Ashtead Group Results Presentation Deck

DEBT AND COVENANTS

30

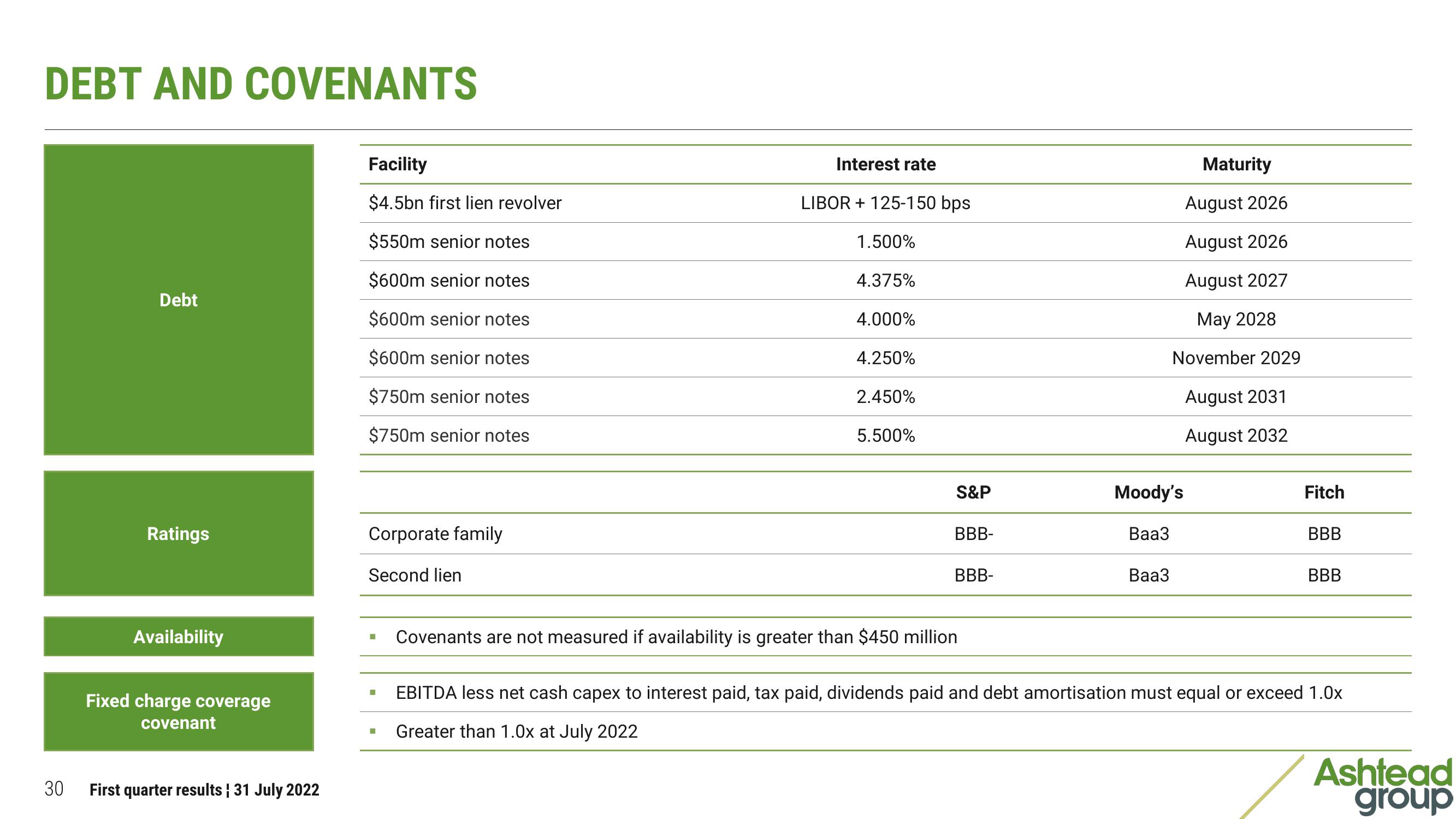

Debt

Ratings

Availability

Fixed charge coverage

covenant

First quarter results ¦ 31 July 2022

Facility

$4.5bn first lien revolver

$550m senior notes

$600m senior notes

$600m senior notes

$600m senior notes

$750m senior notes

$750m senior notes

Corporate family

Second lien

M

■

M

Interest rate

LIBOR + 125-150 bps

1.500%

4.375%

4.000%

4.250%

2.450%

5.500%

S&P

BBB-

BBB-

Covenants are not measured if availability is greater than $450 million

Baa3

Maturity

August 2026

August 2026

August 2027

May 2028

November 2029

Moody's

Baa3

August 2031

August 2032

Fitch

BBB

BBB

EBITDA less net cash capex to interest paid, tax paid, dividends paid and debt amortisation must equal or exceed 1.0x

Greater than 1.0x at July 2022

Ashtead

groupView entire presentation