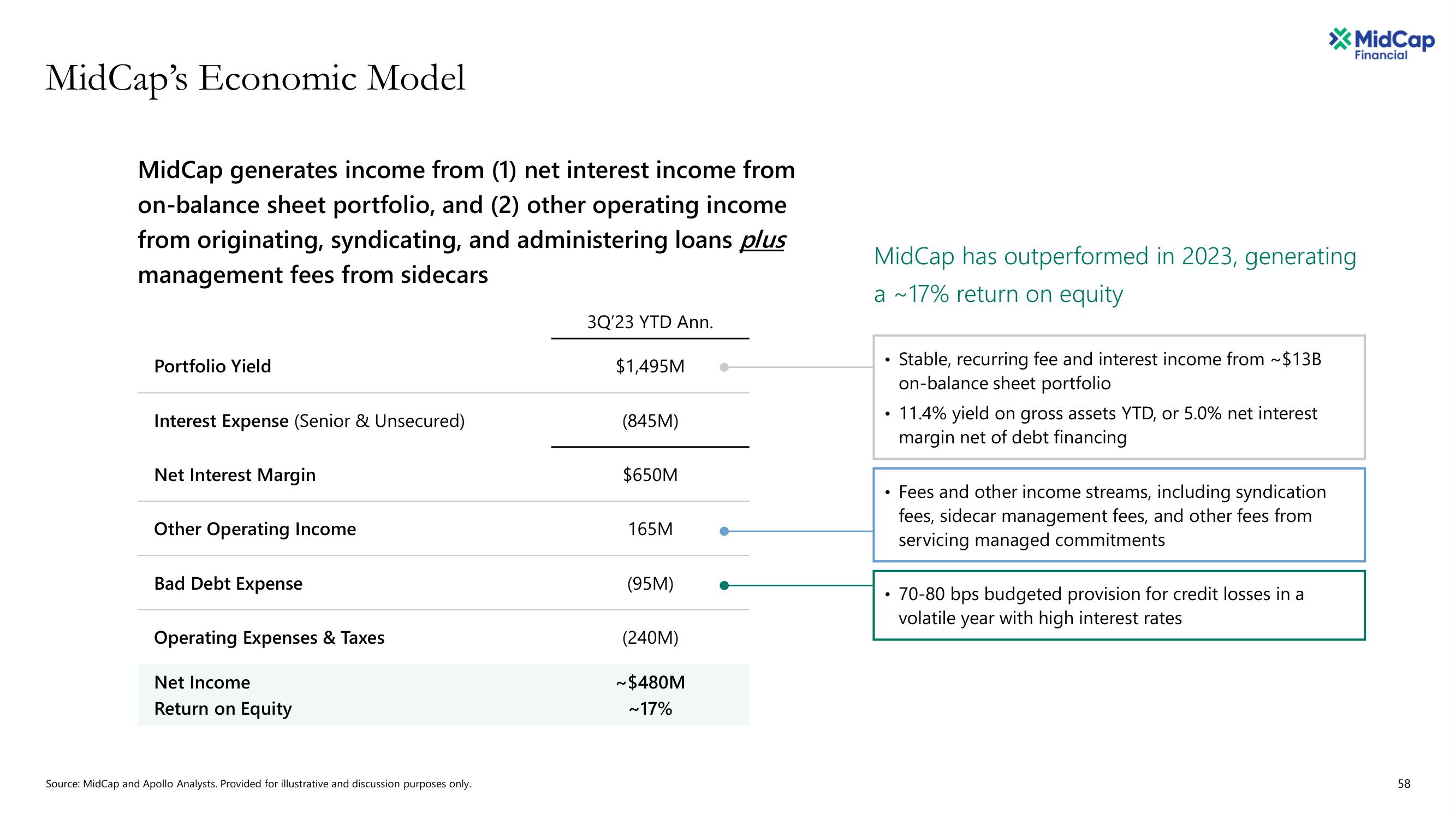

Mid Cap's Economic Model

MidCap generates income from (1) net interest income from

on-balance sheet portfolio, and (2) other operating income

from originating, syndicating, and administering loans plus

management fees from sidecars

Portfolio Yield

Interest Expense (Senior & Unsecured)

Net Interest Margin

Other Operating Income

Bad Debt Expense

Operating Expenses & Taxes

Net Income

Return on Equity

Source: MidCap and Apollo Analysts. Provided for illustrative and discussion purposes only.

3Q'23 YTD Ann.

$1,495M

(845M)

$650M

165M

(95M)

(240M)

~$480M

~17%

MidCap has outperformed in 2023, generating

a ~17% return on equity

●

●

●

●

Stable, recurring fee and interest income from ~$13B

on-balance sheet portfolio

11.4% yield on gross assets YTD, or 5.0% net interest

margin net of debt financing

Fees and other income streams, including syndication

fees, sidecar management fees, and other fees from

servicing managed commitments

*MidCap

Financial

70-80 bps budgeted provision for credit losses in a

volatile year with high interest rates

58View entire presentation