Apollo Global Management Mergers and Acquisitions Presentation Deck

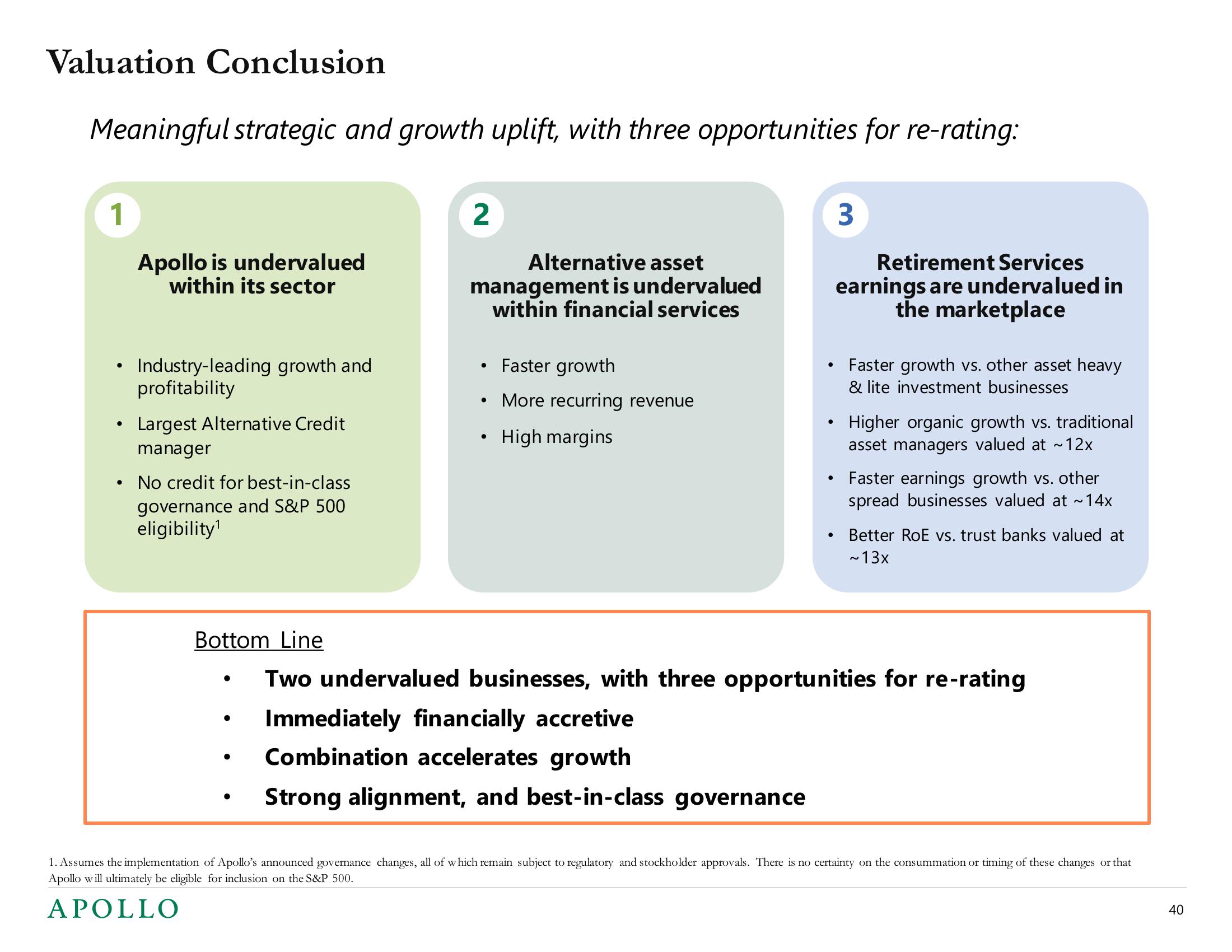

Valuation Conclusion

Meaningful strategic and growth uplift, with three opportunities for re-rating:

1

●

●

Apollo is undervalued

within its sector

Industry-leading growth and

profitability

Largest Alternative Credit

manager

No credit for best-in-class

governance and S&P 500

eligibility¹

●

2

●

Alternative asset

management is undervalued

within financial services

●

Faster growth

More recurring revenue

High margins

●

Immediately financially accretive

Combination accelerates growth

Strong alignment, and best-in-class governance

3

Retirement Services

earnings are undervalued in

the marketplace

Faster growth vs. other asset heavy

& lite investment businesses

Bottom Line

Two undervalued businesses, with three opportunities for re-rating

Higher organic growth vs. traditional

asset managers valued at ~12x

Faster earnings growth vs. other

spread businesses valued at ~14x

Better RoE vs. trust banks valued at

~ 13x

1. Assumes the implementation of Apollo's announced governance changes, all of which remain subject to regulatory and stockholder approvals. There is no certainty on the consummation or timing of these changes or that

Apollo will ultimately be eligible for inclusion on the S&P 500.

APOLLO

40View entire presentation